Knight Frank Malaysia & Berkeley Homes have revealed plans for the first phase of Oval

Village, a two-hectare site transforming the historic Gasworks adjacent to Oval cricket

ground. When complete, Oval Village will feature 1,350 homes making it one of the most

significant regeneration projects in London.

Phase one, Phoenix Court, will launch on the 6th & 7th April through Knight Frank

Malaysia at the Westin Hotel Kuala Lumpur. The release of 286 Manhattan, one, two and

three bedroom apartments presents an opportunity to invest in this iconic central

London development at the earliest possible stage with homes ranging in size from 413

sq. ft. to 1,092 sq.

The Oval Village development benefits from an extremely convenient central London

location – it is just a short walk from Vauxhall, Kennington and Oval stations

connecting to the Victoria Line, Northern Line and National rail. These stations are

just 7 minutes to Oxford Circus, 9 minutes to Bank, 12 minutes to King’s Cross

St.Pancras and 40 minutes to Heathrow Airport.

Set to transform Oval into a top commuter hotspot, Oval Village will transform the area

into a cultural hub for residents and visitors, through the regeneration of the iconic

Oval Gasholders, the provision of commercial spaces and opening up the village with

communal landscaped spaces for all to enjoy.

When built in 1847, the Oval Gasholders were the largest of their kind – a magnificent

feat of Victorian engineering. Now, the historic site’s restoration and redevelopment

marks a new phase in its history where old will blend with new to create a new London

community fit for the 21st century. Within Oval Village will sit The Generator,

presenting six floors of flexible office space, a ground-floor co-working hub, 100,000

sq. ft. of commercial space, a cafe and a community centre.

Residents living in Oval Village will benefit from Berkeley Homes’ industry-leading

approach to delivering outstanding residential property where convenience and comfort

are paramount. A 24- hour concierge will serve every apartment, and for the health

conscious, access to a private swimming pool and gym means no more pre-dawn schleps to

the local leisure centre to stay in shape. An on-site Tesco Superstore will also ease

the burden of the weekly shop.

Simon Howard, Sales Director, Berkeley Homes elaborates on the plans for the

development and how it will feel to live in this new neighbourhood: “Oval Village is an

incredibly exciting regeneration project for Berkeley Homes and we’re delighted to

reach another milestone in creating a new community in this iconic location. The

development will combine impeccably finished homes with public recreation and working

space to create a new kind of neighbourhood with community at its heart. It will offer

a sense of village living with all the benefits of being in the centre of London. As

well as an incredible place to live and spend time, the fantastic Zone 2 location means

that in less than a 30 minute walk you can be in the heart of the City, walking along

the banks of the Thames, enjoying the West End, or relaxing in one of the many tranquil

local parks.”

Dominic Heaton-Watson, Associate Director, International Residential Project Marketing,

Knight Frank Malaysia, commented: “Oval Village SE11 is tremendously well-located for

everything Central London has to offer and there is a significant opportunity for

capital growth at this phase 1 launch.

“With so few regeneration sites of this scale left in central London, Oval Village SE11

will see the creation of a stunning neighbourhood and vibrant destination. The project

is uniquely placed in an area already serviced by extensive underground stations, an

established network of leisure amenities, retail, restaurants and bars, as well as

being just a short walk from the River Thames.

“Oval has one of Transport for London’s (TFL) highest connectivity ratings, is set for

a marked transformation in the years to come. Given that the project’s surroundings are

already well-established, unlike many other urban regeneration projects in London, it

means that purchasers will be able to move in and enjoy all that the neighbourhood has

to offer from day one.”

The development is nestled in the heart of the London borough of Lambeth and in

addition to sitting alongside the world-renowned cricket ground, this location means

that residents will also be able to enjoy more than 60 public parks, commons and

gardens which are located in the Borough. The crown jewel is the award-winning

Kennington Park – just five-minute’s walk from Oval Village – with an array of leisure

facilities, open grassland and a flower garden. There are also many more hidden green

gems in this this part of London, including the enchantingly bohemian Bonnington Square

Pleasure Gardens or Vauxhall City Farm.

Within Oval Village itself, world-renowned landscape architects are designing the

public realm to create a network of private residents’ gardens. The development’s

interconnected green havens will become focal points for the whole community and create

one of London’s most desirable destinations to be part of.

Berkeley Homes is committed to delivering outstanding, high-spec finish to all of the

homes it creates and Oval Village’s interiors will feature a refined and minimalist

material palette for a modern look, while also giving a nod to the area’s industrial

heritage.

Residents can expect to see a sharp contrast of classic dark and light tiling in

bathrooms with sharp angles and clean lines creating a simple and sophisticated feel.

Vintage-inspired accents and fittings – including warm mango woods and powder-coated

black metal – will provide clean lines and reflective finishes. This contemporary style

will contrast with soft, organic furniture, to create a layered aesthetic. In the

bedroom, Oval Village’s soothing colour tones and elegant soft furnishings will create

a calming atmosphere and the ideal place to power down and recharge.

Village, a two-hectare site transforming the historic Gasworks adjacent to Oval cricket

ground. When complete, Oval Village will feature 1,350 homes making it one of the most

significant regeneration projects in London.

|

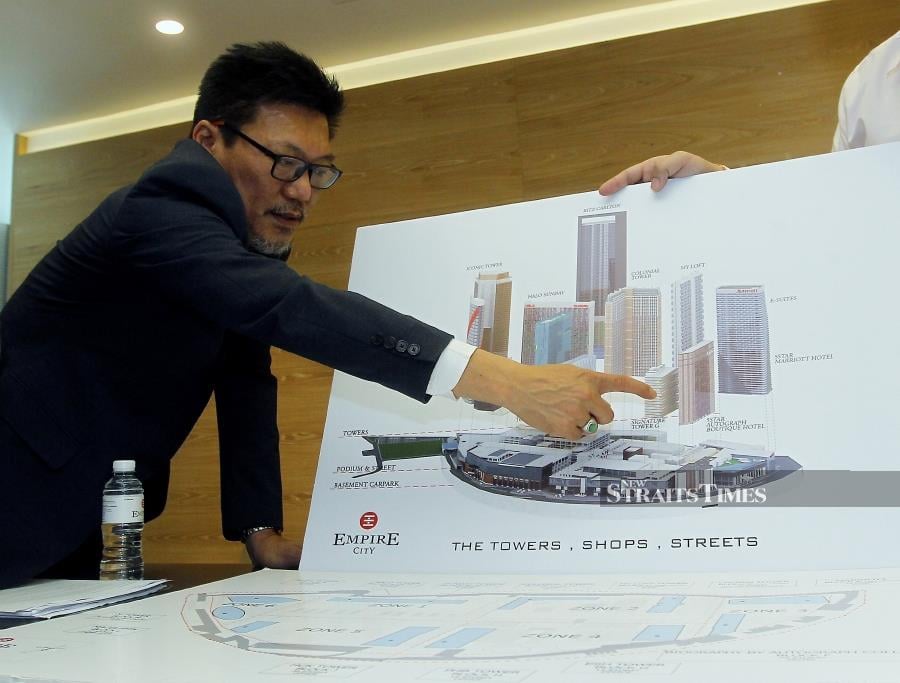

| Knight Frank Malaysia PIC |

|

| Knight Frank Malaysia PIC |

Phase one, Phoenix Court, will launch on the 6th & 7th April through Knight Frank

Malaysia at the Westin Hotel Kuala Lumpur. The release of 286 Manhattan, one, two and

three bedroom apartments presents an opportunity to invest in this iconic central

London development at the earliest possible stage with homes ranging in size from 413

sq. ft. to 1,092 sq.

The Oval Village development benefits from an extremely convenient central London

location – it is just a short walk from Vauxhall, Kennington and Oval stations

connecting to the Victoria Line, Northern Line and National rail. These stations are

just 7 minutes to Oxford Circus, 9 minutes to Bank, 12 minutes to King’s Cross

St.Pancras and 40 minutes to Heathrow Airport.

Set to transform Oval into a top commuter hotspot, Oval Village will transform the area

into a cultural hub for residents and visitors, through the regeneration of the iconic

Oval Gasholders, the provision of commercial spaces and opening up the village with

communal landscaped spaces for all to enjoy.

When built in 1847, the Oval Gasholders were the largest of their kind – a magnificent

feat of Victorian engineering. Now, the historic site’s restoration and redevelopment

marks a new phase in its history where old will blend with new to create a new London

community fit for the 21st century. Within Oval Village will sit The Generator,

presenting six floors of flexible office space, a ground-floor co-working hub, 100,000

sq. ft. of commercial space, a cafe and a community centre.

Residents living in Oval Village will benefit from Berkeley Homes’ industry-leading

approach to delivering outstanding residential property where convenience and comfort

are paramount. A 24- hour concierge will serve every apartment, and for the health

conscious, access to a private swimming pool and gym means no more pre-dawn schleps to

the local leisure centre to stay in shape. An on-site Tesco Superstore will also ease

the burden of the weekly shop.

Simon Howard, Sales Director, Berkeley Homes elaborates on the plans for the

development and how it will feel to live in this new neighbourhood: “Oval Village is an

incredibly exciting regeneration project for Berkeley Homes and we’re delighted to

reach another milestone in creating a new community in this iconic location. The

development will combine impeccably finished homes with public recreation and working

space to create a new kind of neighbourhood with community at its heart. It will offer

a sense of village living with all the benefits of being in the centre of London. As

well as an incredible place to live and spend time, the fantastic Zone 2 location means

that in less than a 30 minute walk you can be in the heart of the City, walking along

the banks of the Thames, enjoying the West End, or relaxing in one of the many tranquil

local parks.”

Dominic Heaton-Watson, Associate Director, International Residential Project Marketing,

Knight Frank Malaysia, commented: “Oval Village SE11 is tremendously well-located for

everything Central London has to offer and there is a significant opportunity for

capital growth at this phase 1 launch.

“With so few regeneration sites of this scale left in central London, Oval Village SE11

will see the creation of a stunning neighbourhood and vibrant destination. The project

is uniquely placed in an area already serviced by extensive underground stations, an

established network of leisure amenities, retail, restaurants and bars, as well as

being just a short walk from the River Thames.

“Oval has one of Transport for London’s (TFL) highest connectivity ratings, is set for

a marked transformation in the years to come. Given that the project’s surroundings are

already well-established, unlike many other urban regeneration projects in London, it

means that purchasers will be able to move in and enjoy all that the neighbourhood has

to offer from day one.”

The development is nestled in the heart of the London borough of Lambeth and in

addition to sitting alongside the world-renowned cricket ground, this location means

that residents will also be able to enjoy more than 60 public parks, commons and

gardens which are located in the Borough. The crown jewel is the award-winning

Kennington Park – just five-minute’s walk from Oval Village – with an array of leisure

facilities, open grassland and a flower garden. There are also many more hidden green

gems in this this part of London, including the enchantingly bohemian Bonnington Square

Pleasure Gardens or Vauxhall City Farm.

Within Oval Village itself, world-renowned landscape architects are designing the

public realm to create a network of private residents’ gardens. The development’s

interconnected green havens will become focal points for the whole community and create

one of London’s most desirable destinations to be part of.

Berkeley Homes is committed to delivering outstanding, high-spec finish to all of the

homes it creates and Oval Village’s interiors will feature a refined and minimalist

material palette for a modern look, while also giving a nod to the area’s industrial

heritage.

Residents can expect to see a sharp contrast of classic dark and light tiling in

bathrooms with sharp angles and clean lines creating a simple and sophisticated feel.

Vintage-inspired accents and fittings – including warm mango woods and powder-coated

black metal – will provide clean lines and reflective finishes. This contemporary style

will contrast with soft, organic furniture, to create a layered aesthetic. In the

bedroom, Oval Village’s soothing colour tones and elegant soft furnishings will create

a calming atmosphere and the ideal place to power down and recharge.