By NST Business Times/Kathy B. - February 27, 2024

KUALA LUMPUR: Malaysia boasts a total of 366 skyscrapers as of Jan 3, securing the fourth position in terms of skyscraper count globally.

Among these impressive structures, 293 soar beyond 150m, with 67 exceeding 200m and six towering over 300m, according to Wikipedia.

Kuala Lumpur hosts the world's second-tallest building, the Merdeka 118, at 678.9m, with a multi-faceted diamond-shaped facade and unique spire design.

Dubai, which has a population of just over three million, boasts the tallest building in the world, the Burj Khalifa, at 828m.

The term "skyscraper" typically refers to buildings surpassing 150m in height and featuring more than 40 floors.

Leading the global skyscraper race are China with 4,377 structures, followed by the United States with 1,164 and the United Arab Emirates with 545.

Even with a relatively modest land area, Singapore lays claim to 130 skyscrapers, reflecting its vertical urban development.

Skyscrapers offer multifaceted contributions to a country's economy, from job creation to attracting foreign direct investment.

From the standpoint of real estate development, these towering structures signify substantial investments, generating revenue for developers, construction firms and property management companies.

According to economists, this infusion of capital fosters economic activity within the construction sector and its ancillary industries.

Moreover, they said the construction and operation of skyscrapers act as catalysts for employment opportunities.

Skilled and unskilled labour are required throughout the construction phase, such as architects, engineers, construction workers and administrative personnel. Post-construction, skyscrapers necessitate ongoing maintenance, security and other services, further bolstering job creation.

Economist K.K. Law from an investment bank said skyscrapers often assumed the role of landmarks and focal points within cities, attracting businesses and residents alike.

"Their presence tends to elevate demand for nearby properties, leading to increased property values and return on investment for property owners.

"Typically housing offices, retail spaces, restaurants, hotels and various commercial establishments, skyscrapers stimulate economic growth by generating revenue, attracting consumers and fostering vibrant business environments."

Law said central business district skyscrapers, in particular, emerged as hubs of economic activity, housing the headquarters of multinational corporations and financial institutions.

Furthermore, the construction of skyscrapers frequently prompts enhancements in infrastructure, such as transport networks, utilities and public spaces.

"These investments not only stimulate economic development but also enhance the overall quality of urban life.

"In essence, skyscrapers symbolise economic vitality and urban progress, playing a pivotal role in propelling economic growth, job creation and investment on a global scale," he said.

Reflecting on Malaysia's prominent position in the global skyscraper landscape, KGV International Property Consultants executive director Samuel Tan deliberated on the driving force behind this phenomenon.

Tan attributed Malaysia's skyscrapers to a blend of national pride and economic ambition, particularly catalysed by former prime minister Tun Dr Mahathir Mohamad's vision to position Malaysia as a modern economic powerhouse.

He said the economic boom of the 1990s spurred skyscraper construction, fuelled by corporate ambitions to showcase prominence and prosperity.

"Flushed with cash, iconic projects and buildings were initiated by private developers and government-linked companies. They started building skyscrapers, changing the landscapes of the larger cities, especially Kuala Lumpur.

"Companies want to make their presence known, and one of the best ways is to have outstanding buildings carrying their corporate names."

However, he cautioned against overzealous development, noting the current challenge of oversupply amid a slowdown in the economy.

Citing occupancy rates and the need for prudent development, Tan emphasised the importance of balancing iconic projects with economic feasibility.

"Now that the economy has slowed down, we are suffering from an 'overbuilt' situation."

According to him, there are 18.39 million square metres of space in the purpose-built office (private) as of the third quarter of 2023, and the occupancy rate was only 72.7 per cent.

The occupancy rates range from 52.4 per cent in Putrajaya to 90.6 per cent in Labuan and 92 per cent in Terengganu.

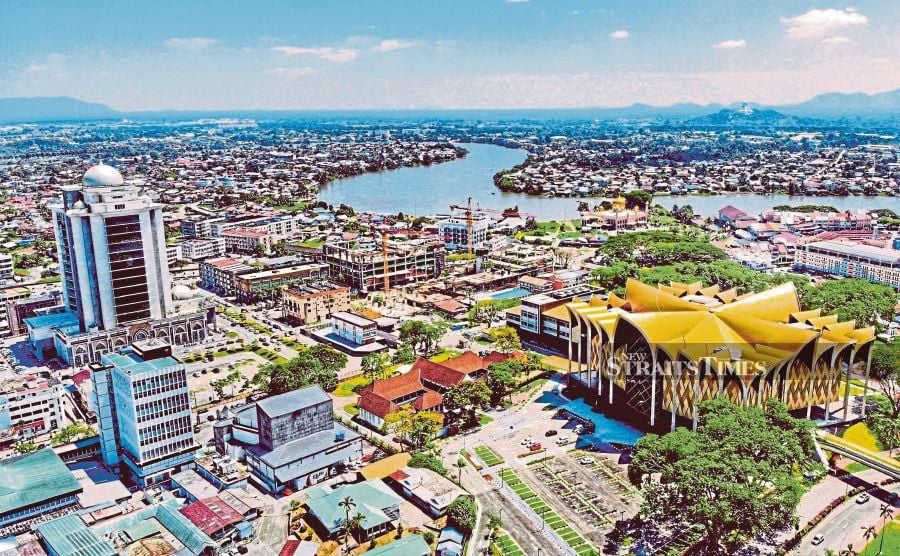

Larger cities in Kuala Lumpur and Selangor reported rates of 72.1 per cent and 70.6 per cent, respectively. Sarawak reported an occupancy rate of 87.4 per cent and Sabah at 87.25 per cent.

Tan urged developers to prioritise sustainable growth and prudent resource allocation to avoid exacerbating oversupply.

He said in essence, while iconic skyscrapers symbolised national progress and corporate success, their construction must align with economic realities and prudent development strategies to safeguard against overbuilding.

"Developers must be mindful that they should avoid overbuilding as there are opportunity costs involved.

"Funds can be utilised for more productive purposes, and these will also help in their business cash flow. Notwithstanding, the pride of having iconic skyscrapers must not be discounted. But it should be done only if one can afford it and it does not add to an oversupply situation."

Last week, Sultan of Perak Sultan Nazrin Shah said skyscrapers did not have meaning if there were still people trapped in poverty.

Alliance For A Safe Community chairman Tan Sri Lee Lam Thye said in a statement skyscrapers might symbolise economic growth with their towering heights and gleaming facades, and stood as a testament to human engineering and ambition.

But below these buildings in some cities and towns, there were shacks housing people who had little access to education, healthcare and basic amenities, he said.

In helping the urban poor, he suggested providing access to more small, low interest loans to enable them to start or expand small businesses, and create sustainable sources of income.

"There should be social welfare initiatives that provide financial assistance, healthcare and housing support to those in need. This can act as a safety net during difficult times," he said.

Source: https://www.nst.com.my/business/corporate/2024/02/1018200/malaysia-boasts-366-skyscrapers-jan-3