By Sharen Kaur - April 14, 2023

KUALA LUMPUR: Tan Sri Lee Kim Yew, a billionaire entrepreneur, says he did not file for bankruptcy but was declared bankrupt by a US citizen named Patrick Healy over a RM3 million (US$681,508) lawsuit.

The founder of Country Heights Holdings Bhd also suggested that an individual was using a dirty trick against him.

Lee said that he was "solidly solvent" and that a bankruptcy notice was filed against him at the Malaysian Insolvency Department (MDI) based on a US arbitration court judgement.

Healy, an employee of a now-defunct US-based Club Excellence Inc, had earlier acquired a RM3 million judgement in his favour in the US and used it in Malaysia to declare him bankrupt, Lee said.

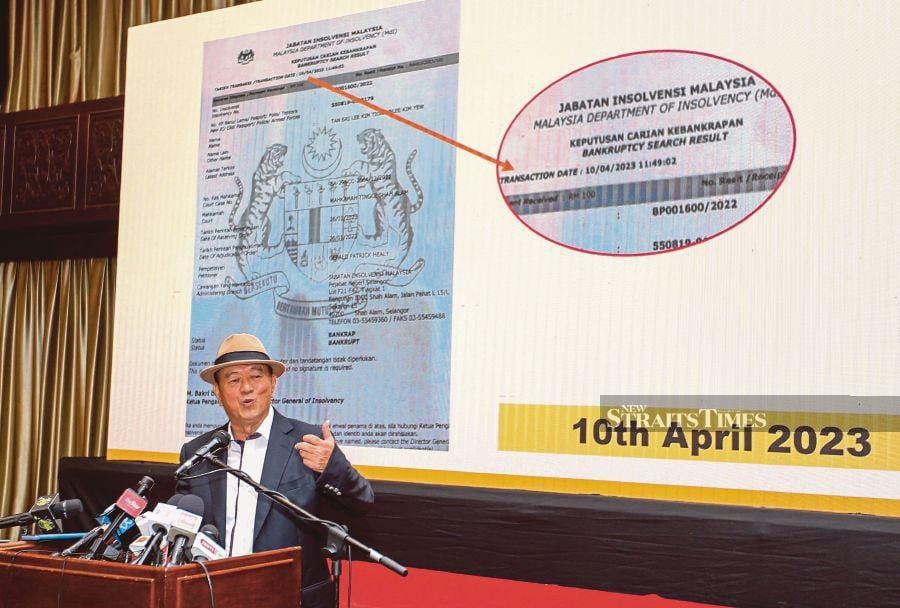

On Wednesday, a screenshot of a bankruptcy search that proved Lee's bankruptcy status went viral.

Lee was supposedly declared bankrupt by the Shah Alam High Court on Jan 26.

"I did not file for bankruptcy. I don't choose to be bankrupt. I don't want to be bankrupt. I never declared myself to be bankrupt nor filed for bankruptcy. I want to continue to help society. This individual declared me bankrupt over a RM3 million suit. It's a personal attack against me," he told reporters at a press conference in Seri Kembangan today.

"Who was the one on April 10 paid RM100 and downloaded from the Department of Insolvency? Who is the one using this dirty trick instead of following the law of Malaysia?" he asked.

Lee also provided numerous slides outlining several reasons why he would not pay Healy the alleged figure, which he considered to be a "small amount."

He is a lawyer and a friend of mine. We could have reached a solution amicably. But he chose to seek a judgement in the United States. He could have chosen a better way.

"Based on the fact that I was attacked on social media and it is not in the best interests of the country, I have written to the Malaysian government to allow my lawyer to continue negotiating with Healy's lawyers for an amicable settlement," said Lee.

If negotiations fail, he said he would file an appeal with the MDI and "deposit RM3 million cash for MDI to deal with Healy."

"I've had calls from family, friends, and business associates as far away as China and Japan. They find it difficult to believe all of this. I have a lot of tangible and intangible assets," said Lee, who, through his public-listed Country Heights and his private firms, own over RM2 billion worth of assets, collectively.

Lee said he had resigned from all corporate directorships as of Jan 26.

He also denied allegations that he had been barred from flying abroad.

Meanwhile, Lee told the News Straits Times that he wished to settle the dispute amicably so that he could focus on building his personal projects.

"I will concentrate my efforts in the conventional banking world, develop a new philosophy, revise the scene by establishing an eco network, and strive for a new world. I see what is happening now as an opportunity. As for Country Heights, when you get to the bottom, and when you change, it will be bigger," he added.

Lee had been credited with transforming the world's largest open cast tin mine, into a world-class resort living-themed city in Seri Kembangan, to being chosen to lead key initiatives under the Malaysian government's Economic Transformation Plan.