By Sharen Kaur

I-Berhad will embark on a Corporate Social Responsibility (CSR) programme at Central Walk @ i-City in the capital city of Selangor which will run from 21 November 2018 till 20th February 2019.

The RM3 million CSR programme will feature major events, community and social activities, as well as charity drives and festive celebrations.

There will also be street activities like food fairs, night bazaars and street performances.

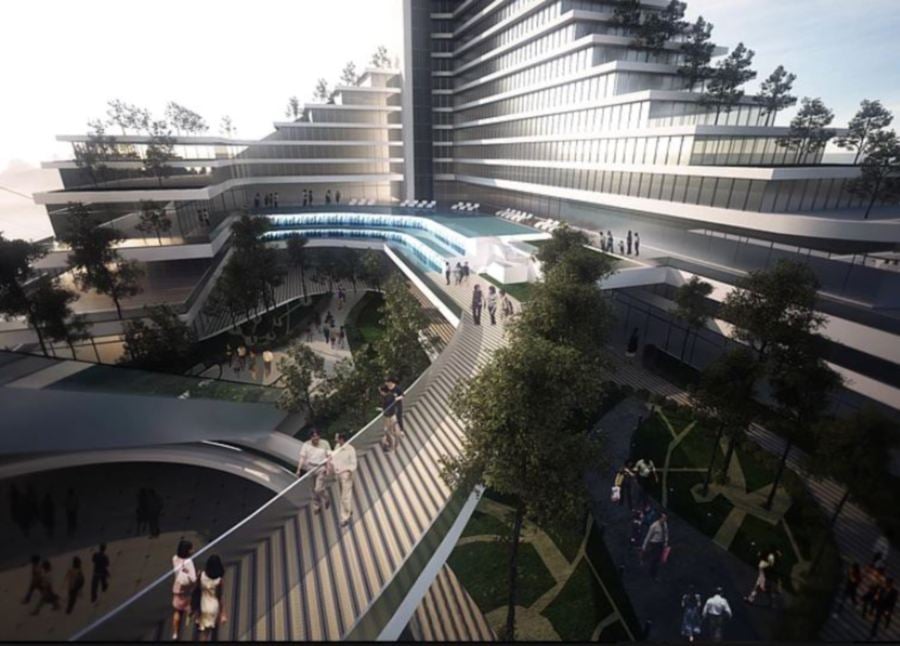

As an International Park frequented by tourists of many nations, this programme will also provide foreign investors and tourists a glimpse of Malaysian life while bridging the cultural divide between the international and local communities, said I-Berhad executive chairman Tan Sri Lim Kim Hong. Central Walk @ i-City is a multi-block leisure, shopping and hospitality spine of i-City encompassing a theme park, the 1.5 million square feet Central i-City Mall, the i-City convention centre, Best Western Hotel, the five-star Double Tree by Hilton, and High Street retail spaces.

As such, it is the most appropriate setting for this programme, said Lim.

i-City is an internationally recognized tourism destination, and has been featured by CNN Travel as one of the world's top 25 most colourful and brightest places.

Key attractions in i-City include the Red Carpet interactive wax museum, the snowfall experience in SnoWalk and the lightscape at the City of Digital Lights.

The Central i-City Mall will be the first mall outside of Thailand by the Central Group that will be opened to the public in Jan 2019.

Lim said, in addition to the many participating parties, i-City will also be working with a number of community service and social organizations to reach out to the less fortunate to ensure that the variety of activities on-hand represent all walks of life and that none are left out.

i-City will also engage with a number of government agencies in line with its status as a MSC Cybercentre, Tourism Destination and International Park for this event.

Highlights of this 3-month programme will be the "White Christmas in i-City" and the New Year Countdown celebrations, the Central i-City Mall opening, and Chinese New Year festivities.

"We are confident that these attractions coupled with the various street performances and cultural shows will offer visitors a unique experience. We are expecting minimum 50,000 students to visit i-City as we will be giving away free tickets as part of the CSR programme.

"In terms of residents, there are 15,000 people living in i-City now and the workforce is also increasing. So it will be a good opportunity for all those who will partake in this event," said Lim.

Lim said, as part of the CSR initiatives, the developer will also cover the SME food and retail operators, as well as telcos and the automotive industry with special retail space offering to serve the expected 500,000 visitors during the programme.

"This CSR will provide opportunities to these operators to boost their income. We will give them space to utilise for free for three months during the CSR programme," said Lim.

I-Berhad will embark on a Corporate Social Responsibility (CSR) programme at Central Walk @ i-City in the capital city of Selangor which will run from 21 November 2018 till 20th February 2019.

The RM3 million CSR programme will feature major events, community and social activities, as well as charity drives and festive celebrations.

There will also be street activities like food fairs, night bazaars and street performances.

As an International Park frequented by tourists of many nations, this programme will also provide foreign investors and tourists a glimpse of Malaysian life while bridging the cultural divide between the international and local communities, said I-Berhad executive chairman Tan Sri Lim Kim Hong. Central Walk @ i-City is a multi-block leisure, shopping and hospitality spine of i-City encompassing a theme park, the 1.5 million square feet Central i-City Mall, the i-City convention centre, Best Western Hotel, the five-star Double Tree by Hilton, and High Street retail spaces.

As such, it is the most appropriate setting for this programme, said Lim.

i-City is an internationally recognized tourism destination, and has been featured by CNN Travel as one of the world's top 25 most colourful and brightest places.

Key attractions in i-City include the Red Carpet interactive wax museum, the snowfall experience in SnoWalk and the lightscape at the City of Digital Lights.

The Central i-City Mall will be the first mall outside of Thailand by the Central Group that will be opened to the public in Jan 2019.

Lim said, in addition to the many participating parties, i-City will also be working with a number of community service and social organizations to reach out to the less fortunate to ensure that the variety of activities on-hand represent all walks of life and that none are left out.

i-City will also engage with a number of government agencies in line with its status as a MSC Cybercentre, Tourism Destination and International Park for this event.

Highlights of this 3-month programme will be the "White Christmas in i-City" and the New Year Countdown celebrations, the Central i-City Mall opening, and Chinese New Year festivities.

"We are confident that these attractions coupled with the various street performances and cultural shows will offer visitors a unique experience. We are expecting minimum 50,000 students to visit i-City as we will be giving away free tickets as part of the CSR programme.

"In terms of residents, there are 15,000 people living in i-City now and the workforce is also increasing. So it will be a good opportunity for all those who will partake in this event," said Lim.

Lim said, as part of the CSR initiatives, the developer will also cover the SME food and retail operators, as well as telcos and the automotive industry with special retail space offering to serve the expected 500,000 visitors during the programme.

"This CSR will provide opportunities to these operators to boost their income. We will give them space to utilise for free for three months during the CSR programme," said Lim.

_1536891566.jpg)

_1536891569.jpg)

_1536891571.jpg)

_1536891578.jpg)

_1536891576.jpg)

_1536891583.jpg)

_1536891581.jpg)

_1536891574.jpg)