'Three shortlisted for TNB job'

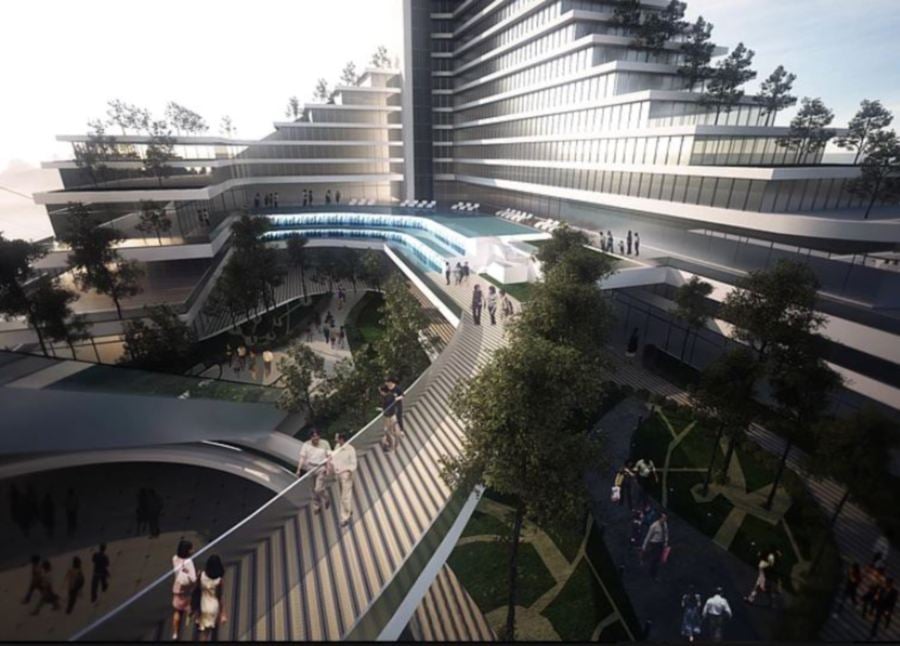

(File pix) An artist’s impression of the new Tenaga Nasional Bhd tower. Pix from Melati Ehsan website

TENAGA Nasional Bhd (TNB) is believed to have shortlisted three companies to develop four office blocks and shared facilities within the vicinity of its headquarters in Jalan Bangsar, Kuala Lumpur.

The three companies are Sunway Construction Group Bhd, Ahmad Zaki Resources Bhd and Pesona Metro Holdings Bhd.

Sources close to TNB said the contract value for Phase 2 of the project is between RM700 million and RM800 million.

Phase 1, which includes a RM40 million job to build Balai Islam complex, has been awarded to Malaysian Resources Corp Bhd (MRCB).

"The frontrunner for Phase2 is Sunway Construction, which will be awarded with the project soon," said the source.

This landmark development with a gross development value (GDV) of more than RM1 billion is expected to house TNB's workforce and offer enhanced synergy and organisation collaboration.

It is also likely where the new TNB headquarters will be located as the existing one is 81 years old. In 2007, TNB had planned to build a new 34-storey headquarters that would cost up to RM300 million and be ready by 2011, but it was called off due to the economic slowdown.

TNB had wanted a new office to cater for its 30,000 workforce and expand operations. The headquarters were supposed to be designed based on Pucuk Rebung, which depicts a young bamboo shoot with strong foundations at its root and few leaves sprouting.

Meanwhile, Bayu Mantap Sdn Bhd, a company linked to property developer-cum-construction firm Melati Ehsan Holdings Bhd, is developing the 1.52ha land for TNB at the corner of Jalan Bangsar/Jalan Pantai Baru.

TNB and Bayu Mantap inked an agreement in June 2016 to undertake the freehold commercial development.

Bayu Mantap is controlled by Melati Ehsan's largest shareholder, Tan Sri Yap Suan Chee, and his family.

According to sources, TNB and Bayu Mantap will develop two high-rise towers and a two-level commercial complex, with a GDV of RM1.3 billion to RM1.5 billion.

One of the towers will be a Grade A office building. The other tower will include high-end serviced apartments and a four- or five-star hotel.

According to Melati Ehsan's website, the two towers will have 66 and 54 levels, respectively.

The other parties involved in this project are international firms, such as Turner Construction Co and Woods Bagot.

Turner Construction is the project management company that is also managing Permodalan Nasional Bhd's PNB 118 building, which is under construction in Kuala Lumpur.

Woods Bagot, a global architecture firm that is responsible for award-winning projects like the National Australia Bank headquarters in Melbourne and Chongqing Tower in China, designed the towers.

URBAN REGENERATION PROJECTS

It is surprising that TNB has started the three projects when the overall market is depressed.

A real estate expert said despite the current market sentiment, a development with the right mix of factors thatinclude location, lifestyle concept, pricing and marketing mix can perform reasonably well and attract buyers.

What the market wants to know is whether the TNB developments will fair well in the current market situation where there is oversupply, especially in retail and office space.

PropertyGuru Malaysia country manager Sheldon Fernandez said the TNB redevelopment is similar to many other urban regeneration projects in Malaysia.

"The goal is to unlock latent value of the land and assets and, if done correctly, is a welcome move. Urban regeneration is an essential part of city development that is similar to the development of TRX (Tun Razak Exchange) and Bandar Malaysia," Fernandez told NST Property.

He said urban regeneration has proven to be successful, citing the transformation of KL Sentral.

Fernandez said the KL Sentral Suites is a good example.

"The crux of the matter, however, is in the details. How will the land be developed? What is the financing model put in place? Will it be a joint-venture with TNB partnering an external developer? Will TNB still retain ownership of the land? What will the government's role be in all this? Has there been a thorough SIA (social impact assessment), TIA (traffic impact assessment and other impact assessment reports been conducted? Would it be a green building?

"Secondly, as always, there would be challenges, especially if the involved parties have different ideas. Recently, a similar development approach between UEM Sunrise Bhd and Telekom Malaysia Bhd signed in 2016 was scrapped.

"At this stage, we need to see more details from both parties before the full potential benefits of the projects and impact can be better gauged. But it is only natural for a company to wish to unlock its assets and commercialise or monetise them."

Fernandez said hospitality components would be a good fit for the TNB developments given the location, which is close to

Pantai Hospital and Pullman Kuala Lumpur Bangsar hotel.

"A hotel may support medical tourism in the area. As for commercial and/or retail, this needs careful planning as there is a present glut of commercial spaces and there are established retail spaces in Bangsar. MidValley also is relatively close by.

"Perhaps the commercial or retail spaces can be geared towards the healthcare sector to give the development a unique edge. If it's going to be Grade A office spaces, this in the long run should continue to do well, as Malaysia continues to see reasonable demand for such spaces and in the long term will likely be filled out, barring other factors aside," he said.

Fernandez also does not think the TNB projects would directly compete with KL Eco City and Pelaburan Hartanah Bhd's seven towers opposite The News Straits Time Press (Malaysia) Bhd.

"Rather than compete, we always believe that complementing existing developments is a better strategy to unlock value, while at the same time finding a unique niche within the specific location. A medical tourism or hospitality component may be suitable for the development to distinguish itself from others," he said.

Fernandez said Bangsar remains a well desired address and a mature locale and established suburb.

Prices continue to show upside on average for all residential property types— highrise homes, landed terrace homes, semi-detached and bungalow residences, he said.

"However, residents have voiced concerns about overdevelopment. Therefore, it is rather crucial that developments remain sustainable. However, given the location of TNB's land, which is not too close to residential areas, it is likely to have little social impact. But a TIA and SIA should be conducted to ensure this," said Fernandez.

On whether TNB is turning to real estate development, Fernandez believes that it is likely that TNB has considered all propositions and has adopted this approach to maximise its investment.

TNB, in its 2017 annual report, said it has 76.19ha leasehold and freehold land in the Federal Territory of Kuala Lumpur valued at almost RM228 million.

The net book value of its land and buildings in Kuala Lumpur is in excess of RM700 million and nationwide RM14.45 billion.

No comments:

Post a Comment