By NST Property, Published June 16, 2020

The Short-Term Economic Recovery Package (ERP) valued at RM35 billion may boost the country's economy but there are concerns that the property sector will lag amid larger unemployment and pay cuts brought about by the Covid-19 pandemic.

The Short-Term Economic Recovery Package (ERP) valued at RM35 billion may boost the country's economy but there are concerns that the property sector will lag amid larger unemployment and pay cuts brought about by the Covid-19 pandemic.

"A lot of small-medium enterprises, government-linked firms, and public-listed companies (PLC) are retrenching or asking their employees to go on unpaid leave until the situation improves. They are also cutting staff salary by up to 40 per cent and terminating contracts.

"So who will benefit from this stimulus package and who is addressing the issue of people losing their jobs or getting pay cuts? There are more than one million job losses now since the outbreak of the Covid-19.

"With the unemployment rate set to rise by the end of this year, more people will be skeptical to do anything concerning a big-ticket item like property. These include buying, selling, renting a new property and renovation. This will dampen property transactions," said the ex-chief executive officer and chief operating officer of several PLCs.

The measures introduced under the ERP for the property sector include the reintroduction of the Home Ownership Campaign (HOC) and revised Real Property Gains Tax (RPGT).

Gains arising from the disposal of residential properties by Malaysian citizens between June 1, 2020, to December 31, 2021, will be exempted from RPGT. The exemption is given up to three residential properties per individual.

Currently, the applicable RPGT rates for Malaysian citizens and permanent residents range from five per cent to 30 per cent depending on the holding period.

The existing financing limit of 70 per cent margin on housing loan for a third residential property valued at RM600,000 and above will also be lifted.

"These incentives are supposed to ease the challenges faced by developers during this difficult time and to provide financial relief to buyers. But if people do not have income, how are they suppose to buy a property and get a loan? The assessment of the bank is so stringent. There is no loan without proper income.

"While the HOC is a good thing, it will only benefit people with money. A cash-rich person will buy a property and keep it until it reaches a certain value and years down the road will flip it, make money, and walk away. I know cash is king now but if I have a lot of cash, I still won't buy a property as there are so many uncertainties right now. I would rather hold on to my cash," said the ex-property chief.

On RPGT, the ex-chief said that while it is a good move to boost property transactions, nobody will sell in a slumping market unless they are desperate, as they will not get the value their property deserves.

"If I bought my property for RM1 million, and a year ago it was worth RM1.5 million, I am not going to sell it today when the price has dropped to RM1.2 million. I will weight it out even if it takes three years or more for the price to get back to RM1.5 million. By then the RPGT exemption will no longer be applicable. I would still sell if I want to in three years.

"Unless I bought my property 20 years ago and if I sell now under the current market conditions and still make a lot of money, I would consider it.

"Regarding the third house financing with up to 90 per cent loan, I feel you are just going to create more debts in the market. I think the government didn't address the problem. Overall, I believe the housing market will continue to suffer," said the ex-chief.

A silver lining for property?

PropertyGuru Malaysia country manager Sheldon Fernandez said that property provisions in the ERP serve to unlock the demand for high-rise and landed residential.

Fernandez said while Gross Domestic Product (GDP) projections have gone from 4.6 per cent to -4.7 per cent for 2020, the deficit spending approach taken in the ERP is an established strategy in addressing potential recession trends, laying the foundation for a return to pre-Covid-19 levels for the market.

Pre-crisis asking prices were on the uptrend, with the PropertyGuru Malaysia Property Market Index rising by 0.63 per cent to 89.46 in the first quarter of 2020, along with a strong interest in the central region.

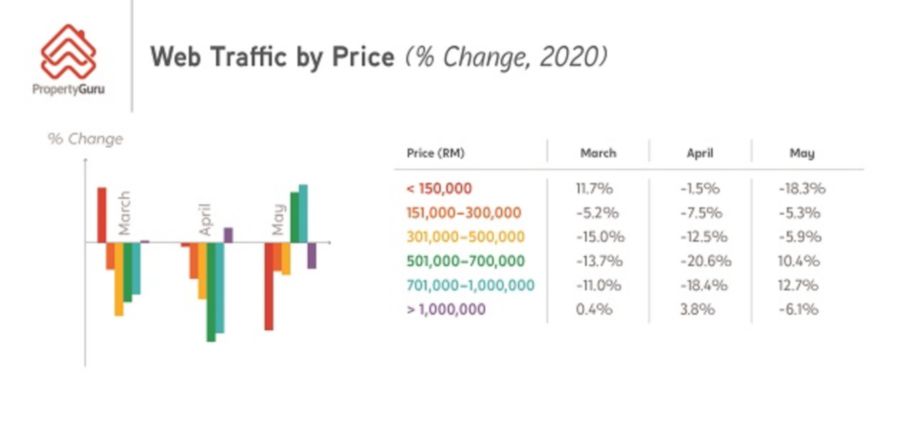

In May, web traffic for properties priced RM501,000 to RM700,000 and RM701,00 to RM1 million saw the highest increase on the property portal, at 10.4 per cent and 12.7 per cent respectively, he said.

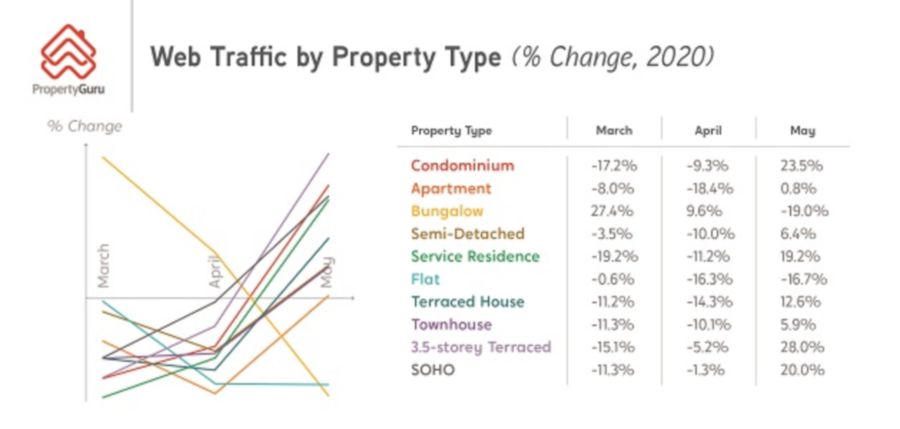

Fernandez said similar increases were seen in condominiums (23.5 per cent), service residences (19.2 per cent), 3.5-storey terraced homes (28 per cent), and SOHO units (20 per cent), indicating healthy demand for these property types as property bounces back post-crisis.

However, search patterns moved away from the central region, with Johor (22.5 per cent) and Penang (19.3 per cent) as prime beneficiaries.

On the HOC, Fernandez said that it could help address ongoing residential overhang concerns, having sold 31,415 units worth RM23.2 billion in 2019.

"The overhang declined to 30,664 units worth RM18.82 billion in the same year, though this downward trend will likely be impacted by the Covid-19 crisis.

"However, some clarity is required when executing these provisions. Do stamp duty exemptions apply to new launches as well as overhang units? If so, it may be difficult to reduce the overhang even with HOC 2020," he said.

Mah Sing Group Bhd founder and group managing director Tan Sri Leong Hoy Kum said the reintroduction of the HOC bodes well for the group to work towards achieving its 2020 sales target of RM1.6 billion.

The developer secured 60 per cent of its sales in 2019 from the previous HOC campaign.

Additionally, the government's move to uplift the 70 per cent margin of financing limit for the third housing loan onward for properties valued at RM600,000 and above during the HOC period will encourage upgrade of homes, he said.

"The previous HOC introduced in 2019 has proven to be effective as it has garnered positive results in terms of sales and most importantly, increasing the country's home ownership level, particularly first-time homebuyers. Malaysia still has a large population of youths whom have yet to own their first homes and thus, the HOC will help provide first-time homebuyers the opportunity to own their ideal home," he said.

Lower appetite for sub-sale market

Joe Hock Thor, CEO of MyProperty Data, operator of the PropertyAdvisor platform said more than 60 per cent of the sub-sale market in 2019 consisted of first-time buyers.

He said with so much uncertainty, he does not expect to see demand returning to pre-Covid-19 levels among first-time buyers in the sub-sale market until at least the fourth quarter of 2020.

He also believes that buyers looking to purchase a home at this current juncture might be greeted with better options, but that it is vital to undertake due research.

No comments:

Post a Comment