By NST Property/ Kathy B. - October 16, 2023

KUALA LUMPUR: The government's New Industrial Master Plan 2030 (NIMP) to increase manufacturing value adds positively to Malaysian industrial demand.

According to UBS, growth in foreign direct investment (FDI) and domestic direct investment (DDI), as well as industrial property values transacted, has historically been faster than growth in value add (2.0 to 5.0 percent per year).

"Hence, to get to the government's goal of 6.5 per cent per annum improvement in value added between 2021 and 2030, we think this will imply up to a 10 per cent compounded annual growth rate (CAGR) in FDI/DDI and, consequently, industrial transaction values," it said.

The strong inbound direct investments are expected to entail significant industrial land requirements in the setup of manufacturing and logistics capabilities.

UBS said mature industrial parks near Senai are seeing strong interest from both multinational companies (MNCs) and Small and medium-sized enterprises (SMEs).

"For Johor, industrial parks are not distinguished by a particular sector concentration but are better categorised by light, medium, or heavy industries. Hence, such parks can fill up quickly. Overall, we think industrial lands that are connected to transport hubs (particularly near Senai, Pasir Gudang Port in Johor's north and east) are becoming scarcer. This is based on our comparison of the built-up area versus existing land zoning.

"We think developers' subsequent landbanking push to industrial is unlikely to result in oversupply. The key is developers sizing up the demand potential effectively," it said.

UBS said that for now, recent industrial landbank transactions that it observes are in the 'hundreds of acres', as opposed to 'thousands of acres' seen within residential townships, as in the past.

It said that, to some extent, prime industrial lands are already constrained by their remaining undeveloped size.

"While it would be an opportune moment for agricultural landowners to extract value from their lands, our conversations with key landowners in Johor (Johor Corporation) suggest that prime industrial lands near connectivity nodes will likely be kept. This will mitigate the supply profile," it said in a note.

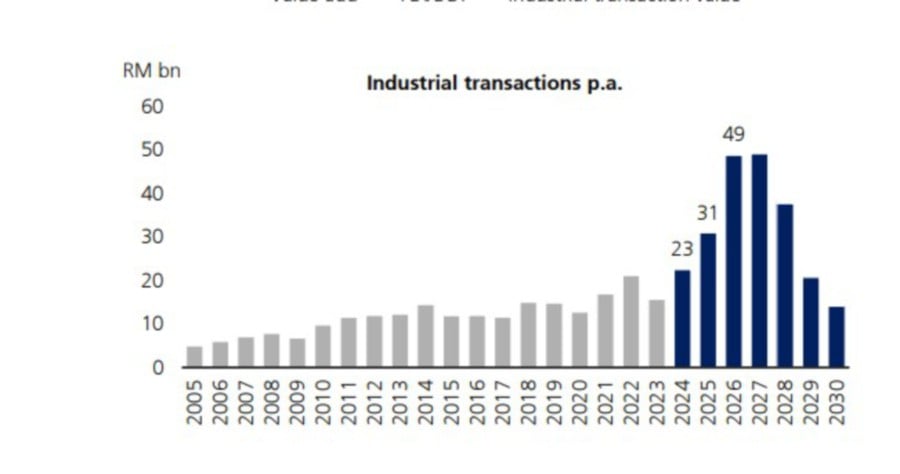

UBS said that, in terms of timing, direct investments (including industrial properties) are likely to be frontloaded into the earlier years of the NIMP (2024–2026).

It believes that the size of the addressable market could approach a significant RM23 billion to RM49 billion per annum, a record high.

"This assumes the government's targets are met. If we assumed a modest 3.0 per cent CAGR on value-added growth and a twofold increase in direct investment (6.0 per cent), the floor for industrial transactions could be a minimum of RM13 billion to RM15 billion per annum, still sizeable. This growing pie would spell abundant opportunities for developers to capture market share," it noted.

The National Energy Transition Roadmap (NETR) push towards renewable energy is also land-intensive, particularly from solar farms, which need to be located on industrial zoned lands.

"There is an announced plan to create up to 1 GW of hybrid solar capacity. We estimate that this would translate to a minimum of 2,000 acres of industrial land required, conservatively speaking. This assumes a large-scale 'efficient' rooftop solar setup.

"If we assume stand-alone solar farms, that brings demand for industrial land to a high of 5,000 acres. While the need is big in theory, there are certain hurdles that the developers face in participating meaningfully.

"We list down payback considerations between different industrial and solar projects. Developers' current business model of building to sell industrial properties would appear to be the most cash-generative. Although operating solar farms has a similar payback period (on upfront costs) to leasing industrial properties, high maintenance costs and lower perceived capital appreciation pose longer-term investment uncertainties at the moment.

"This is why solar farms are only a small fraction of developers' industrial townships. Should the former issue of higher maintenance costs be resolved (by working groups such as Sime Darby Property), this could then unlock a meaningful expansion of the addressable market for industrial land," it said.

Source: https://www.nst.com.my/property/2023/10/967564/new-industrial-master-plan-2030-will-drive-industrial-demand-malaysia

No comments:

Post a Comment