THERE will be renewed confidence in the local property market with the expected rise in demand for properties across the board as the new government promises clean and fair governance.

“We would like to reiterate that 2018 will be significant for the Malaysian property market. However, the second quarter of the year would be relatively quiet for property transactions, with the onset of the Ramadan fasting month,” said Savills Malaysia executive chairman, Datuk Christopher Boyd.

He said the condusion of the 14th General Elections (GE14) would encourage residential property buyers who had been holding back transactions.

Boyd expects a period of adjustment and consolidation to clear existing stocks before prices increase.

“Generally, we foresee prices firming up in 2019, and it will be in early 2020 before developers can respond by stepping up supply. In short, particularly in Greater KL and Penang, there has never been a better time to buy,” he said.

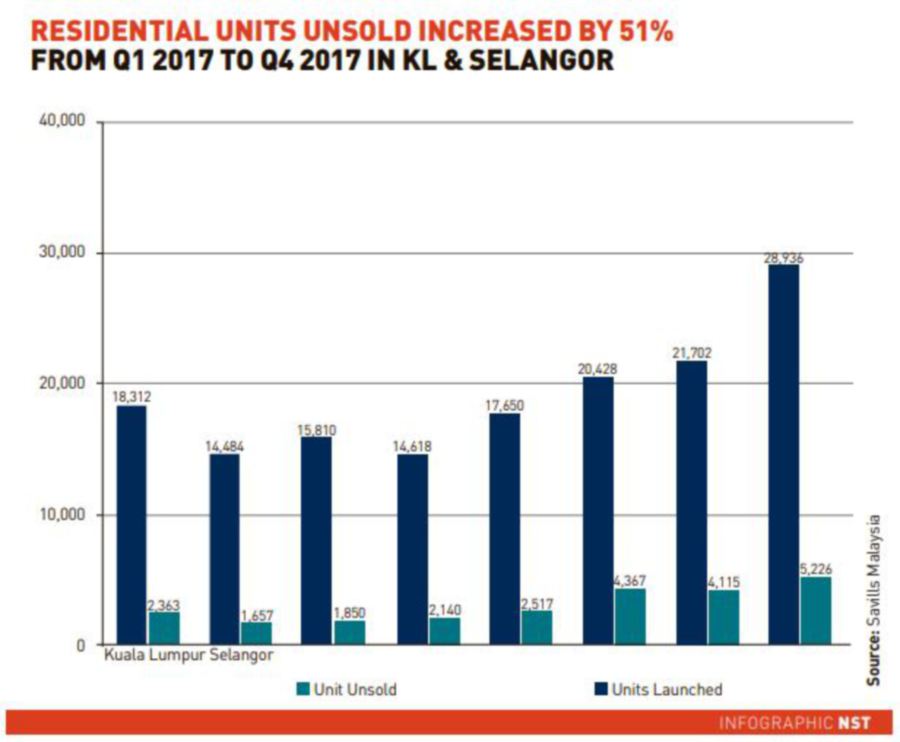

The value of unsold units that were completed in Kuala Lumpur and Selangor rose 44 per cent last year.

The number of unsold houses in Selangor rose by 108 per cent to 5,200 units during the same period.

OFFICE SPACE, RETAIL TO MOVE UP?

For the office space, Boyd said it will take some time for the market to absorb the 16.9 million sq ft of new space to be completed by 2020.

“In the short term, we anticipate that with the uncertainties of the elections behind us, more potential upgraders will see their way clear to invest in a move to new premises.

“This could lead to an absorption of more than the 1.9 million sq ft we saw in Greater KL last year. In the medium term, we expect the new office take-up to increase in tandem with a growing economy and more foreign direct investments (FDIs),” he said.

Boyd had said at the Savills Malaysia Breakfast Forum in March that the existing stock of office space in the Klang Valley stood at some 120 million sq ft, which was higher than Singapore and Bangkok.

He said the current vacancy rate for office buildings in the Klang Valley was between 20 and 25 per cent and was likely to hover around 25 per cent until the surplus space was absorbed, which may happen around 2021/2022.

Meanwhile, Boyd said the abolition of the Goods and Service Tax (GST) will not have any impact on office rentals.

However, it will have a positive impact on the retail sector, he added.

“While the market is likely to remain well-supplied in Greater KL, we see the likelihood the retail turnover picking up in areas where GST is lifted from merchandise, and not replaced by a sales tax.

“We hope luxury goods will fall under this category, making Malaysia a tourist shopping destination,” said Boyd.

The Finance Ministry announced recently that starting from June 1 this year, the GST will be zero-rated for all goods and services nationwide until further notice.

Savills Malaysia deputy executive chairman Allan Soo said groceries, food and beverage, and fashion brands will see positive impact from the lifting of the GST.

Retail sales in Malaysia rose 8.6 per cent year-on-year in March this year, after a 9.2 per cent gain in February, the weakest growth since August 2016.

INDUSTRIAL SECTOR

Savills Malaysia managing director Datuk Paul Khong believes renewed market confidence would boost FDIs.

Coupled with surging domestic consumption, the prospects for the industrial and logistics market are positive, he added.

“Look out for rising industrial rents which have lagged behind recent strong increases in industrial land values,” he said.

Khong said there will be some good news for real estate investment trusts and other funds that are focused on the sector.

“Institutional investors, particularly foreign investors, dislike uncertainty.

With GE14 behind us, we are preparing for a major uplift in domestic and foreign interest in commercial investment properties.

“Malaysia has liberal policies related to foreign investments in commercial property and can offer attractive yields,” he said.

Khong said the prospects of ringgit’s appreciation and strong economic growth would make Malaysia an outstanding regional investment opportunity.

NST Infographic

No comments:

Post a Comment