(File

pix) Effective January 1 this year, a five per cent RPGT will be

charged on houses sold from the fifth year and onwards, including

properties bought more than 30 years ago.

IN

the 2019 Budget, among the measures that stood out the most is the

imposition of five per cent Real Property Gain Tax (RPGT) on gains from

disposal of property after the fifth year of owning it. Industry experts

feel that the impact is more on long-term property investors than

short-term speculators who gain from flipping properties.

Regardless of who is impacted, everyone who owns a house will have to pay the tax when they sell at a profit on January1this year and thereafter, especially the sales and purchase document signed on this given date or thereafter, said PropertyGuru Malaysia country manager Sheldon Fernandez.

“However, it must also be taken into account that the valuation for RPGT will be taken from year 2000 onwards, which applies to properties bought at that time,” Fernandez said.

He said the imposition of five per cent RPGT from the sixth year and onwards in perpetuity means that residential owners are now being treated as commercial owners just as properties bought under a company rather than as an individual.

Asked whether if its fair for a homeowner who bought a house 30 to 40 years ago at RM200,000 and sold it for RM1 million today to pay the five per cent RPGT, Fernandez said such a move will take away from the gains made by many owners, most of whom have held properties as a means to preserve their wealth or as a form of a long-term investment to finance their children’s education or for retirement.

“It will impact many middle-income or middle-class Malaysians. It may appear that five per cent is not a big amount, but based on the example (purchase price of RM200,000 and sale price of RM1 million), the gross profit is RM800,000.

Therefore, five per cent RPGT is RM40,000 and it is not a small amount for most Malaysians today.

“However, the numbers must take in account that for older properties, the valuation will be based from year 2000 onwards. This may somewhat offset the impact and will vary on a case-by-case basis. It is good the government has implemented this caveat of sorts to lessen the blow on retirees and those who bought their properties a long time ago,” Fernandez told NST Property.

The decision, however, affects the savings of many retirees and older Malaysians or those who have bought properties to finance their children’s education, he said.

“There are no gains even on profits made from the stock market, so taxing property gains such as this seems one-sided and it will impact the supply side,” he added.

Fernandez reminded people looking to invest or buy a property in Malaysia to have a clear understanding of the RPGT.

What is RPGT?

Levied by the Inland Revenue Board (IRB), RPGT is a tax imposed on gains from disposal of real property. In short, a tax on one’s net profit when one sells a property.

It is also imposed on the disposal of shares in companies, where 75 per cent of tangible assets are in properties, such as Real Property Companies (RPC).

RPGT was first introduced in 1976 under the Real Property Gains Tax Act 1976. It was temporarily suspended between April 2007 and December 2009, before it was reintroduced in 2010.

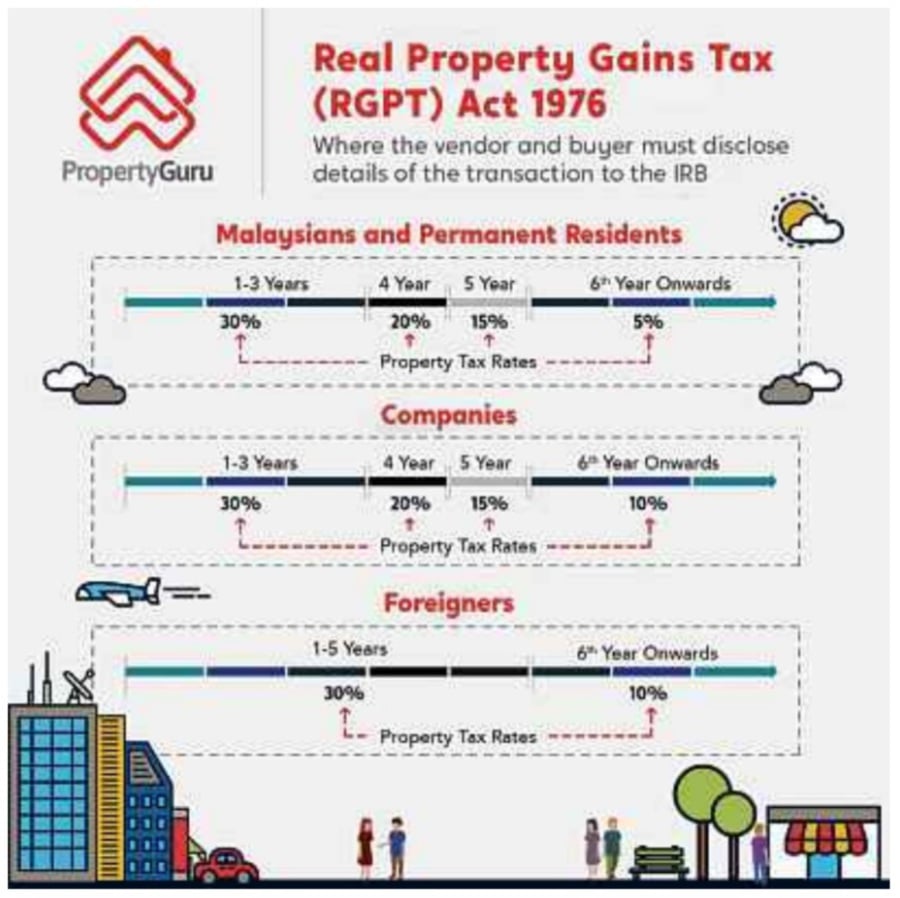

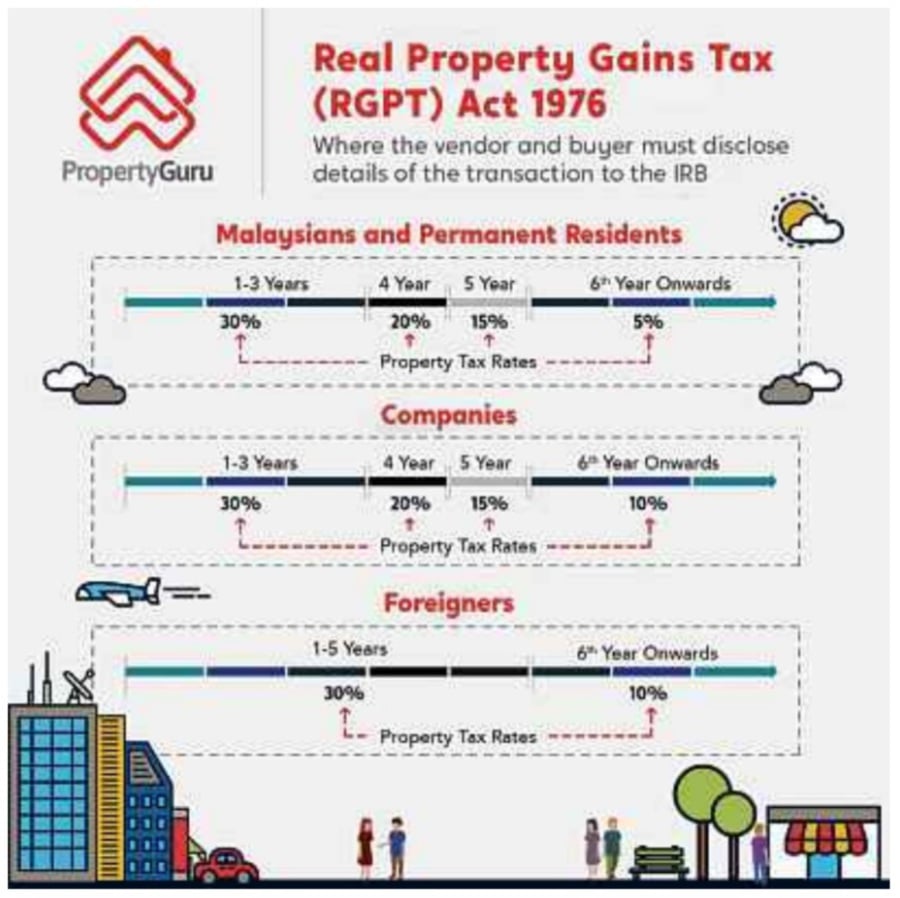

The rates payable depend on the entity on which the RPGT is imposed and the holding period of the property. The holding period is based on the date of signing of Sale and Purchase Agreement and disposal date.

As such, a Malaysian citizen or permanent resident who disposes of his or her property within the first five years of acquiring it is subject to RPGT. And, with the new RPGT rates announced in the 2019 Budget, Malaysians will now be charged five per cent in property taxes after the fifth year, where it used to be zero per cent.

Non-citizens and companies on the other hand will be charged 10 per cent RPGT when they dispose of their property after more than five years from purchasing it.

How is RPGT computed?

How is RPGT computed?

To know the amount payable for this tax, itis important that one knows what is the chargeable gain — which is basically the amount arrived after deducting the property’s disposal price from its purchase price.

Bear in mind that an individual may only be taxed on the positive net capital gains which is simply the amount arrived after deducting the disposal price with the purchase price and miscellaneous charges, such as legal fees, administrative fees, advertisement charges, and stamp duty.

The net chargeable gain would then be multiplied to the applicable RPGT rate.

How to file to pay RPGT

1. Fill out Disposal of Real Property (CKHT 1A) form. Attach with the Sale and Purchase Agreement and other documents supporting the deductions that one plans to make from RPGT.

2. Those applying for RPGT exemptions should also fill out Notification under Section 27 RPGTA 1976 (CKHT 3) form.

3. Ensure that the buyer fills out the Acquisition of Real Property (CKHT 4) form, which should come with a copy of the Sale and Purchase Agreement.

4. Submit the forms and other supporting documents to the nearest IRB

branch within 60 days.

Note: The forms are available at any IRB branch and can also be downloaded from IRB’s website.

Regardless of who is impacted, everyone who owns a house will have to pay the tax when they sell at a profit on January1this year and thereafter, especially the sales and purchase document signed on this given date or thereafter, said PropertyGuru Malaysia country manager Sheldon Fernandez.

“However, it must also be taken into account that the valuation for RPGT will be taken from year 2000 onwards, which applies to properties bought at that time,” Fernandez said.

He said the imposition of five per cent RPGT from the sixth year and onwards in perpetuity means that residential owners are now being treated as commercial owners just as properties bought under a company rather than as an individual.

Asked whether if its fair for a homeowner who bought a house 30 to 40 years ago at RM200,000 and sold it for RM1 million today to pay the five per cent RPGT, Fernandez said such a move will take away from the gains made by many owners, most of whom have held properties as a means to preserve their wealth or as a form of a long-term investment to finance their children’s education or for retirement.

“It will impact many middle-income or middle-class Malaysians. It may appear that five per cent is not a big amount, but based on the example (purchase price of RM200,000 and sale price of RM1 million), the gross profit is RM800,000.

Therefore, five per cent RPGT is RM40,000 and it is not a small amount for most Malaysians today.

“However, the numbers must take in account that for older properties, the valuation will be based from year 2000 onwards. This may somewhat offset the impact and will vary on a case-by-case basis. It is good the government has implemented this caveat of sorts to lessen the blow on retirees and those who bought their properties a long time ago,” Fernandez told NST Property.

The decision, however, affects the savings of many retirees and older Malaysians or those who have bought properties to finance their children’s education, he said.

“There are no gains even on profits made from the stock market, so taxing property gains such as this seems one-sided and it will impact the supply side,” he added.

Fernandez reminded people looking to invest or buy a property in Malaysia to have a clear understanding of the RPGT.

What is RPGT?

Levied by the Inland Revenue Board (IRB), RPGT is a tax imposed on gains from disposal of real property. In short, a tax on one’s net profit when one sells a property.

It is also imposed on the disposal of shares in companies, where 75 per cent of tangible assets are in properties, such as Real Property Companies (RPC).

RPGT was first introduced in 1976 under the Real Property Gains Tax Act 1976. It was temporarily suspended between April 2007 and December 2009, before it was reintroduced in 2010.

The rates payable depend on the entity on which the RPGT is imposed and the holding period of the property. The holding period is based on the date of signing of Sale and Purchase Agreement and disposal date.

As such, a Malaysian citizen or permanent resident who disposes of his or her property within the first five years of acquiring it is subject to RPGT. And, with the new RPGT rates announced in the 2019 Budget, Malaysians will now be charged five per cent in property taxes after the fifth year, where it used to be zero per cent.

Non-citizens and companies on the other hand will be charged 10 per cent RPGT when they dispose of their property after more than five years from purchasing it.

PropertyGuru Inforgraphic

To know the amount payable for this tax, itis important that one knows what is the chargeable gain — which is basically the amount arrived after deducting the property’s disposal price from its purchase price.

Bear in mind that an individual may only be taxed on the positive net capital gains which is simply the amount arrived after deducting the disposal price with the purchase price and miscellaneous charges, such as legal fees, administrative fees, advertisement charges, and stamp duty.

The net chargeable gain would then be multiplied to the applicable RPGT rate.

How to file to pay RPGT

1. Fill out Disposal of Real Property (CKHT 1A) form. Attach with the Sale and Purchase Agreement and other documents supporting the deductions that one plans to make from RPGT.

2. Those applying for RPGT exemptions should also fill out Notification under Section 27 RPGTA 1976 (CKHT 3) form.

3. Ensure that the buyer fills out the Acquisition of Real Property (CKHT 4) form, which should come with a copy of the Sale and Purchase Agreement.

4. Submit the forms and other supporting documents to the nearest IRB

branch within 60 days.

Note: The forms are available at any IRB branch and can also be downloaded from IRB’s website.

No comments:

Post a Comment