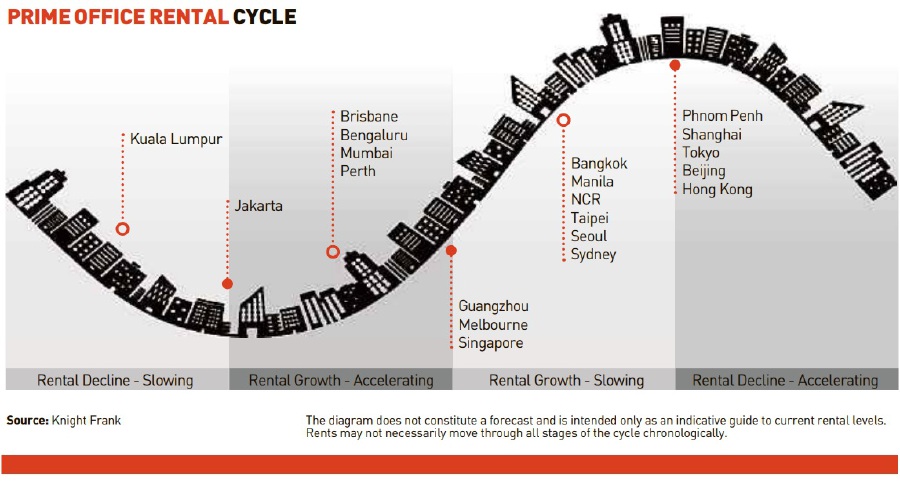

Prime office rents in Kuala Lumpur City (KL City) are poised to remain under pressure with landlords competing to attract new occupiers and retain existing tenants.

According to Knight Frank’s Asia-Pacific (Apac) Prime Office Rental Index for the second quater of 2019 (Q2 2019), there was a marginal decline of 0.2 per cent for office rents in KL City in

the second quarter from the previous quarter.

The drop was attributed to factors such as oversupply and difficulty to secure new tenant.

Office stocks in Greater Kuala Lumpur total 126 million sq ft. It is the second largest in the Asean region after Hong Kong, which has 127 million sq ft. Neighbouring Bangkok has 97 million sq ft of office space, Singapore 80 million sq ft, Manila 73 million sq ft and Jakarta 67 million sq ft.

Between this year and 2022, KL City and its suburbs will have 13 million sq ft of office space due to Tun Razak Exchange and PNB118, among others.

impending office supply driven by new constructions, prime grade office rents in KL City continue to be under pressure.

Teh said based on the report, prime net headline rent in the city centre stood at RM5.80 psf per month and is forecast to remain under pressure in the next 12 months.

Knight Frank has maintained its growth expectations with rents likely to end the year flat, as compared to 7.7 per cent rise in 2018.

Overall, office market rents in the 20 Apac cities tracked by the index recovered slightly in Q2 2019, rising 0.9 per cent quarter-on-quarter. On a yearly basis, office rents in Apac cities were up 3.4 per cent year-on-year, despite the generally soft economic climate.

Singapore, meanwhile, saw its prime office rental grow 0.9 per cent quarter-on-quarter on healthy net absorption, led by growth in the co-working sector. On a year-on-year basis, the rent grew by 10.3 per cent.

Knight Frank head of research for Asia-Pacific Nicholas Holt expects the rest of the year to remain

challenging for Asia-Pacific office markets as there is no end in sight over the trade tensions between the world’s two biggest economies.

There is also the looming prospect of a hard Brexit and the ongoing concerns in Hong Kong, he said.

WATCH THE VIDEO

According to Knight Frank’s Asia-Pacific (Apac) Prime Office Rental Index for the second quater of 2019 (Q2 2019), there was a marginal decline of 0.2 per cent for office rents in KL City in

the second quarter from the previous quarter.

The drop was attributed to factors such as oversupply and difficulty to secure new tenant.

Office stocks in Greater Kuala Lumpur total 126 million sq ft. It is the second largest in the Asean region after Hong Kong, which has 127 million sq ft. Neighbouring Bangkok has 97 million sq ft of office space, Singapore 80 million sq ft, Manila 73 million sq ft and Jakarta 67 million sq ft.

Between this year and 2022, KL City and its suburbs will have 13 million sq ft of office space due to Tun Razak Exchange and PNB118, among others.

impending office supply driven by new constructions, prime grade office rents in KL City continue to be under pressure.

Teh said based on the report, prime net headline rent in the city centre stood at RM5.80 psf per month and is forecast to remain under pressure in the next 12 months.

Knight Frank has maintained its growth expectations with rents likely to end the year flat, as compared to 7.7 per cent rise in 2018.

Overall, office market rents in the 20 Apac cities tracked by the index recovered slightly in Q2 2019, rising 0.9 per cent quarter-on-quarter. On a yearly basis, office rents in Apac cities were up 3.4 per cent year-on-year, despite the generally soft economic climate.

Singapore, meanwhile, saw its prime office rental grow 0.9 per cent quarter-on-quarter on healthy net absorption, led by growth in the co-working sector. On a year-on-year basis, the rent grew by 10.3 per cent.

Knight Frank head of research for Asia-Pacific Nicholas Holt expects the rest of the year to remain

challenging for Asia-Pacific office markets as there is no end in sight over the trade tensions between the world’s two biggest economies.

There is also the looming prospect of a hard Brexit and the ongoing concerns in Hong Kong, he said.

WATCH THE VIDEO

No comments:

Post a Comment