By Sharen Kaur - Published in NST Property, July 15, 2021

Bandar Malaysia, South East Asia's single largest city development worth over RM140 billion is faced with another hurdle given that Ekovest Bhd has decided not to proceed with its heads of agreement (HOA) with Iskandar Waterfront Holdings Sdn Bhd (IWH) to buy into the project.

This is following the lapse of the RM7.4 billion sale of 60 per cent in Bandar Malaysia Sdn Bhd (BMSB) to a joint venture company IWH-CREC Sdn Bhd.

IWH-CREC's proposed acquisition of 60 per cent in BMSB from the Ministry of Finance Inc (MOF)-owned TRX City Sdn Bhd (TRXC) for RM7.4 billion lapsed in May as the parties involved did not meet the conditions precedent for the deal.

IWH-CREC is a 50:50 joint venture between IWH and China Railway Engineering Corp (M) Sdn Bhd.

Businessman Tan Sri Lim Kang Hoo controls 30.8 per cent of Ekovest and his investment vehicle Credence Resources Sdn Bhd holds a 63.13 per cent stake in IWH.

Ekovest said in a filing today that it has been notified by IWH on July 15, 2021, that the restated and amended share sale agreement executed between IWH-CREC and TRXC had lapsed.

"Consequence on the above, Ekovest and IWH will no longer proceed with the HOA dated December 8, 2020, as it is now deemed null and void," it said.

The HOA entailed Ekovest taking a 40 per cent stake in a special-purpose vehicle which would in turn control 50 per cent of IWH-CREC.

Ekovest's total investment commitment for the proposed participation and investment in Bandar Malaysia was about RM1.48 billion.

According to a joint statement by TRXC and IWH-CREC, the parties agreed to mutually terminate the share stake purchase after the conditions precedent in the agreement were not fulfilled within the condition precedent period.

Further, no extension was sought, the statement read.

"TRX City and ICSB had been working together to find solutions to preserve the partnership to realise the common vision of unlocking Bandar Malaysia's potential.

"Despite such efforts, to date, the parties have not been able to mutually agree to the terms of the extension of the condition precedent period. Thus, the agreement is now deemed null and void," it said.

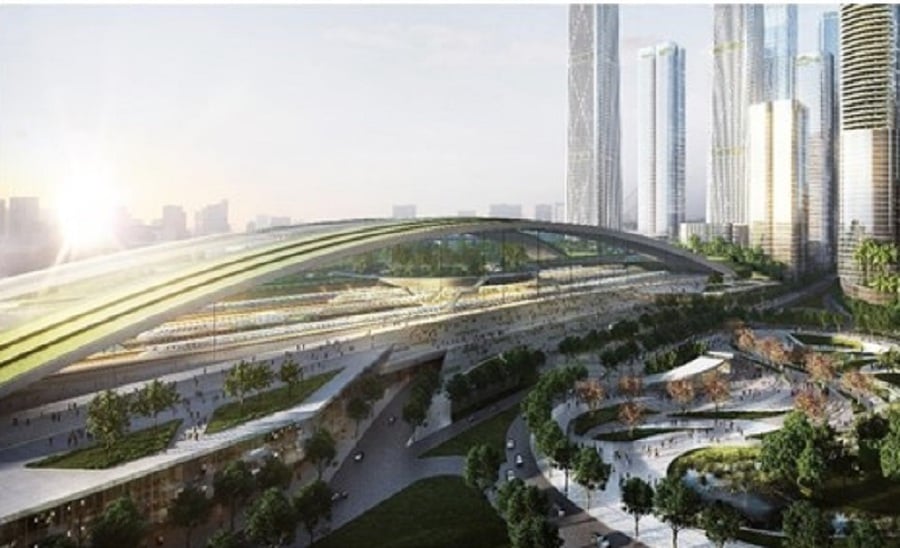

The 198.4 hectares Bandar Malaysia, located at the site of the former Royal Malaysian Air Force base in Sungai Besi in Kuala Lumpur is planned as a financial and business centre, comprising offices, residential, retail, medical and education components, arts and entertainment, and an underground canal city.

Based on international real estate consultants' estimates, the gross development value (GDV) of the Bandar Malaysia project is estimated to be over RM200 billion, far from the MOF's estimates of RM140 billion.

Lim, who is IWH executive chairman told NST Property last September that Phase 1 of Bandar Malaysia will have more than 12 towers comprising Grade A office towers, hotels, serviced apartments, and luxury residences, with a gross floor area of over 12 million square feet.

He also said that Phase 1 will have an estimated gross development value (GDV) of around RM10 billion and construction was slated to commence in June this year.

No comments:

Post a Comment