By HENRY BUTCHER MALAYSIA - Published in NST Property on March 29, 2022

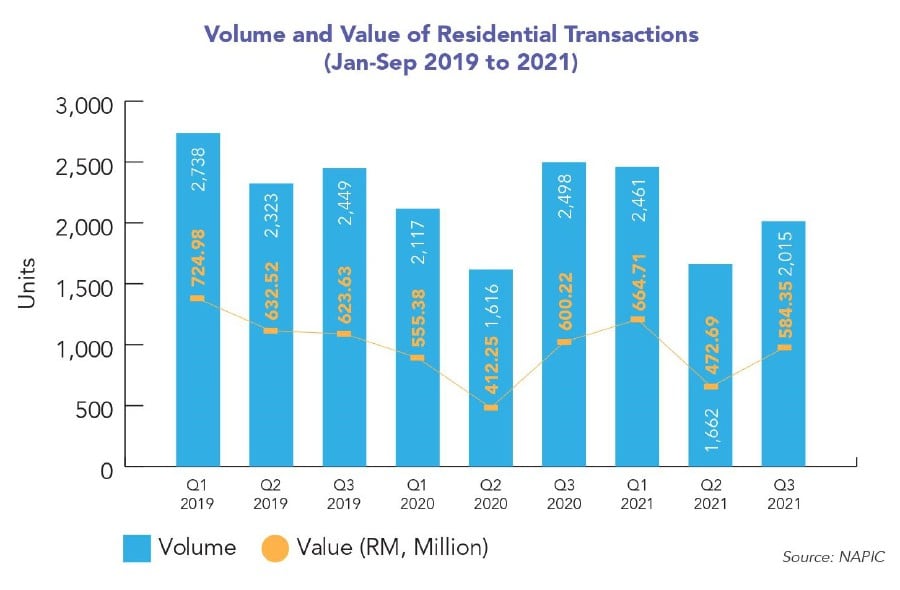

After the drop in numbers in 2020, the first nine months of 2021 saw Melaka's overall property market continue declining by 5.6% to 9,118 units in the volume of transactions compared to the corresponding in 2020 while its value of transactions rose by 8.7% to RM3.1 billion. The signs of recovery seen in 1H 2021 with both volume and value of transactions rising 12.2% and 19.7% respectively compared to the same period in 2020 were however not sustainable. This is perhaps due to the shrinking demand induced by the various modes of lockdowns after the National Recovery Plan began on 15 June 2021.

Melaka's property market is expected to remain stable as businesses resume operations and gear towards pre-pandemic levels. In addition, the historical state is also looking to welcome more new launches in early 2022 after most of the development approvals were obtained in H2 2021. Approved projects are mainly located on the fringes of Melaka Tengah District with new townships earmarked in Jasin and Alor Gajah Districts. Other notable developments include Taman Desa Bertam, Molek Residence (Phase 3), Taman Botani Parkland in Jasin, Bandar Scientex Jasin, and PB Residence @ Rembia in Jasin and Alor Gajah Districts. Other notable developments include Taman Desa Bertam, Molek Residence (Phase 3), Taman Botani Parkland in Jasin, Bandar Scientex Jasin, and PB Residence @ Rembia.

Incentives provided by Budget 2022 to the SMEs are expected to motivate more demand for commercial and industrial properties in the state. This is in line with the country's progressive lifting of various restrictions after the successful National Covid-19 Immunisation Programme which began in February 2021. It is also the reason behind Melaka's aim to revive its tourism sector seeing that the VTL (Vaccinated Travel Lane) has been introduced between Malaysia and Singapore at the end of November 2021.

Some of the mega projects worth noting in Melaka are The Sail, The Rise, Taman Botani Parkland, Taman Scientex, and Taman Desa Bertam.

Factors to Watch

●The current low interest rate to finance the purchase of property is expected to continue in 2022.

●Restrictions imposed on foreign tourists to visit Malaysia are likely to be lifted in 2022. This augurs well for Melaka's tourism and its related industries and is expected to stimulate demand for hotel and commercial properties.

Bright Spots

●Steady growth for the residential sub-sector and landed medium-cost/affordable housing will command better demand.

●More SMEs are anticipated to expand their businesses to meet the higher demand for manufacturing of products and logistics facilities, leading to an uptrend in the industrial sub-sector.

●Incentives for the SMEs from Budget 2022 seem to be more encouraging compared to previous budgets in 2020 and 2021.

●The government's initial announcement of the VTL (Vaccinated Travel Lane) with Singapore and the relaxation of interstate travel has seen occupancy rates for Melaka hotels improve especially during the weekends and festive periods.

●With more relaxations on foreign tourists and general improvement of Covid-19 caseloads worldwide, Melaka's hospitality industry is expected to gradually return to normal in 2022.

●Continuation of mega projects in 2022 includes The Sail, The Rise, Taman Botani Parkland, Taman Scientex, and Taman Desa Bertam.

Outlook for 2022

•Melaka's residential sub-sector is expected to see more positive growth in 2022.

•The state's retail sub-sector will remain challenging in 2022.

•Hospitality is anticipated to chart a progressive return to normal in 2022.

•Commercial shop lots and shop offices will gradually improve in 2022.

•Melaka's industrial market is poised to remain stable in 2022.

Residential Overview & Outlook

Melaka's residential sub-sector has led the growth of the state's property market spotting higher volume and value of transactions in 2021. It is expected to lead the state's property market alongside development lands after having concluded more transactions in these categories in 2H 2020 and 1H 2021

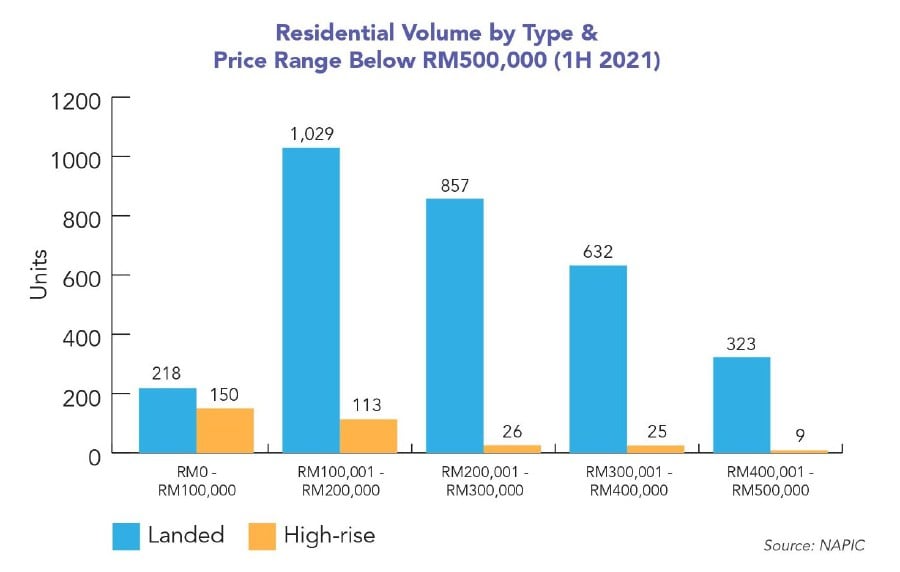

There was a marginal 1.5% decrease in the volume of transactions to 6,138 units in the first nine months of 2021 compared to the 6,231 units in the corresponding period in 2020. The overall value of transactions however went up by 9.8% to RM1.7 billion compared to RM1.57 billion in the same period, owing to higher-priced properties transacted but unlike 2020, demand for homes priced under RM500,000 has been declining. This can be due to property buyers' cautious spending pattern as their buying sentiments have been affected by the economic uncertainty and job insecurity arising from the pandemic.

In terms of property type, the more sought-after landed residences in Melaka have held their price points better in 2021 compared to the high-rise apartments and condominiums. This is evident in places like the choice neighbourhood of Jalan Ujong Pasir where prices for semi-detached and detached houses had generally been stable while its single-storey terrace houses registered an increase of about 9% from RM330,000 to RM360,000 per unit and double-storey terrace houses going up to RM480,000 per unit. Apartments and condominiums on the other hand trended downwards by 5% to 10% compared to the previous year. Response to new launches for high-rises was also weak in 2020.

Thus far in the first nine months of 2021, Melaka has seen 2,488 residential units launched on the market and these new launches have achieved a sales take-up rate of 41%, or 1,020 units. This is an improvement over the 39.6% sales achieved in 2020 or 436 units sold out of the 1,100 units launched. It is also noted there were no new launches in Q1 2020 whilst Q3 2021 recorded the highest sales take-up rate of 63.65% ie. 471 units from 740 units launched. The better sales performance could be attributed to the ending of the lockdowns and the loosening of the SOPs in Q3. Some of these new projects are Taman Botani Parkland, Taman Desa Bertam (Phase 3), Molek Residence, Bandar Scientex Jasin, and PB Residence @ Rembia.

As there was also an increase in the submission of new development orders in 2021 compared to the muted the year of 2020, more new launches can be expected in Melaka in Q1 2022. A cautionary approach must however be taken since there was a slight uptick of 5.7% in the state's overhang residential properties from 2H 2020 to 1H 2021. In line with that, the state government had also imposed a high quota for bumiputra units and a limited release of bumiputra units for every project.

Over the years, Melaka's property market has progressed steadily, thanks to the state government's push for economic and social development in areas such as industrial, housing, tourism, and trade. On top of that, Melaka is said to have one of the lowest overhang properties in the country. Supported by a steady supply of houses in the state, Melaka should see more positive growth in the near future with upcoming projects in Kota Syahbandar, Taman Desa Bertam, and Taman Belimbing Setia. Developers are also seen to be actively acquiring development land for future developments.

Retail Overview & Outlook

Malaysia's high vaccination rate against Covid-19 is a reason to cheer for Melaka's tourism sector as the containment of the virus means businesses have a better chance of getting back to normal even if it was gradually.

From the reduction of Work From Home (WFH) to the opening of F&B outlets and tourism destinations, supported also by the lifting of travel restrictions, Melaka saw a large influx of domestic tourists as recently as October 2021, giving business owners and travel operators a chance to finally breathe a sigh of relief.

The good news is made much sweeter after the government announced the opening of VTL (Vaccinated Travel Lane) between Malaysia and Singapore in late November, enabling Malaysian visitors residing in the Republic to make their way into Melaka for their family visits and quick getaways among other activities. The VTL is subsequently halted at the end of December 2021 due to the emergence of the Omicron variant. However, when the VTL is reinstated again in the near future after the risks of the new variant is much more understood and better controlled, it is expected to raise the take-up rates of commercial shop lots and shop offices although it would not be the same for the retail units in shopping centres as the latter is currently in oversupply.

Melaka's retail challenge stems from a host of factors ranging from rental rates, flight of customers to online shopping, limited retailers in the market, high vacancy rates in existing retail outlets, and the influence of mall oversupply some of which are almost dormant like the Elements Mall and Imperio Mall at Hatten City and Vedro Mall.

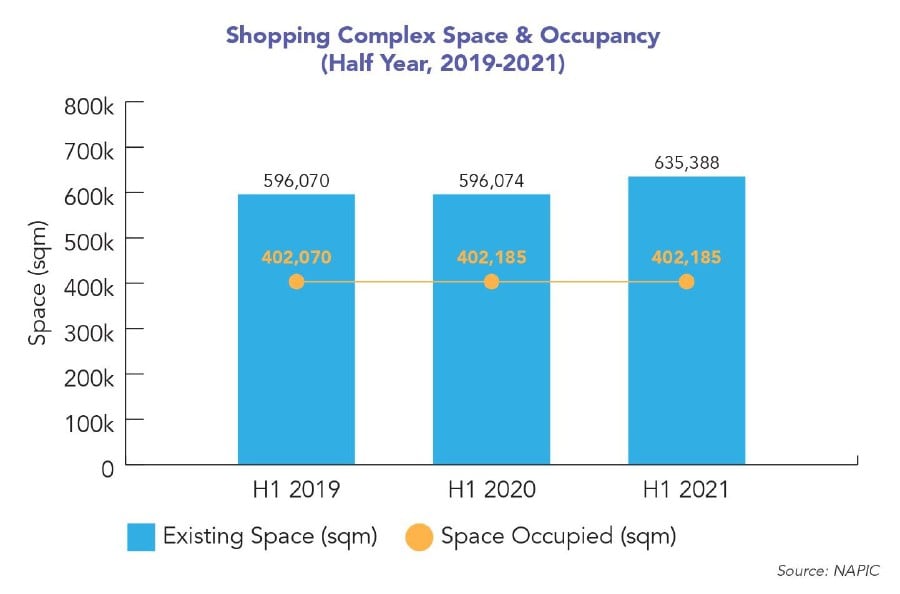

There were 31 shopping complexes in Melaka as of Q3 2021 with a total retail floor space of 635,390 sq metres. Owing to the difficult business conditions over the past two years, the occupancy rate of the complexes has gone down from 67.45% in 1H 2019 to 67.48% in 1H 2020 and sliding further to 63.30% as of Q3 2021. The adverse prevailing conditions are expected to see the market take a few years to recover and in fact, could be the last property sub-sector to recover in the state.

Hospitality Overview & Outlook

Where retail seemed challenging, looking brighter after the drought is the hospitality which before this bout of resuscitation has seen The Ramada Plaza Hotel and Equatorial Hotel closed for operations in 2021. But no sooner than when the state borders were opened in October 2021, the hotels wrestled back 65% occupancy on weekdays (Sunday to Thursday) and 85% on weekends (Friday to Sunday).

The rise in occupancy is a reminiscence of December 2020 when the state borders were open to domestic tourists after the MCOs. This shows that Melaka's inherent popularity as one of Malaysia's tourism darlings is an ultra-strong factor, one that should never be overlooked by investors mulling an entry into the historical state.

Hospitality as such is looking at a progressive return to normal in 2022 with continuous relaxation for foreign tourists to enter Malaysia and a general improvement of the Covid-19 caseloads worldwide.

Office Overview & Outlook

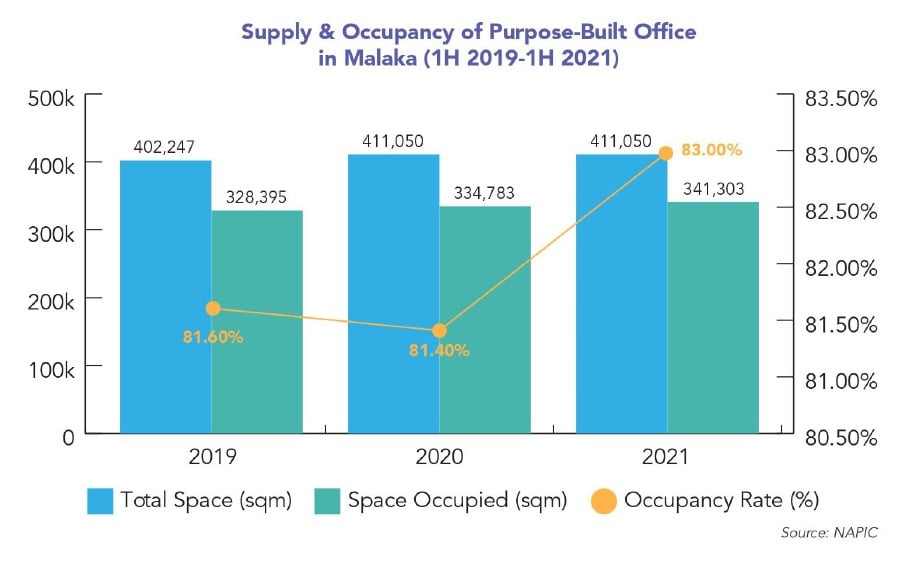

There were 48 privately-owned purpose-built offices (PBOs) buildings in the state of Melaka supplying a total of 240,710 sq metres of office space as of Q3 2021. About 48% of the space is located within Melaka Town and another 47% in Melaka Tengah. The occupancy rate of the PBOs in the state as of Q3 2021 was 71% with Melaka Town recording a higher occupancy rate of 76.1% and Melaka Tengah a lower rate of only 63.8%. Although the market may spot a turnaround with returning tourists to fuel the retail and business sectors, Melaka's office sub-sector is expected to remain stagnant in 2022 because business owners are caught between business growth and rental commitments. Without a strong indicator of a promising future, they are unlikely to commit to long-term leases especially after weathering through the devastating pandemic. The saving grace in Melaka is however in its limited supply of purpose-built offices where this scarcity may prove to be favourable for the existing stock of shop lots and shop offices as it may spur a higher take-up rate among the vacant units. If it pans out to be so, this category of commercial properties can look towards a gradual improvement towards 2022 as consumption will first absorb the existing supply of conventional shops in the market.

Industrial Overview & Outlook

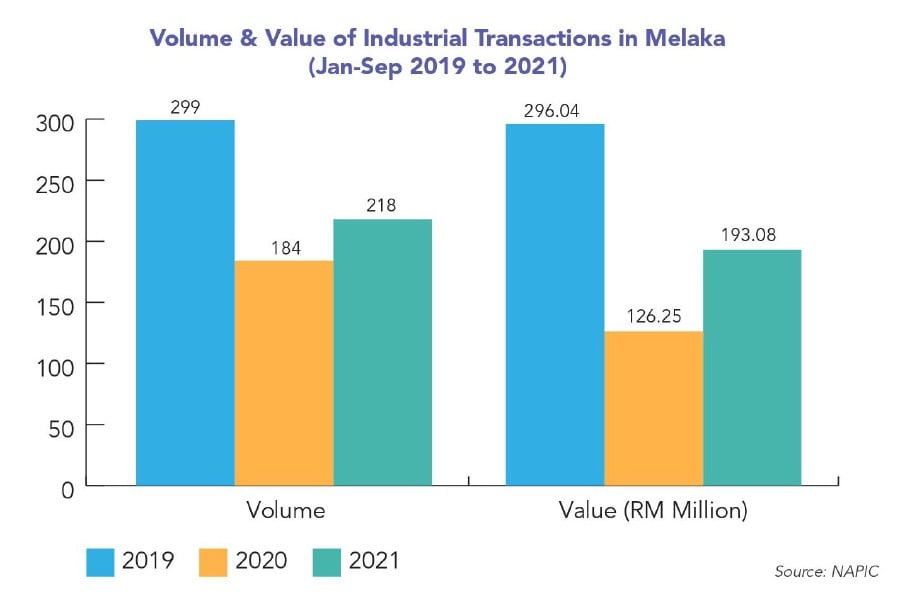

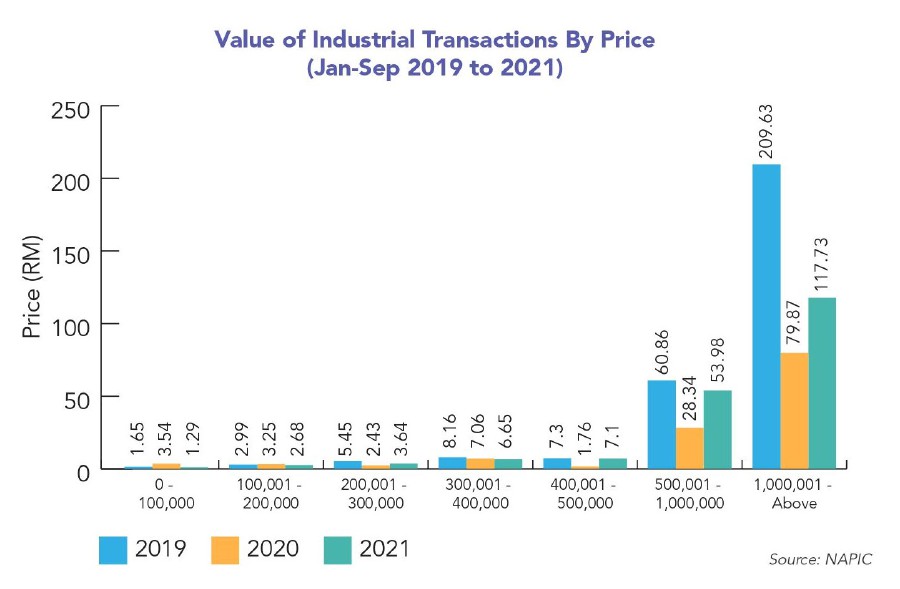

The industrial property sub-sector in Melaka appeared to have recovered in 2021 after the decline suffered in 2020 during the height of the Covid-19 pandemic. There was a 19% increase in the value of industrial property transactions in the first nine months of 2021 compared to the corresponding period the year before and an even higher jump of 53% in the value of transactions. The state is becoming an attractive destination for industrialists and this has led to an increase in demand for industrial properties in the state.

In that regard, more SMEs are anticipated to expand into business activities that require industrial space as there is now an incremental demand for manufacturing and logistics. This is further boosted by the government's better incentives allocated to the SMEs through Budget 2022 in comparison to those announced in Budget 2020 and 2021. The uptrend expected in the sub-sector shall see Melaka's industrial sub-sector continue to be stable in 2022. - Henry Butcher Malaysia

No comments:

Post a Comment