By Sharen Kaur - Published in NST Property, May 4, 2022

sharen@nst.com.my

More than 3,000 new hotel rooms and hotel suites are set to open in Kuala Lumpur this year, according to the latest Kuala Lumpur Hotel Market Outlook & Prospects 2022 report by CBRE|WTW's global joint venture partner, CBRE Asia Pacific.

Among them are the 232-room Park Hyatt Kuala Lumpur at PNB 118, the 544-room Conrad Kuala Lumpur (the former MAS headquarters on Jalan Sultan Ismail), the 535-room Parkroyal Collection Kuala Lumpur (and Pan Pacific Serviced Suites Kuala Lumpur), the 160-room Kempinski Hotel Kuala Lumpur, the 252-room Amari Kuala Lumpur, and the 690-room Fairmont Kuala Lumpur.

An additional 1,260 new hotel rooms will open between 2023 and 2025. They include the 471-room Kimpton Kuala Lumpur @ The Tun Razak Exchange, the 226-room So Sofitel Kuala Lumpur Hotel & Residence in Jalan Ampang, the 213-room Jumeirah Kuala Lumpur Hotel & Residences, and the 350-room Edition Kuala Lumpur.

Can these new hotels and hotel residences generate high revenues when they first open and in the years after that?

The Covid-19 crisis has had a significant impact on the global hospitality industry. Hotels, restaurants, casinos, golf resorts, entertainment centres, and sporting venues have been closed for more than a year as governments and public health officials work to stop the spread of the coronavirus. These businesses moved quickly to mitigate the impact on their operations, furloughing employees, cutting costs, and going digital, among other things, until they were given the go-ahead to reopen.

According to the Malaysian Association of Hotels (MAH), the industry lost revenues of more than RM10 billion in 2021, up from RM6.3 billion in 2020. During the Movement Control Order in 2020, the industry lost about RM300 million in revenue every two weeks.

After more than a year of the Covid-19 pandemic, Malaysia's hard-hit hospitality industry saw at least 120 hotels close their doors, either temporarily or permanently, due to significant financial losses.

When all economic sectors were allowed to operate again at the end of last year, the hospitality sector regained its momentum.

At the moment, Malaysia's international borders are only open to certain international business travellers and those who have applied under Singapore's Vaccinated Travel Lane (VTL) arrangement, either by land to Johor Bahru or by air to Kuala Lumpur International Airport (KLIA).

The resumption of VTL with Singapore, Malaysia's historically top source market, is expected to have a significant positive impact on the country's and Kuala Lumpur's economic and tourism market recovery in 2022.

Business picked up quickly after domestic travel resumed last year, according to a hotelier.

"I believe Malaysian hotels and resorts will be driven by domestic demand for at least another year, or until the global economy improves and there are no international travel restrictions. People prefer to travel within Malaysia for the time being because travelling abroad is inconvenient. Meanwhile, we can see that discretionary spending has suffered and that spending patterns have shifted. New routines and expectations have emerged. To weather the storm, both new and existing hotel players will need to consider all of these factors," he said.

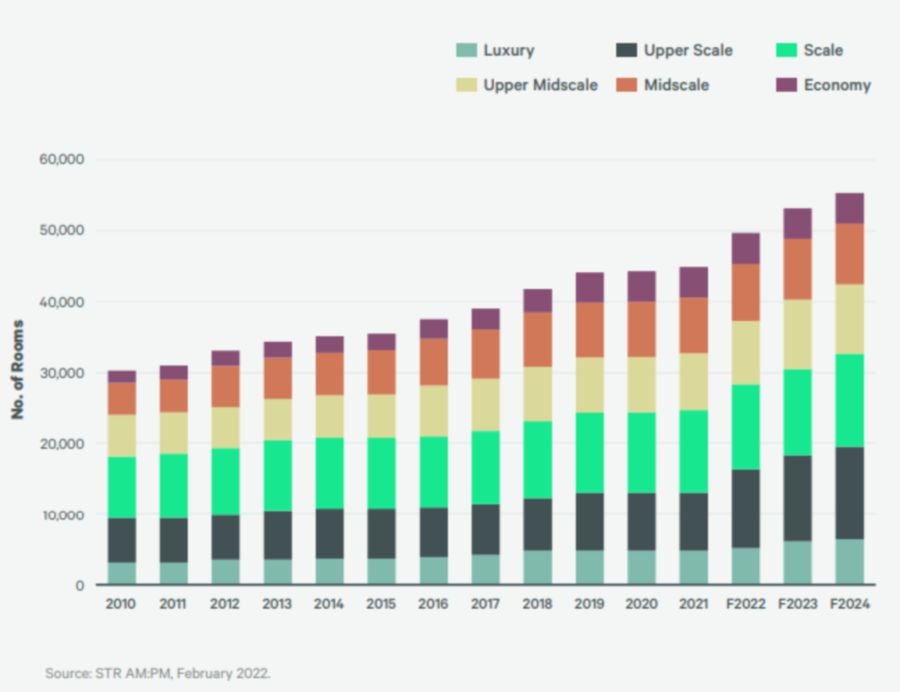

According to STR AM:PM, which tracks major hotel supply, 65 new hotels (about 14,000 keys) opened between 2011 and 2021, growing at a compounded annual growth rate (CAGR) of 3.8 per cent per year.

As of 2021, Kuala Lumpur hotel room supply included 23 per cent economy, 19 per cent midscale, 15 per cent upper midscale, 22 per cent upscale, 12 per cent upper-upscale, and eight per cent luxury.

According to the report, luxury and upper-upscale will account for more than 60 per cent of total new supply over the next three years.

There is a high level of brand penetration. Sixty per cent of the hotels are independently owned and operated, while fourty per cent are affiliated with a chain. Over the last ten years, the total number of chain-affiliated rooms has increased at a CAGR of 4.5 per cent.

Meanwhile, according to the report, five of the top ten operators in Kuala Lumpur are global hotel groups, accounting for about 26 per cent of the current hotel stock tracked by STR AM:PM. Accor and IHG have the most active pipelines, with 2,710 rooms across nine hotels and 2,158 rooms across seven hotels, respectively. These two brands together account for 36 per cent of the total pipeline.

Hotel deals to continue this year?

According to a CBRE Asia Pacific report, 11 hotel transactions totalling about RM2.3 billion (some US$549 million) were completed between 2017 and 2019, with interest from both international and domestic investors.

Kuala Lumpur had one of its best years in 2017, reflecting positive sentiment in the hotel market as tourism recovered from a weaker performance in 2015 and 2016. The 921-key Renaissance Kuala Lumpur (RM765 million) and 503-key Hilton Kuala Lumpur are among the major transactions (RM497 million).

"Similar to many markets worldwide, Covid-19 had caused challenges to the tourism industry. Consequently, Kuala Lumpur experienced a slowdown in transactions and investment volume in 2020," according to CBRE Asia Pacific.

According to the report, the number of deals in 2020 increased, but total investment volume remained one-fifth of 2017 levels due to uncertainty about the pace of recovery. Smaller hotels and serviced apartments, such as the 158-key City Comfort Hotel, were sold in 2020, primarily to domestic investors. Foreign investment was limited as a result of pandemic-related obstacles such as border closures.

According to the firm, the lower investment volumes since 2020 are most likely the result of a pricing mismatch between sellers' and buyers' expectations.

"However, the recent completion of the 418-key Royale Chulan Bukit Bintang indicates that the gap is starting to narrow, and sellers and buyers may be adopting a more realistic view of the prices given the current market conditions," it said.

The sale of the property was concluded at RM177 million in early 2021, a 10 per cent decline from the original indicated sale price of RM197 million in 2019.

"Price dislocation opportunities are limited on the back of positive sentiment of reopening borders. CBRE Hotels advises clients to focus on centrally located hotels with proven strong operating cash flows," the firm said.

No comments:

Post a Comment