By HENRY BUTCHER MALAYSIA - Published in NST Property, May 17, 2022

Key highlights and observations of JPPH's property market report 2021

The annual Malaysian property market report for 2021 published by the Jabatan Penilaian Dan Perkhidmatan Harta was officially launched by the Minister of Finance on April 1, 2022. The following are the key highlights as well as our observations and comments on the report.

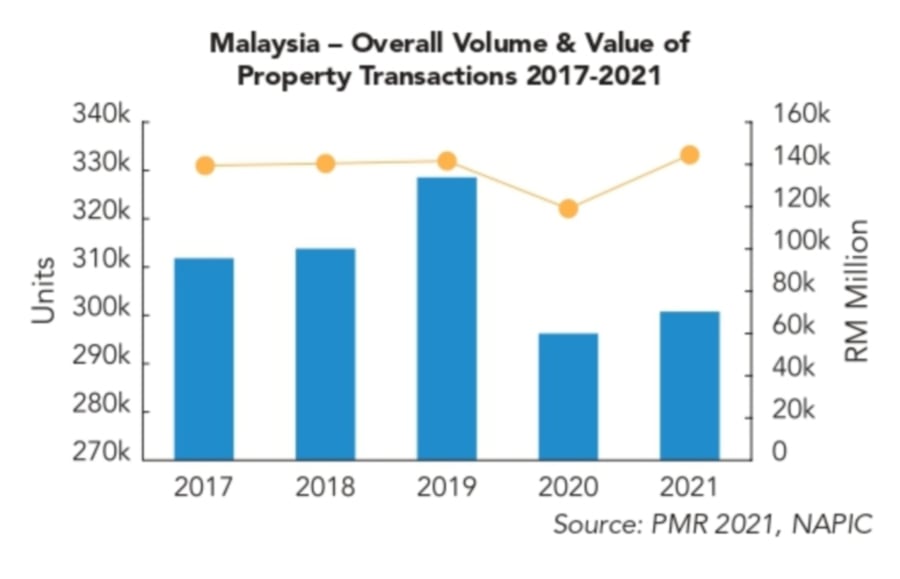

Overall market performance

The property market has shown signs of recovery from the pandemic-induced slowdown in 2020, with the overall volume of transactions recording a marginal 1.5 per cent increase but a substantial 21.7 per cent rise in the value of transactions. This would imply that the average value of the transactions is higher than that of the preceding year.

There was a drop in the volume of transactions during the second and third quarters as home sales were affected when the country went into various modes of MCO (Movement Control Order) but the volume of residential transactions picked up significantly during the last quarter as house buyers tried to beat the year-end deadline to qualify for the benefits under the HOC (Home Ownership Campaign) 2020-2021.

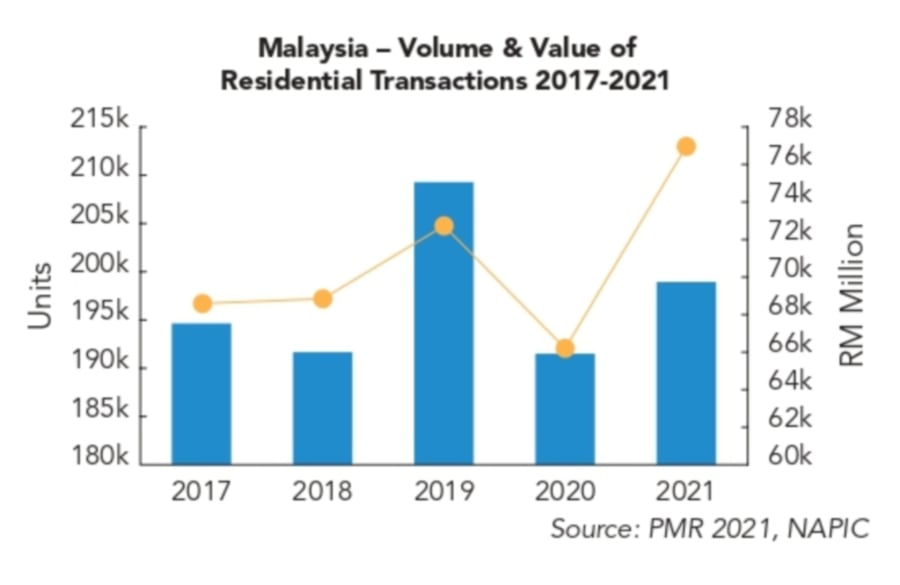

Residential sub-sector

The residential sub-sector was again the biggest contributor as it has traditionally been all these years, with a share of 66.2 per cent of the volume of transactions and 53.1 per cent of the value of transactions. The sector registered a small 3.9 per cent increase in the volume of transactions over that of the preceding year whilst the value of transactions went up by a respectable 16.7 per cent.

Selangor was the top contributor to both volume (24.5 per cent) and value (34.4 per cent) of transactions while Kuala Lumpur ranked the second highest in terms of contribution to the value of transactions, with 12.6 per cent share. Terraced houses continued to be the most popular housing type amongst Malaysians and contributed a share of 43 per cent of the total residential transactions. Vacant plots and high-rise units were next with each contributing almost 15 per cent.

Nearly 56 per cent of all residential transactions were of affordable houses priced at RM300,000 and below, followed by those within the RM300,001 to RM500,000 (24.6 per cent) and RM501,000 to RM1 million (14.8 per cent) brackets. Transactions of residences costing above RM1 million made up only 4.8 per cent of total transactions but registered a 26.3 per cent increase over that achieved in 2020.

In terms of new launches, there were a lesser number of units launched in 2021 as developers understandably held back from launching and concentrated on clearing existing stocks. The number of units launched declined from 47,178 units in 2020 to 43,860 units (down 7.6 per cent). Landed properties which were more saleable, formed 43.3 per cent of the units launched whereas the high-rise residences contributed 28.9 per cent.

About 70 per cent of the new launches were houses priced at RM500,000 and below and those above RM1 million made up only 2.1 per cent. This underscores developers' current focus on more affordably priced homes which commanded a higher level of demand within the context of the current softer market conditions.

Selangor led with new launches amounting to 9,827 units followed by Johor with 5,513 units and Perak with 5,239 units. Kuala Lumpur which topped the list of new launches in 2020 did not feature among the top 3 this time around. Terrace houses accounted for about 60 per cent of the new launches while the condominiums and apartments made up only 27.4 per cent.

In terms of sales performance, Penang came up top with 65.1 per cent followed by Kedah (61.2 per cent), Selangor (54 per cent) and Johor (49.2 per cent). Kuala Lumpur fared poorly in 2021 with a sales performance of only 14.4 per cent. The improved sales performance in 2021 saw a 31 per cent increase in the value of loans approved compared to 2020 as the market showed vital signs of recovery and in fact, the value of the loans approved was the highest recorded over the last 10 years.

The national residential overhang rose 24.7 per cent in 2021 with 36,863 units worth RM22.6 billion (up 20.5 per cent). On the other hand, the overhang of serviced apartments added another 33,181 units valued at RM1.58 billion. Interestingly, houses priced under RM300,000 made up 31.5 per cent of the residential overhang whereas those priced between RM300,000 to RM500,000 contributed another 25.7 per cent and houses above RM1 million made up only 12.6 per cent.

The industry needs to find out the reason for the high number of overhang units for houses that are more affordably priced. Is it that the location of these projects are in areas that are not so preferred or are inconvenient to the buyers that are being targeted, or are they built in areas where the targeted buyers are not really on the market for new homes as they are comfortably settled in their kampung homes?

Perhaps the unsold homes are reserved for Bumiputeras and more efforts have to be put in to attract and assist buyers from this community. Agencies entrusted with building affordable homes could also relook at their business model by, say, for example, building homes for rental to the lower-income groups or at least tying up with financial institutions to offer Rent-to Buy schemes to the target groups.

Similar to past years, the largest stock of residential overhang are high-rise residences which made up 55.6 per cent whilst terrace houses contributed about 21.3 per cent. In terms of state, Selangor and Johor had the highest residential overhang stocks with each contributing about 6,000 units with the value of the residential overhang hitting RM5.28 billion for Selangor and RM4.72 billion for Johor. This was followed by Penang with 5,493 units worth RM3.56 billion and Kuala Lumpur with 3,908 units valued at RM3.17 billion.

With regards to the overhang of serviced apartments, those priced between RM500,000 to RM1 million contributed about 64 per cent to the overhang numbers and those above RM1 million made up about 23.4 per cent. The higher price bracket of the unsold service apartments is understandable as most of these projects which have commercial titles are built-in more urbanised locations where land cost is typically higher.

The Malaysian House Price Index (MHPI) rose marginally by 0.6 per cent in 2021. The rate of growth of house prices appeared to have peaked in 2012 and has slowed down since. Whilst Johor and Selangor registered marginal increases in the HPI at the state level, Kuala Lumpur and Penang recorded declines. Terrace houses were the only housing type that recorded a marginal two per cent rise in the HPI with all other types recording small declines.

The national median house price went up by five per cent to RM310,000 in 2021. This also represents a 96.2 per cent increase from the RM158,000 recorded for the base year 2010. Putrajaya recorded the highest median price at RM628,000 followed by Kuala Lumpur at RM490,000, Selangor at RM410,000, Johor at RM360,000, and Penang at RM317,000. The state with the lowest recorded median price is Kedah at RM207,000.

Going forward, 1Q 2022 will likely see a lower volume and value of residential transactions compared to the HOC fuelled 4Q 2021. The first half of the year will also see developers trying to find the right mix of incentives and sales packages to entice buyers while the economic fallout from the sanctions imposed by the West after Russia invaded Ukraine will lead to some hesitation on the part of the investors.

The problems of rising building material costs, supply chain constraints, and labour shortage will increase construction costs but developers will be unable to pass on all the additional costs to purchasers given the softer market conditions. A firmer market recovery will be more likely to happen in the second half of the year especially if the 15th General Elections (GE15), which are widely anticipated to be held this year, have produced a more stable government.

Other sub-sectors

The agriculture sub-sector was the second-largest contributor, with transactions making up 18.9 per cent of the volume of transactions but contributing to only 8.2 per cent of the value of transactions. This would probably be attributed to the lower price of agricultural land compared to residential, commercial, and industrial development land.

The industrial sub-sector, on the other hand, contributed only 1.9 per cent of the volume of transactions but a commendable 11.7 per cent of the value of transactions. The commercial sub-sector was also a significant contributor to the value of transactions with a 19.3 per cent share although, in terms of volume, the sector only makes up 7.5 per cent of total transactions. Whilst the performance of the commercial sub-sector registered a 10.7 per cent increase in the volume of transactions over that of the previous year, in terms of value, the increase was a significant jump of 43.1 per cent.

The industrial sub-sector also performed well, registering an increase of 17.6 per cent over 2020 in the volume of transactions and a 32.9 per cent increase in the value of transactions. The agriculture sub-sector recorded declines in both volumes (-7.5 per cent) and value (-5.1 per cent) of transactions in 2021. It is interesting to note that while there was a decline of 7.4 per cent in the volume of transactions for development land, the value of transactions went up by a significant 33.2 per cent. This could imply that the development lands that were transacted in 2021 were of higher values and probably in more urbanised/prime locations.

Purpose built office sub-sector

The total supply of purpose-built office (PBO) space in the country increased to 23.970 million sq m and faced a slowdown in business growth resultant largely from the Covid-19 pandemic, witnessing a decline in occupancy rates from 80.2 per cent the year before to 78.3 per cent in 2021. Privately owned PBOs recorded an even lower occupancy rate of 71.5 per cent. The "Supply & Occupancy Rates of PBOs as at end 2021" table summarises the supply of PBOs in the various states and their respective occupancy rates.

The increase in supply coupled with lower demand caused occupancy rates to soften and this put some pressure on rental rates. The PBO Rental Index (PBO RI) declined marginally by 0.1 per cent for the main urban centres of Georgetown, Klang Valley and Johor Bahru. The PBO RI for these areas stood at 126.7 for Georgetown with average rents of RM31.10 per sq m, 130.8 for Klang Valley (average rents of RM48.55 per sq m) and 130.1 for Johor Bahru (average rents of RM34.20 per sq m).

Based on NAPIC's data, it is noted that the rate of growth of the PBO RI peaked around 2018/2019 and it has decelerated since then so the decline in the index in 2021 was not unexpected given the challenging business conditions in 2020 and 2021. The PBO sub-sector will continue to face headwinds in 2021 given the oversupply situation, especially in the Klang Valley and the absence of strong demand factors.

Retail sub-sector

The supply of space in shopping malls in the country rose to 17.282 million sq m in 2021. The reduced physical shopping activities during the pandemic hit periods in 2020 and 2021 caused many retailers to close unprofitable/non-performing outlets, thus causing the national occupancy rate to decline from 77.5 per cent in 2020 to 76.3 per cent in 2021. The "Supply & Occupancy Rates of Retail Space in Shopping Malls as at end 2021" table summarises the supply of shopping malls and occupancy rates in the key urban centres in the country.

The rental index for shopping centres showed only a very marginal rise in 2021 but this may not reflect the actual rentals received by the mall owners as many malls had to offer rental rebates or other forms of subsidies over the past two years to support and retain tenants. The retail sub-sector is expected to see an improvement in 2022 due to the opening up of the economy with the country has moved into an endemic phase. People have begun to eat out more often and patronise shopping malls again after being cooped up at home and shopping online for a good part of the past two years. Nevertheless, the economic recovery is still at a nascent stage and there is always the worry of a new and more infectious strain of the Covid-19 virus appearing which may lead to another round of lockdown as is being experienced in some cities in China recently. However, as the country has reached a high rate of full vaccination for its citizens, a full-blown crisis as seen in the early part of the pandemic appears unlikely and the retail sub-sector is expected to continue on a gradual recovery path.

Industrial sub-sector

It was reported in the property market report 2021 that the industrial sub-sector recorded 5,595 transactions worth RM16.96 billion in 2021 which represents an increase of 17.6 per cent in terms of volume of transactions and 32.9 per cent in value of transactions.

Selangor, the traditional powerhouse of the manufacturing sector, continued to lead the market in the volume of transactions, with a nearly 35 per cent share, followed by Johor (close to 15 per cent) and Perak (9 per cent).

After the problems of business closures during the lockdowns in 2020 and early part of 2021 as well as supply chain and logistics issues that affected production, the manufacturing sector has staged a strong recovery, supported by export-oriented industries. This is reflected in the impressive trade statistics chalked up in the past year where trade rose by 17.5 per cent y-o-y to RM184.75 billion in February 2022, the 13th consecutive month of double-digit growth whilst exports surpassed RM100 billion for the first time, increasing by 16.8 per cent to RM102.27 billion, the seventh consecutive month of double-digit growth. Imports expanded by 18.4 per cent to RM82.48 billion. Overall, the trade surplus grew by 10.7 per cent to RM19.79 billion.

The strong trade performance augurs well for the industrial property sub-sector as manufacturers who have benefitted from the strong export performance may expand and set up new factories to cater to the increased demand while the rosy prospects may attract others to venture into the business. The industrial sub-sector is therefore expected to continue to do well in 2022. - Henry Butcher Malaysia

No comments:

Post a Comment