By NST Property/Sharen Kaur - August 14, 2023

sharen@nst.com.my

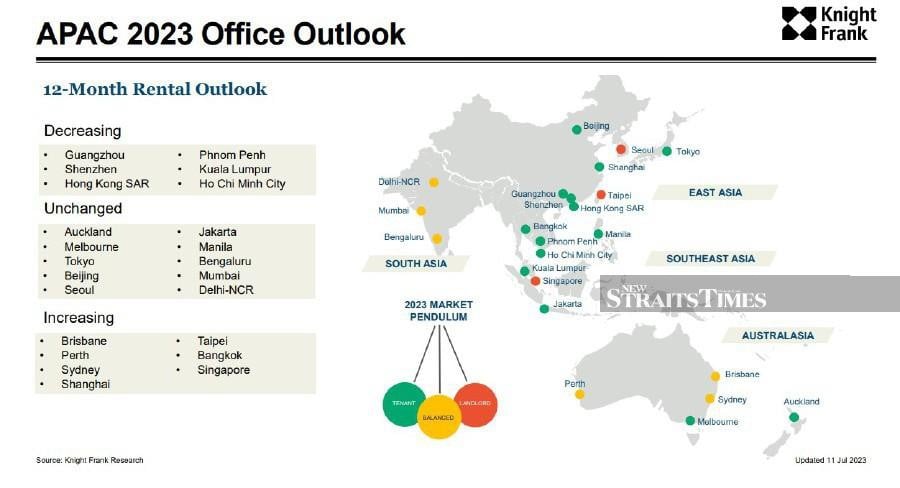

KUALA LUMPUR: The higher prime office space supply pipeline in Asia Pacific, along with a weaker-than-expected economic rebound in the Chinese Mainland, has adjusted expectations for the region's office market to stage a short-term recovery.

While occupiers remain cautious about space requirements, they are also constantly evolving responses to hybrid working and higher aspirations for their real estate portfolio, ranging from sustainability ambitions to a more transformational role in operational aspects, according to Christine Li, head of research at Knight Frank Asia-Pacific.

"These dynamics will continue to fuel strong underlying demand for prime-quality assets, which belies the overall declining rental trajectory, and generate new and different occupier trends across the region's occupational markets over the current cycle," Li said.

According to Knight Frank's Asia-Pacific Prime Office Rental Index, rental growth in Southeast Asia's emerging markets is showing signs of moderation as an elevated supply pipeline erodes pricing power.

With new supply easing, vacancy levels in the Pacific markets are expected to tighten gradually in the second half of 2023.

However, rents in Ho Chi Minh City remain on an upward trend, as new supply in 2023, while substantial, is the first injection in over two years.

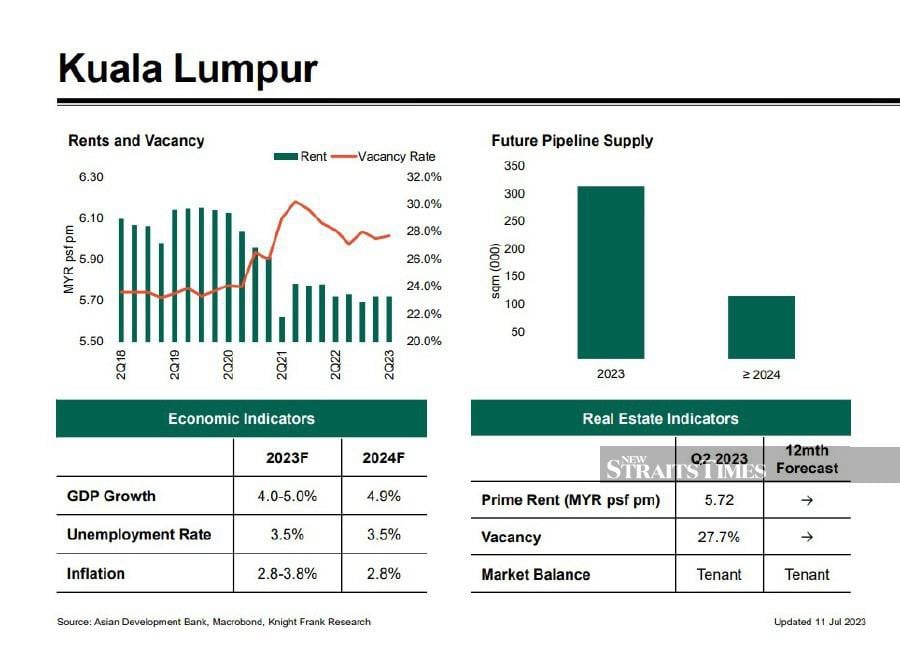

Kuala Lumpur's market was also strong, with rents remaining stable during the quarter, supported by gross domestic product (GDP) growth in the first quarter, which beat expectations as the country continued to bounce back from the pandemic slump, said Teh Young Khean, executive director of office strategy and solutions at Knight Frank Malaysia.

Meanwhile, Singapore's market continued to remain robust despite corporate relocations and a flight-to-quality trend.

Despite elevated vacancies, rents across Oceania rose or remained unchanged, supported by robust demand for prime spaces.

Incentives remained above pre-pandemic levels, but across the continent's major markets, corporate tenants, focusing on the quality of their office footprint, are widening the rental gap between higher-rated assets and lower-quality ones.

Melbourne was the only market to experience a sequential quarterly fall in gross effective rents. With a lower exposure to TMT and Financial Services tenants, Australia's resource-driven markets—Brisbane and Perth—are enjoying a resurgence since the end of the last commodity boom.

Perth recorded the highest year-on-year rental growth in Asia-Pacific, as it benefited from elevated bulk commodity prices and the strongest employment growth over the past three years.

No comments:

Post a Comment