By Sharen Kaur - August 1, 2023, Published in NST Property

sharen@nst.com.my

KUALA LUMPUR: The recovery of the residential real estate market is still cautiously optimistic, but at a slower rate because of rising borrowing prices and inflationary pressures in the context of a slowing economy.

The lack of new launches indicates that developers are becoming more cautious, according to Keith Ooi, group managing director, Knight Frank Malaysia.

He said this sentiment may continue as a result of the imbalance between supply and demand in some areas, probable future increases in the overnight policy rate (OPR), and growing construction costs, among other things.

They are, however, optimistic in achieving their sales target as they continue to prioritise digitalisation and ESG elements in providing better homes, he said.

"The real estate sector has shown promising signs of growth and resilience during the first half of this year, supported by a favourable economic landscape. However, amid growing external headwinds, Bank Negara Malaysia expects the country's economic growth to moderate to between four per cent and five per cent in 2023, underpinned by firm domestic demand," he said.

In the first quarter of this year (1Q2023), 53,923 residential properties with a collective value of RM20.87 billion changed hands, according to Knight Frank Malaysia's Real Estate Highlights 1st Half of 2023 (REH) report that was released today.

Strong rebound in 2022

According to the report, the residential property market staged a strong rebound in 2022 with a 22.4 per cent yearly increase in sales volume and a corresponding 22.6 per cent growth in sales value following the normalisation of economic activity (2022: 243,266 residential transactions valued at RM94.32 billion; 2021: 198,825 residential transactions valued at RM76.9 billion).

As for Kuala Lumpur, the combined transacted volume and value of the apartment, condominium, and serviced apartment categories were higher by 28.4 per cent and 44.2 per cent respectively (2022: 9,406 transactions worth RM8.07 billion / 2021: 7,324 transactions valued at RM5.59 billion).

The Malaysian House Price Index (MHPI) was higher by 2.8 per cent year-on-year to record 208.4 points in 2022 (2021: 202.7 points).

The gradual recovery in the residential market was supported by favourable housing policies and market incentives. During this period, the contraction in the All-House Price Index for Kuala Lumpur improved to -0.2 per cent in 2022 (2021:-2.8 per cent).

Meanwhile, the high-rise unit price index for Kuala Lumpur and Kuala Lumpur Central stood at 207.3 points and 197.4 points, respectively, in 4Q2022, lower year-on-year (4Q2021: 211.1 points and 205.6 points).

Judy Ong, senior executive director of research and consultancy, Knight Frank Malaysia, said during the review period, the condominium / serviced apartment segment in Kuala Lumpur experienced mixed trends in prices.

The localities of Kenny Hills and Mont' Kiara witnessed price growth, while for KL City and Bangsar, there were slight dips in the average transacted prices, she said.

As for Ampang Hilir / U-Thant and Damansara Heights, the prices held steady, according to her.

"Overall, the average transacted prices of high-end condominiums / serviced apartments in Kuala Lumpur were marginally lower by circa 1.3 per cent in 1H2023 when compared to the preceding period (2H2022)," Ong said.

Future supply and demand

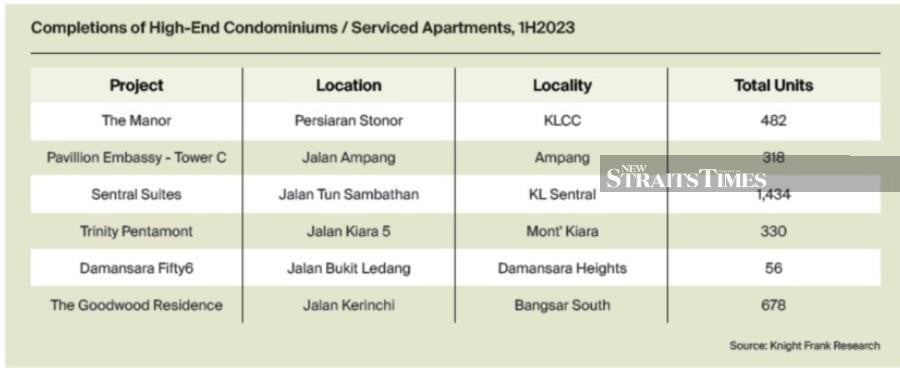

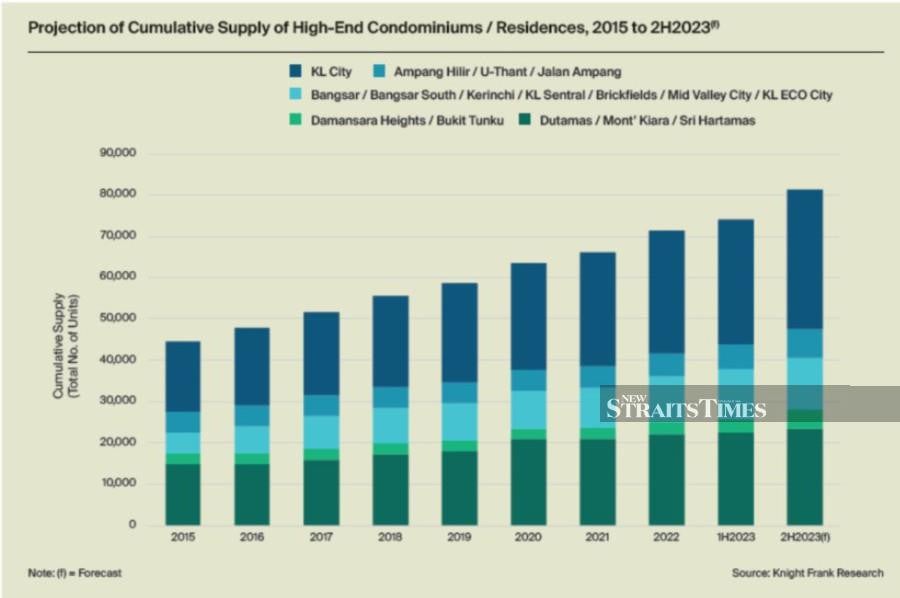

As of 1H2023, the cumulative supply of high-end condominiums / serviced apartments in Kuala Lumpur stood at 74,053 units. This follows the completion of six projects, contributing an additional 3,298 units to the existing stock, the report showed.

Another 7,312 units from several projects are slated for completion by the second half of this year.

Ong said the significant increase may be attributed to the rise in construction activities, which align with the ongoing economic recovery.

During the review period, there were several notable project launches, such as Hugoz Suites @ KLCC, Miranda Hill, and The Minh.

Located at Jalan Liew Weng Chee, Hugoz Suites @ KLCC is a mixed-use development offering office suites and serviced suites. The 320 units of serviced suites come with built-up areas of 452 sq ft and 646 sq ft for the dual-key type. The development by Exsim Development Sdn Bhd provides partially and fully furnished packages, targeting investors and potential Airbnb hosts. It is expected to be completed by the end of 2027.

Miranda Hill at North Kiara is a 7.84-acre residential-titled development by Bandar Raya Developments Bhd (BRDB). This freehold multi-generational project comprises 552 units of condominiums with spacious built-up areas ranging from 943 sq ft to 2,200 sq ft. It is slated to be completed by 2027.

The Minh by UEM Sunrise Berhad is a resort-style condominium project with an Indochina-inspired design that blends French Colonial architecture with the traditional and cultural influences of Vietnam. This low-density freehold development spans 6.2 acres of land and offers a total of 496 units. The project has garnered significant interest, with 70 per cent of the first tower sold prior to its official launch. It is expected to welcome its residents / occupiers by the end of 2027.

No comments:

Post a Comment