COOLING measures may have led to an increase in loan rejections, but the good news is that housing loan approval rates are slowly increasing.

There are more property transactions in the market, especially those below RM500,000.

The approval rate is the ratio of the number of housing loan applications approved by all local banks to the number of housing loan applications received during the same period.

According to Bank Negara Malaysia, the overall housing loan approval rate remained high at 74.2 per cent with an average of 74.1 per cent between 2012 and last year.

A total of RM22.3 billion house financing was approved in the first quarter of this year to 90,137 borrowers. Of these, more than half was for buyers of affordable housing units priced below RM500,000.

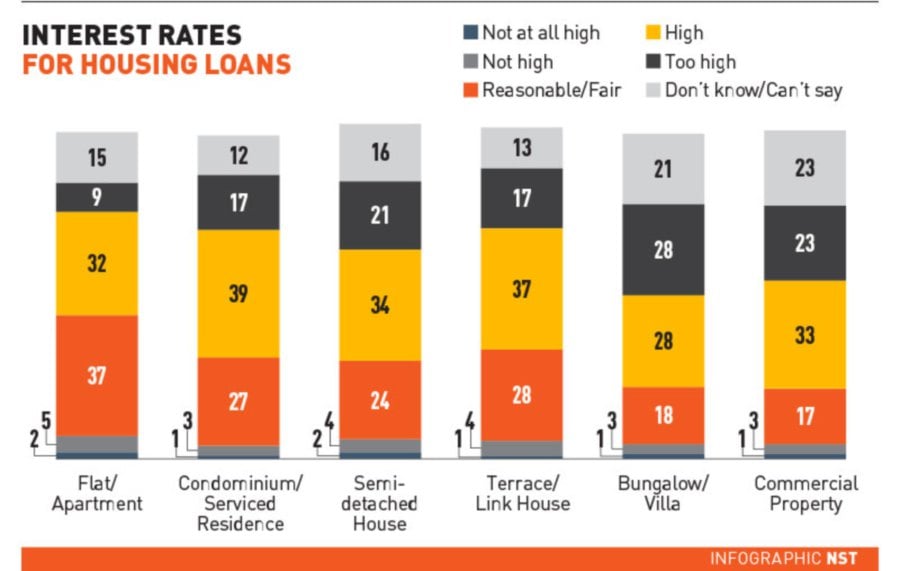

But, there are still many dissatisfied, citing the high interest rate, given the present economic challenges.

“While more loans are being approved, especially due to more joint applications, consumers are declining on account of the margin obtained and monthly installment amounts.

“Banks are now approving more applications, but at times the package offered by the banks is not attractive to them,” said PropertyGuru Malaysia country manager Sheldon Fernandez.

According to PropertyGuru’s Consumer Sentiment Survey, 46 per cent of those who were surveyed said interest rates were too high for them to consider buying. Surprisingly 31 per cent accepted the current interest rates charged on home loans, while the rest were undecided or chose not to comment on the matter.

The survey measured property sentiments and expectations in the property market with 949 local respondents.

Meanwhile, house buyers have been struggling to obtain loans because of measures introduced by banks since 2010 to curb excessive speculative activities in the housing market and prevent over-borrowing. One of it was the maximum loan-to-value ratio of 70 per cent imposed on borrowers with three or more outstanding housing loans.

Fernandez said home loans remained a vital component for the property eco-system.

According to PropertyGuru data, an astonishing 91 per cent said they would require a bank loan to purchase a property, of which 45 per cent would opt for a 90 per cent financing, while 25 per cent would go for a 70-80 per cent financing. Another 18 per cent preferred full financing.

Obstacles still remain for purchasers, especially first-time home buyers who are left with insufficient funds after paying their monthly installments or meeting upfront costs, such as stamp duties, legal fees, moving costs and so on.

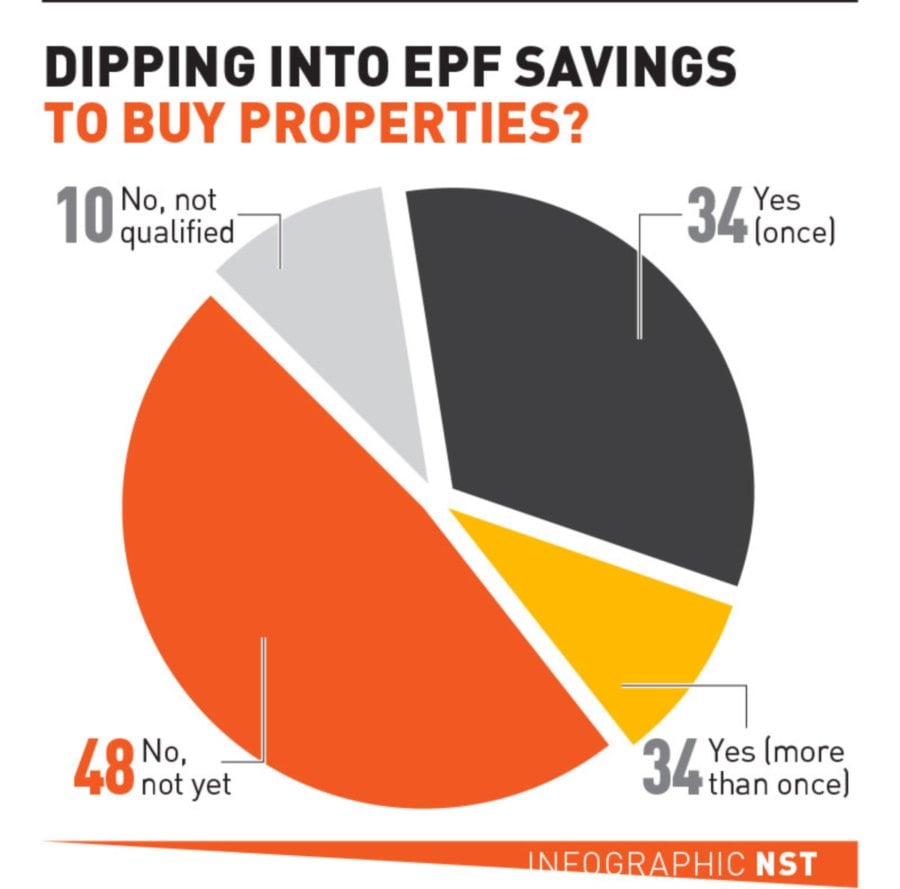

Fourty-three per cent of the respondents had used their Employees’ Provident Fund (EPF) savings to purchase property, either as part of the initial downpayment or to offset their principal home-loan amount. This is a five per cent rise in the sentiment this year compared with 38 per cent in the second half of last year.

Fernandez said the use of EPF funds, which were essentially retirement savings, provided much insight into the mindset of consumers.

“Generally speaking, dipping into one’s savings for retirement to buy a property is a sign of unaffordability in the market. It could also mean consumers are prioritising home ownership over their retirement.

“Others may feel returns from EPF are not that attractive, hence the money is better invested into a home that would generate capital appreciation and also provide a roof over their heads,” added Fernandez.

No comments:

Post a Comment