BETTER-THAN-EXPECTED economic results have lifted the Asia Pacific prime office market, according to independent global property consultancy Knight Frank.

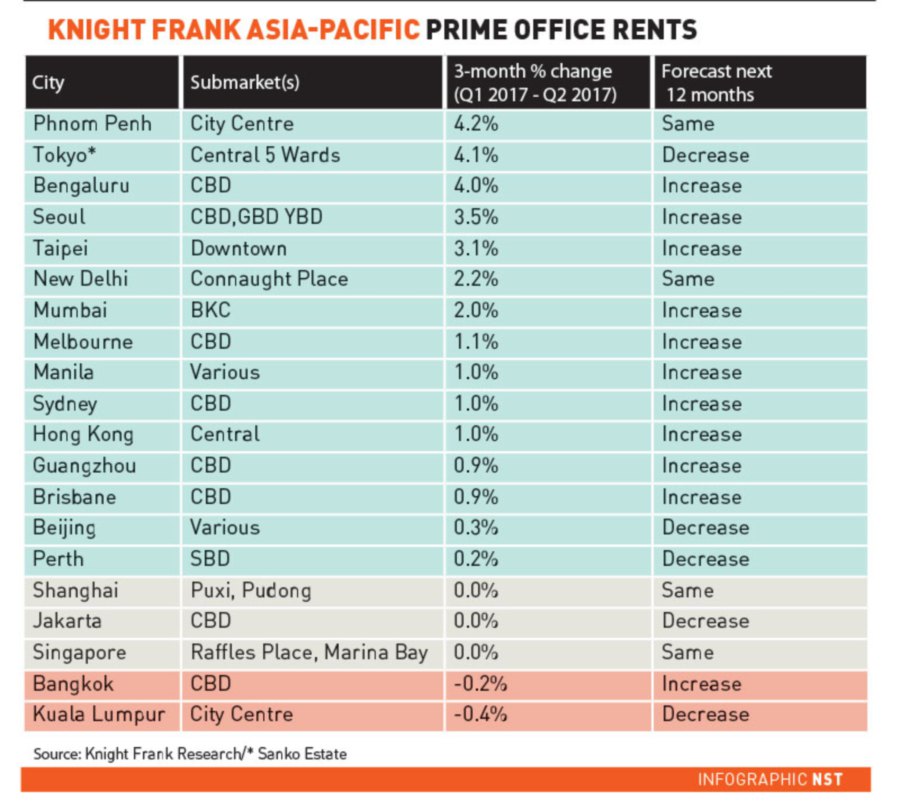

The firm recently launched the “Asia Pacific Prime Office Rental Index Q2 2017”, which saw a growth of 1.2 per cent quarter-on-quarter and 0.6 per cent year-on-year as at the end of the second quarter of this year.

The increase in the index was the result of rising rents in 15 markets in the region over the quarter.

Phnom Penh topped the chart this quarter with a 4.2 per cent increase quarter-on-quarter, compared to a flat performance in the last quarter.

The completion of Exchange Square not only set a new benchmark standard for Grade A office but its strong pre-commitment level also boosted prime rental levels in the Cambodian capital.

A total of 20 markets were tracked in the region and only two experienced rental declines, namely Kuala Lumpur and Bangkok.

Bangkok, which topped the chart last quarter, saw its first decline this quarter in close to three years, said Knight Frank.

It noted that given the limited supply however, a rising trend may resume for the remainder of this year.

Knight Frank Malaysia corporate services executive director Teh Young Khean said Kuala Lumpur had been experiencing rental decline for a year, coupled with creeping overall vacancy rates.

However, he expects to see sustained demand in selected established and upcoming decentralised office locations served by the light rail transit (LRT) and the Klang Valley Mass Rapid Transit (KVMRT) lines.

The KVMRT system is one of the most important and largest transport infrastructure projects Malaysia has embarked on, providing a boost to the residential, office and retail markets.

It involves the construction of a rail-based public transport network which, together with the existing LRT, monorail, KTM Komuter, KLIA Ekspres and KLIA Transit systems, form the backbone of the Greater Kuala Lumpur/Klang Valley region.

The KVMRT project will have three MRT lines; MRT Line 1 (Sungai Buloh-Kajang), MRT Line 2 (Sungai Buloh-Serdang-Putrajaya) and MRT Line 3 or Circle Line.

The MRT Line 1, which begins from Sungai Buloh and runs through the city centre of Kuala Lumpur before ending in Kajang, was fully completed in July.

The MRT Line 2 will serve a corridor with a population of around two million, stretching from Sungai Buloh via the central business district of Kuala Lumpur to Bandar Malaysia, Kuchai Lama and Serdang before ending at Putrajaya.

The initial phase of the line between Sungai Buloh and Kampung Batu is due to be operational by July 2021 and the remainder of the line from Kampung Batu to Putrajaya Sentral is scheduled to be opened by July 2022.

Market experts said despite challenges faced by markets globally, the MRT lines were expected to spur foreign direct investment in the Klang Valley.

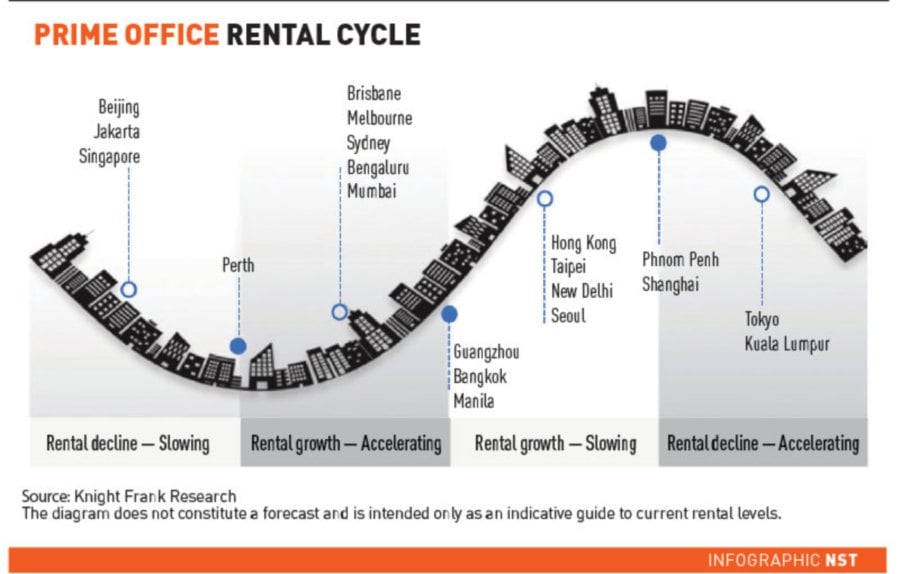

Over the next 12 months, Knight Frank expects rents in 15 cities out of the 20 tracked to either remain steady or increase, which is the same as its previous forecast.

Nicholas Holt, its head of research for Asia-Pacific, said: “The pickup in global trade and domestic demand has negated geo-political risks to a certain extent, thereby providing a strong foundation for the Asia Pacific prime office markets”.

In the first half of this year, the regional economies of China, Asean-5 countries (Indonesia, Malaysia, the Philippines, Singapore and Thailand) and Japan performed considerably better than expected, as the International Monetary Fund revised its growth projections upwards for emerging and developing Asia.

No comments:

Post a Comment