UEM Sunrise Bhd aims to buy at least two parcels of land in Australia next year with the completion of its land sale in Canada.

The luxury developer received C$113 million (RM381.87 million) from selling 1.98ha land in New Westminister, Richmond, and plans to use some of the proceeds for land acquisition in the world’s most liveable city — Melbourne — and Sydney.

According to its managing director and chief executive officer Anwar Syahrin Abdul Ajib, the company has “narrowed” its search for new landbank in the two cities.

“We are actively looking, but the numbers must make sense. We hope to have one or two deals next year because we want to make sure there is continuation of launches.

“In the last three years we launched three projects in Australia. We want to make sure that every year there is at least one new launch there,” Anwar told NST Property.

UEM Sunrise’s three projects in Melbourne are Aurora Melbourne Central, Conservatory and Mayfair with an estimated value of RM5 billion.

The sites for these developments were acquired beginning in 2014 for a collective sum of A$122 million (RM405.80 million).

UEM Sunrise acquired a 0.4ha site on LaTrobe Street for Aurora, a 0.4ha site on Mackenzie Street for Conservatory and a 21-storey office tower on 412 St Kilda Road for Mayfair.

The Australian operations have contributed between 20 and 30 per cent to earnings in the second quarter ended June 30 this year.

Anwar said Australia is an important market for UEM Sunrise which is seeking growth through diversification.

“The Australian market is always attractive because of its liveability. The demand is always there for places like Melbourne and Sydney. So, it is a matter of getting the right product in,” he said.

Ultra luxury living in Melbourne

“Our first two projects, Aurora and Conservatory, we were selling at about A$1,000 and A$1,100 per square foot (psf), respectively. For Mayfair, we are approaching nearly A$2,000 psf. Mayfair is a premium product as the location is special. We are targeting about 50 per cent buyers to be local Australians. It is an owner’s stay kind of development so it is pretty exciting for everybody,” he said.

Anwar said from the total 158 units in Mayfair, UEM Sunrise has secured up to 30 per cent sales, inclusive of bookings.

“Our guys are all over. We have done a soft launch in Singapore, Malaysia and Australia. We were in Taiwan recently,” he said, adding that there were 20 Malaysian buyers.

“They are the same people who also bought units in Aurora and Conservatory. They bought because they like the place and the product. People are excited about the product and the location.”

Meanwhile, the existing office tower on the Mayfair site was expected to be demolished early next year, said Anwar.

This was provided the developer had sold up to 70 per cent of the 158 units.

“We are giving ourselves a bit more flexibility. Hopefully we can have high percentage within the next three to six months. Once we have sold 60-70 per cent we will start demolishing the building hopefully by early next year.”

Anwar expects Mayfair, which has a gross domestic value of A$1.1 billion, to contribute a profit margin of 20 to 25 per cent to UEM Sunrise.

RIDING ON FOREIGN INTEREST

He said there was a lot of foreign interest in properties in Melbourne, Sydney and Brisbane.

“Brisbane is a good market, but we are not going there now. Our focus is Melbourne and Sydney. We are bullish on prospects, but we have to make sure what we launch is good.

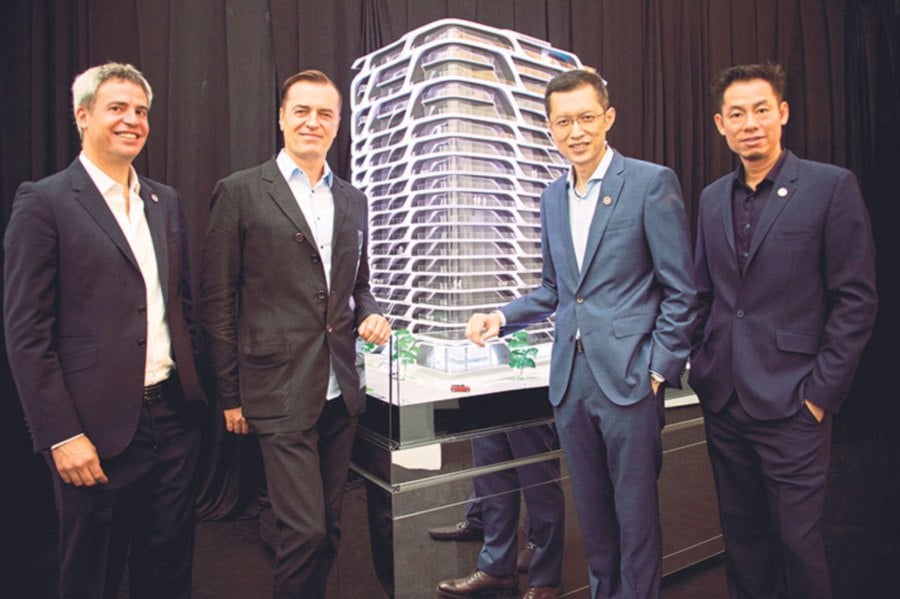

(From left) Zaha Hadid Architects associate director Michele Pasca di Magliano, principal and director Patrik Schumacher, UEM Sunrise managing director and chief executive officer Anwar Syahrin Abdul Ajib and chief operating officer of commercial, Raymond Cheah, at the preview of Mayfair recently in Kuala Lumpur.

“Our products are pretty unique so far. They are pretty ultra luxurious because the price point is always high. For Mayfair, in a way we are setting the price benchmark for the area because the product to us is very special and unique. Mayfair is designed by well-known Zaha Hadid Architects. It is a sculpture the way we craft the project,” said Anwar.

It was reported recently that Chinese investment would continue to flow into Australia’s housing market despite tighter capital restrictions by the China government.

Real estate portal Juwai.Com has predicted levels will peak again despite a near-10 per cent fall in inquiries earlier this year.

Bloomberg reported that the restrictions on money flowing out of China had not stemmed Chinese interest in offshore investments.

No comments:

Post a Comment