By Sharen Kaur - Published in NST Property on April 22, 2022

sharen@nst.com.my

Country Heights Holdings Berhad (CHHB) is set to reappear on the radar of investors as management begins to implement new plans that will lead to greater transformation.

According to TA Securities, based on the recent series of events at CHHB since the appointment of managing director (MD) Datuk Jared Lim Chih Li (DJ) in September 2020, the group could reach new heights.

DJ, the son-in-law of Tan Sri Lee Kim Yew, CHHB's former MD and controlling shareholder with current collective interest of 63 per cent, brings nearly 30 years of experience in corporate finance, private equity, entrepreneurship, and transformational leadership with him.

Lee has stepped back from operations and has publicly stated that he intends to resign from the Board in the near future to focus on his privately held ventures.

According to TA Securities, CHHB has laid out multiple plans to integrate its existing businesses with technology to achieve the goal of being an integrated digital landlord under the new leadership of DJ.

"Given the congruence of goals for being the family member of controlling shareholder and management, we believe DJ would make the most out of the company and take it to new heights," the firm said in a note today.

DJ is the executive director of Techna-X Bhd, which is spearheading diversification and leading transformation in the energy storage and digital transformation space, in addition to CHHB.

According to TA Securities, given Techna-renewed X's primary activities, which include energy storage solutions and smart batteries, smart city and IoT solutions, business intelligence, and data analytics, CHHB will be able to source digital solutions from the company to accelerate productivity and improve residents' experience in the group's projects.

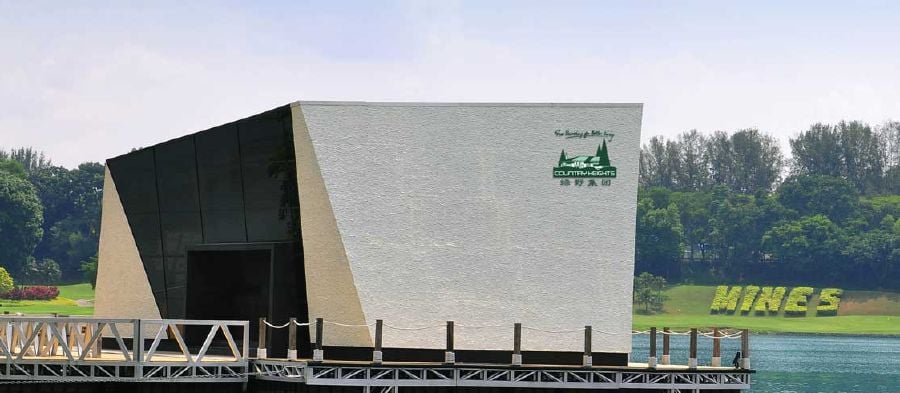

In October 2020, CHHB signed a Memorandum of Understanding with Techna-X to form a blockchain-technology-driven smart city partnership for Mines Wellness City stakeholders.

The journey of transformation

Country Heights Kajang was the first township development established by CHHB in 1984. Mines Resort City was then built from the world's largest open cast tin mine.

The group reached its peak in the late 1990s. However, as Lee began to focus on other ventures in his private portfolios, his activities and property launches dwindled.

The market has taken notice of the group again in the last 18 months, thanks to DJ's leadership, according to TA Securities.

"We are excited about the potential of transforming CHHB into a digital landlord and the possibility of CHHB regaining its prior glory," TA Securities said.

CHHB now has four main business divisions: healthcare, resort and hospitality, exhibition and convention, and property. It plans to launch a new retail division (JDMines) in the second half of the fiscal year 2022.

According to TA Securities, the group's future earnings/cash flow generators will be the property and new retail divisions.

The firm's property division, according to the firm, owns legacy land and property with significantly higher than market margins.

In the coming years, the property division is expected to be more robust, with deliberate plans to monetise about RM300 million in assets in the form of completed properties, including the sale of Mines Wellness Suites (GDV of RM180 million) and College Heights Estate (GDV of RM85 million).

Plans are in the works to transform Mines township, CHHB's crown jewel, into a smart city connected via a Mines smart city app and infrastructure upgrades.

Its wellness division, based in the Mines, has also begun expansion plans to build a complementary medicine hospital and a confinement centre.

"These are expected to raise the overall value of the township where CHHB still has a significant land bank," according to the firm.

Assets are worth more than it appears

According to TA Securities, CHHB's assets are significantly more valuable than what appears on the financial statement (given that accounting standard tends to be prudent and recognise long-term assets based on historical cost).

As of December 31, 2020, the firm discovered that more than 80 per cent of CHHB's 2,357-acres of properties were acquired or last revalued before 2002 (20 years ago), and significantly understate the value of its properties compared to the marketable value today.

"For instance, an 11-acre land in Kajang acquired in 1987 has a book value of RM2 million or RM4.00 per st ft (psf) despite fetching a realisable value of RM100 sq ft to RM150 sq ft now. Similarly, some of CHHB's key investment properties such as the Palace of the Golden Horses, Mines Wellness Hotel and Mines International Exhibition Centre that carry book values based on the period of 1998-2008 appear underappreciated by the investment community. Note that, the Malaysian house price index has been on the rise for most of the 21st century except for the recent two years when Covid-19 mildly dampened the market sentiment," it said.

According to management, the book value of CHHB's properties is closer to RM2 billion in today's market valuation than the RM1.1 billion stated in its financial statement.

When combined with Lee's upcoming asset injection, the realisable value of CHHB's properties is estimated to be RM2.5 billion, or RM3.00 per enlarged share cap, after accounting for all foreseeable corporate exercises, according to the firm.

"We see no obstacles for CHHB to fund its expansion plans given multiple avenues to raise funds. These include leveraging on its current balance sheet (low gearing of 0.24 times with a high net asset of RM800 million, its proposed private placement of up to 20 per cent of the group's total number of issued shares, and potential proceeds from the exercise of outstanding warrants, which could raise to RM158 million (RM132 million outstanding warrants at an exercise price of RM1.20), " it said.

No comments:

Post a Comment