By HENRY BUTCHER MALAYSIA - Published in NST Property, April 8, 2022

Transactions in Johor for the first nine months of 2021 saw a slight decline of 1.9% in volume to 24,657 units from 25,128 units compared to the same period in 2020. However, moderate growth was spotted in its value of transactions, recording an increase of 8.5%, reaching RM12.3 billion from RM11.4 billion.

Johor's property market has less performed as expected in 2021, girded with anticipation and expectations for borders to re-open with Singapore. Its commercial lifeline depends on it and, to a large extent, impacts every facet of the market from daily retail consumables, leisure travel hospitality, industrialised business movements and uptakes of big-ticket items like property. While there may be differences between capital Johor Bahru and those further away like Pontian, Muar and Batu Pahat, how one reads the data shall dictate where they will spot the next opportunity after the Covid-19 dilemma, and this too has connotations to fellow Singaporean investors' sentiments towards the southern state.

In 2021, Johor's residential sub-sector improved from the pandemic year of 2020. This is consistent with Malaysia's overall property market. Part of the factors influencing the uptick is the incentives and discounts provided through the Home Ownership Campaign (HOC) 2020-2021, the low Overnight Policy Rate (OPR) that made financing home purchase attractive and the resultant effect of the National Covid-19 Immunisation programme which went on an acceleration mode midway through has found itself in a sweet spot with the restoration of confidence in the society and the market.

With a different mood on the ground and supported by the National Recovery Plan that has gradually opened up all sectors of the economy from its implementation date of 15 June 2021 except for night entertainment, and also some provisions made through Budget 2022, not forgetting other governmental programmes and initiatives, the residential sub-sector is expected to remain soft but stable with hints of a recovery in 2H 2021 but better than 1H 2021 as it concludes 2021.

Taking a page from the residential market's performance, the overall Johor property market will also move into positive territory barring any major virus outbreak that will impede progress. Should things remain calm and with the pandemic brought under control, boosted by the opening of the borders, Johor's property market will be looking at a steady pace of recovery in 2022.

In terms of catalytic projects, Budget 2022 has allocated a total of RM4.6 billion for 434 development projects, including 79 new projects in Johor. The Gemas Electric Double Track to Johor Bahru and the Johor Bahru-Singapore Rapid Transit System (RTS) Link are among them. Further away, Johoreans can look forward to the Muar Furniture Park and Sime Darby's Bandar Universiti Pagoh.

Other positive contributing factors to the state's recovery include the removal of the RPGT (Real Property Gains Tax) for disposal of property from the sixth year onwards, the RM2 billion Housing Credit Guarantee Scheme to assist participants from the informal sector in buying homes, special tax exemption for building and commercial property owners offering at least 30% rental discount to potential and the existing tenants and the allocation of RM1.5 billion for the continuation of housing programme such as the development of Rumah Mesra Rakyat. A slight reduction of the developer's selling price would not hurt as long as the income margins remain on track for the property enterprise.

Factors to Watch in 2022

●Ongoing major infrastructural projects will provide a significant boost to the economic development of the state and, when completed, will benefit the property market:

oThe completion of the Johor Bahru-Singapore Rapid Transit System (RTS) Link will ease the congestion at the Causeway and Second Link and facilitate passenger flow across the borders between both countries.

oThe construction of the Iskandar Malaysia Bus Rapid Transit (IMBRT) with busways and stations is a crucial initiative to build up a comprehensive and efficient public transport network in Johor Bahru and boost the areas along the route served by the BRT.

●Johor continued as the most significant residential property overhang contributor in the country. The many service apartment/Soho and condominium projects that have been completed for some time remain unoccupied. This has deterred investors from investing in such properties. Some developers have begun offering substantial discounts to clear the unsold stock, and some banks have also begun auctioning the apartments at much lower prices than the original selling prices.

●The revised conditions under the MM2H (Malaysia My 2nd Home) programme have made it less attractive and will deter new applicants from applying. This will reduce foreign interest in Johor's property market.

Bright Spots in 2022

●The success of the National Covid-19 Immunisation Programme and the easing of the lockdowns have brought back some life to the retail and hospitality sectors. However, it is still a long way before the situation can be restored to pre-pandemic levels. The start of the Vaccinated Travel Lane (VTL) between Singapore and Malaysia will help bring back some tourists from down south. However, the emergence of the Omicron variant has put the programme on the backburner. It is difficult for the retail and hospitality sectors to recover from their glory days without foreign tourists.

●The residential property market has not yet seen a sustainable recovery in 2021, but 2022 may see better performance for the sector. However, the problem of oversupply and excessive vacant units will continue to weigh down on the service apartments/sohos and condominiums.

Outlook for 2022

●The residential property market is expected to improve, particularly in the landed residential sub-sector. The service apartment/soho/condominium sub-sectors will be bogged down by the oversupply situation and lack of foreign interest.

●The purpose-built office sector is expected to be stable in 2022 as there is not expected to be any significant increase in supply.

●The hospitality and retail sectors will only see a sustainable recovery once foreigners are allowed to enter the country again without too many hassles.

●The industrial property sector will continue to register a healthy performance in the coming year.

Residential Overview & Outlook

Like all the other states in the country, the residential property market in Johor was severely affected by the Covid-19 pandemic in 2020. For that year, the volume and value of residential property transactions came down by 23.8% and 24.6%, respectively. Although there were still lockdowns implemented in 2021 during MCO 3.0 and FMCO (Full MCO), the easing of the restrictions and the ongoing Home Ownership Campaign (HOC) 2020/21 subsequently helped stir activity in the residential property market.

The first nine months of the year recorded a 5% drop in the volume of transactions y-o-y, but interestingly, there was a marginal 2% increase in the value of the transactions. Johor Bahru was the most active followed by Kota Tinggi and Pontian. The bulk of the transactions in Johor Bahru remains the 2 to 3 storeys terrace houses followed by single-storey terrace houses. Still, things were reverse for Kota Tinggi and Pontian as single-storey terrace houses took the lead, followed by 2 to 3 storeys terrace houses. The majority of the transactions were within the price range of RM500,001 to RM1 million, followed by the RM300,001 to RM400,000 and RM400,001 to RM500,000 price brackets.

As developers worked to clear their existing stocks in 2021, some have proceeded to offer the Rent-To-Own (RTO) scheme in conjunction with attractive discounts and incentives via HOC. New landed residences priced between RM500,000 to RM700,000 were also launched in H2 2021. This trend is expected to continue in 2022, although the market can expect launches to occur at a more random spread, with some priced 10 to 25% higher in light of the rising material costs.

Regarding residential property overhang, the state registered a marginal increase in the first nine months of 2021 to 6,509 units from the 2020s 6,166 units (excluding commercial titled sohos/serviced apartments) and continues its top position as the highest contributor of overhang properties in the country. The bulk of the overhang is made up of sohos and service apartments, and a large number of these are located in Iskandar Puteri, which were targeted at the foreign market. However, due to the pandemic and the suspension of the Malaysia My 2nd Home (MM2H) programme in 2020/21, which was subsequently imposed with a tall order of requirements, marketing efforts by the developers and sales agents were made futile as foreigners were not able to enter the country. In light of the oversupply, the state authority has stopped approving high-rise apartments as one of the ways to mitigate the glut. The overhang numbers are anticipated to rise in 2022 but at a slower pace in line with the slower incoming supply.

Although overall residential transactions showed signs of picking up in 1H 2021, Johor's residential sub-sector continued to be soft in 2H 2021 due to the Covid-19 pandemic, various forms of lockdown imposed throughout the year the absence of foreign investors and buyers. To turn things around for steady growth in 2022, some of the more viable solutions include the opening up of the border through mechanisms such as the VTL to encourage the inflow of potential buyers and investors, including Malaysians working and residing in Singapore, an extension of the HOC in the primary market to 2022 and expansion of the campaign into the secondary market to alleviate the burdens of cash strapped property owners, and lowering down of the MM2H requirements.

Commercial Overview & Outlook

Like residential, the commercial property sub-sector in Johor saw a significant drop in the volume and value of transactions in 2020, registering declines of 22.9% and 28.8%, respectively. The sub-sector appeared to be reasonably stable in 2021, where the volume of transactions was maintained at nearly the same level, but there was a 13.8% increase in the value of the transactions y-o-y. Regarding property type, 2 to 2.5 storeys shop lots and 3 to 3.5 storeys shop lots were the most popular, followed by vacant commercial lands.

Over in the purpose-built offices (PBOs) sector, the supply in Johor recorded only a marginal change in the period from Q1 to Q3 2021, with occupancy more or less the same as 2020 levels. Unlike the residential sub-sector, there has been no significant increase in the supply of PBOs as developers were not constructing additional office buildings in a big way. But the opening up of the economic sectors has encouraged people to return to their respective workplaces instead of continuing to work from home. The heightened activity in the marketplace will see the commercial market recover gradually and occupancy rate improve in prime locations with good connectivity, amenities, and infrastructure. Further, the return of the workforce will also see a higher income-generating capacity among the individuals. This will propagate interest for purchases of goods and services and lead to increased demand in business premises like retail and office space.

Johor's retail sub-sector is expected to remain soft towards 2021 as long as the border restrictions are still in place. Johor's heavy reliance on regional tourism and Singaporean shoppers for weekend holidays and shopping are given. It will take some time before Johor's retail market can return to pre-Covid-19 days.

On the other hand, the hospitality sub-sector is likely to experience a resuscitation of business first in Johor compared to retail, with domestic tourism enjoying a little hiatus from the prolonged absence of tourists. This comes on the back of the high vaccination rate that led to the lifting of interstate travel restrictions.

Johor Bahru has an equal favour for both, where an investor can look for potential investment between hospitality and retail in 2022. It presents a vital drawing factor to visitors from the Republic. Further away in Pontian, hospitality seems to have the upper hand, while in Batu Pahat and Muar, retail has better chances since they are not prominent touristy destinations.

Barring any new variant outbreak, Johor's commercial sub-sector is poised for a steady pace of recovery and better prospects for properties in a good location supported by convenient accessibility and reasonable prices.

Other potentially vital factors to boost the market are the VTL, Johor's very own Business Traveller & Centre (BTC) programme as announced by the state to facilitate short-term business arrivals from Singapore, which is expected to begin in June 2022 and the unique tax exemption for building/commercial unit owners extending at least 30% rental discount to the tenants.

Industrial Overview & Outlook

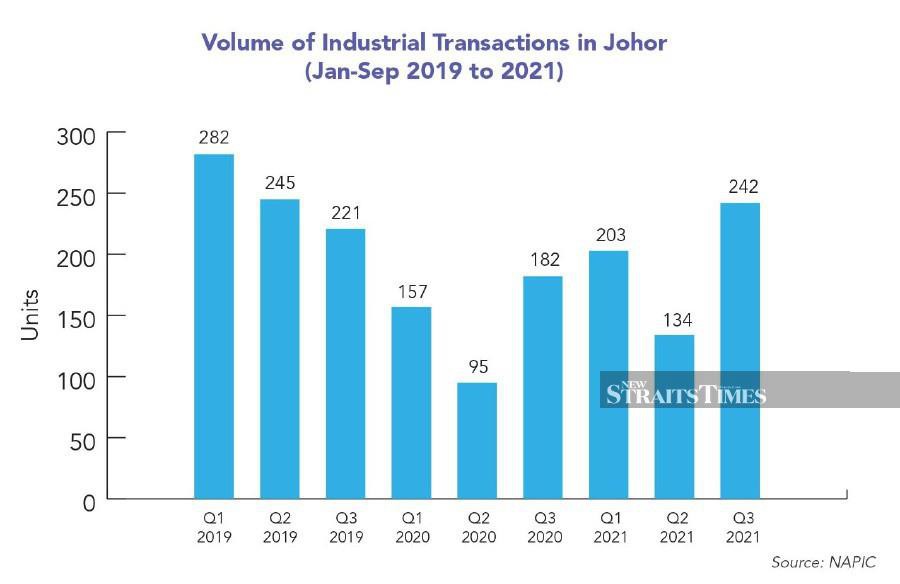

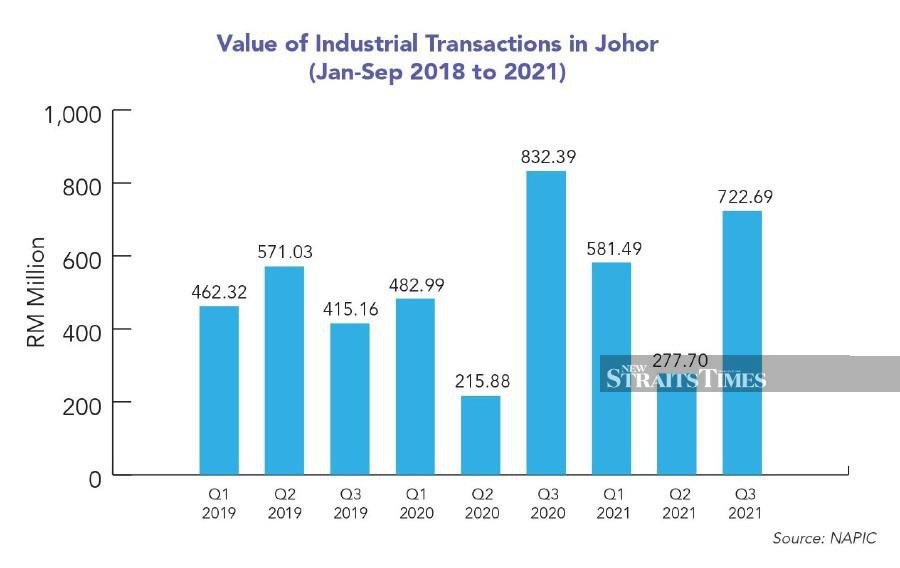

The volume and value of industrial property transactions in Johor registered an improvement in the first nine months of 2021, which saw an increase of 33% in the volume and a marginal 3% rise in the value of the transactions. Notable transactions for this period include:

●the purchase of a warehouse in Pasir Gudang by Axis REITs for RM32 million.

●the development of a data centre in Nusajaya Techpark by GDS Holdings Ltd.

●Tiong Nam Bhd acquired lands in Senai Airport City to build a warehouse.

●Tropicana Industrial Park, which started in July 2021, is currently undergoing site clearance and earthworks.

Areas such as Pasir Gudang and the Port of Tanjung Pelepas remained popular locations for industrial properties, and transactions in these areas were pretty active. Many of the transactions were of vacant industrial land followed by terrace factory/warehouse and detached factory/warehouse.

As signs of confidence are already prevalent in Johor's industrial sub-sector in 2021, this market is anticipated to remain steady with anticipation of continuous demand and growth in 2022. - Henry Butcher Malaysia

No comments:

Post a Comment