By NST Property - Published in NST Property on April 28, 2022

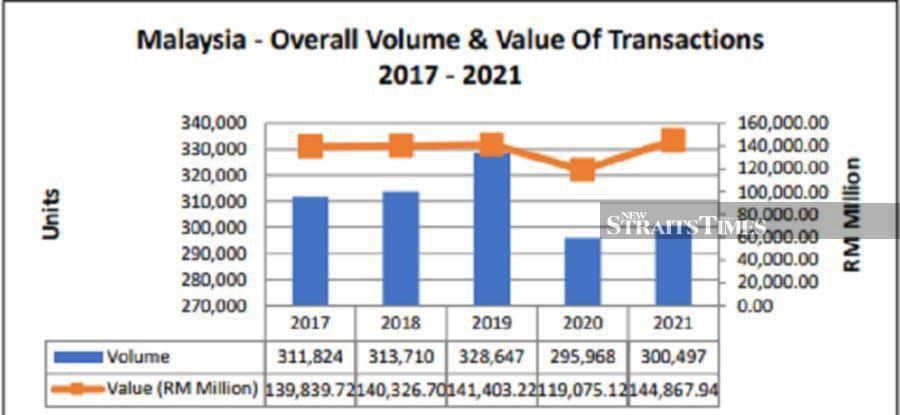

The property market has shown signs of recovery from the pandemic-induced slowdown in 2020, with the volume of transactions increasing by a marginal 1.5 per cent but the value of transactions increasing by a significant 21.7 per cent, according to the annual Malaysian property market report for 2021.

Tang Chee Meng, chief operating officer at Henry Butcher Malaysia, said this would imply that the average value of transactions is higher than the previous year.

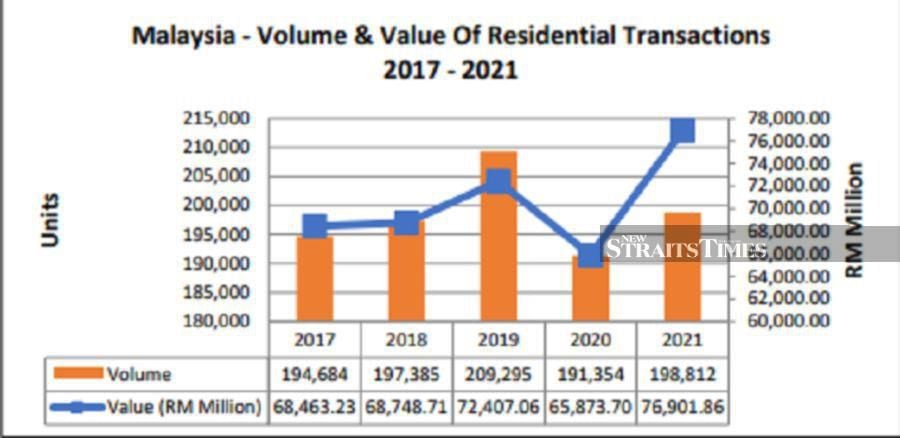

According to the report published by the Valuation and Property Services Department on April 1, 2022, the volume of transactions fell during the second and third quarters as the country entered various Movement Control Order (MCO) modes, but the volume of residential transactions increased significantly during the fourth quarter as home buyers tried to beat the year-end deadline to qualify for benefits under the Home Ownership Campaign (HOC).

Residential sector performance

The residential sub-sector, as it has been for many years, was once again the largest contributor, accounting for 66.2 percent of transaction volume and 53.1 percent of transaction value. Transaction volume increased by 3.9 percent over the previous year, while the transaction value increased by a respectable 16.7 percent.

Selangor contributed the most to both the volume (24.5 per cent) and the value (34.4 per cent) of transactions, with Kuala Lumpur ranking second in terms of contribution to the value of transactions (12.6 per cent).

The residential sub-sector was once again the largest contributor, as it has been for many years, accounting for 66.2 pe rcent of the transaction volume and 53.1 per cent of transaction value. The sector saw a small 3.9 per cent increase in transaction volume over the previous year, while transaction value increased by a respectable 16.7 per cent.

Tang said that terraced houses remained the most popular housing type among Malaysians, accounting for 43 per cent of total residential transactions. Vacant lots and high-rise apartments came next, each accounting for nearly 15 per cent of the total.

Nearly 56 per cent of all residential transactions were for affordable houses priced at RM300,000 or less, followed by those priced between RM300,001 and RM500,000 (24.6 per cent) and RM501,000 to RM1,000,000 (14.8 per cent).

"Although transactions for residences costing more than RM1,000,000 accounted for only 4.8 per cent of total transactions, the number of transactions increased by 26.3 per cent over that achieved in 2020," Tang said.

Tang said that there were fewer new launches in 2021 as developers, understandably, held back on new launches and concentrated on clearing existing stocks.

The number of units launched fell from 47,178 in 2020 to 43,860 in 2021 (down 7.6 per cent).

Landed properties accounted for 43.3 per cent of the units launched, while highrise residences accounted for 28.9 per cent. Houses priced at RM500,000 and below accounted for roughly 70 per cent of new launches, while those priced above RM1 million accounted for only 2.1 per cent.

"This highlights developers' current focus on more affordably priced homes that commanded a higher level of demand in the context of the current softer market conditions," Tang said.

Selangor led the way with 9,827 new launches, followed by Johor with 5,513 units and Perak with 5,239 units. WP Kuala Lumpur, which topped the list of new launches in 2020, did not make the top three this time.

Terraced houses accounted for approximately 60 per cent of new launches, while condominiums and apartments accounted for only 27.4 per cent. Penang led the way in terms of sales performance, with 65.1 per cent, followed by Kedah (61.2 percent), Selangor (54 per cent), and Johor (49.2 per cent).

WP Kuala Lumpur performed poorly in 2021, with a sales performance of 14.4 per cent.

The improved sales performance in 2021 resulted in a 31 per cent increase in the value of loans approved when compared to 2020, as the market showed strong signs of recovery.

The total amount of loans approved was the highest in the last ten years.

The national residential overhang increased by 24.7 per cent in 2021, totaling 36,863 units worth RM22.6 billion (an increase of 20.5 per cent), while the overhang of serviced apartments increased by 33,181 units worth RM1.58 billion.

Surprisingly, houses priced under RM300,000 accounted for 31.5 per cent of the residential overhang, with those priced between RM300,000 and RM500,000 accounting for the remaining 25.7 per cent. Houses costing more than RM1 million accounted for only 12.6 per cent of the residential overhang.

"It is critical for the industry to determine the reason for the high number of overhang units for lower-priced houses. Is it because these projects are being built in less desirable or inconvenient areas for the buyers who are being targeted, or because they are being built in areas where the targeted buyers are not really in the market for new homes because they are comfortably settled in their kampung homes? Perhaps the unsold homes are for Bumiputeras, and more efforts must be made to attract and assist buyers from this community," Tang said.

Tang suggested that agencies tasked with developing affordable housing rethink their business model by building homes for rent to lower-income groups or partnering with financial institutions to offer Rent-to-Buy schemes to the target groups.

He said that, as in previous years, high-rise residences accounted for 55.6 per cent of residential overhang, while terrace houses contributed about 21.3 per cent.

Selangor and Johor had the highest residential overhang stocks in terms of state, each contributing about 6,000 units, with the total value of the residential overhang reaching RM5.28 billion for Selangor and RM4.72 billion for Johor. Penang came in second, with 5,493 units worth RM3.56 billion, and WP Kuala Lumpur came in third.

Penang came in second with 5,493 units worth RM3.56 billion, and WP Kuala Lumpur came in third with 3,908 units worth RM3.17 billion.

Tang said that in terms of serviced apartment overhang, those priced between RM500,000 and RM1 million made up about 64 per cent of the total, while those priced above RM1 million made up about 23.4 per cent.

"The higher price bracket of the unsold service apartments is understandable given that most service apartment projects with commercial titles are built in more urbanised areas where land costs are typically higher," Tang explained.

In terms of the Malaysian House Price Index (HPI), it increased by 0.6 per cent in 2021.

Tang said that the rate of growth in house prices appeared to have peaked in 2012 and has since slowed.

While Johor and Selangor saw marginal increases in the HPI at the state level, Kuala Lumpur and Penang saw declines.

Terraced houses were the only housing type to see a two per cent increase in the HPI, while all other types saw small declines.

In 2021, the national median house price increased by five per cent to RM 310,000. This represents a 96.2 per cent increase over the RM158,000 recorded in 2010. Putrajaya had the highest median price at RM628,000, followed by Kuala Lumpur (RM490,000), Selangor (RM410,000), Johor (RM360,000), and Penang (RM317,000). Kedah has the lowest recorded median price, at RM 207,000.

Tang predicted that the first quarter of 2022 will likely see a lower volume and value of residential transactions than the fourth quarter of 2021, which was fueled by HOCs.

He predicted that in the first half of the year, developers will try to find the right mix of incentives and sales packages to entice buyers, while the economic fallout from the sanctions imposed by the West after Russia invaded Ukraine will cause investors to be cautious.

Rising building material costs, supply chain constraints, and labour shortages will raise construction costs, while developers will be unable to pass on all additional costs to purchasers due to softer market conditions.

A stronger market recovery will be more likely in the second half of the year, he said, especially if the general elections, which are widely expected to be held this year, produce a more stable government.

No comments:

Post a Comment