By HENRY BUTCHER MALAYSIA - Published in NST Property on April 12, 2022

In 2021, Sabah's total property transactions for the first nine months recorded a rare increase when compared to other states in Malaysia with an 11.2% rise in volume and a 26% growth in value against the same period in 2020.

In tangible numbers, this was a rise from 5,053 units valued at RM2.3 billion to 5,621 units valued at RM2.9 billion. But the delicate nature of tourism has been tested far and wide by Covid-19 and in Sabah, it was stretched the whole nine yards.

Going by what was forecasted for 2021, the year unfolded as predicted with secondary locations' properties, retail shops in the shopping centres, and high-rise residences all experiencing some form of price corrections. For the record, this price adjustment had begun as early as Q3 2020. The weakened condition continued when more properties were foreclosed but not taken up as swiftly in the open market. Bidders were said to have held back unless prices dropped significantly to make it more attractive but such an outcome was not meant to be or at least not yet under the overcast spell.

There were however glimmers of hope in niche pockets like landed residentials, traditional shop offices, and industrial lots, not forgetting exemption from RPGT (Real Properties Gains Tax) for properties sold after the fifth year in possession. But like all states in Malaysia, Sabah's economic locomotives can only really pick up when immigration borders are fully open to domestic and international travel. The abracadabra will then spark off a chain reaction of growth in other property sub-sectors including that of other economic sectors. The only exception may be palm oil where crude prices have galloped to as high as RM5,071/tonne on 20 October 2021 and again on 3 November 2021 after the positive trajectory touched RM3,621/tonne in December 2020 from just RM2,074/tonne in May the same year. Those invested in the palm oil sector would undoubtedly have had a reason to smile after the property market took a beating in 2020.

As part of the state's continuous plan for urbanisation, Sabahans can look forward to projects like the continuation of the Pan-Borneo Highway, Tanjung Aru Eco Development (TAED), the Mega Coastline Project at Meruntum valued at RM7 billion, and the Sepanggar Bay Container Port Expansion as catalysts to move the market.

Factors to Watch

•A number of major infrastructure projects being undertaken will provide a boost to the state's economy and ultimately benefit Sabah's property market, they are:

oPan-Borneo Highway's continuous implementation.

oRedevelopment of the TAED comprising hotel, resort, residential, commercial, parks, and recreational areas.

oRM7 billion mega coastline project at Meruntum on 160 hectares of coastline land (Lok Kawi Resort City; a joint venture between Yayasan Sabah and WCT Holdings Bhd).

oSepanggar Bay Container Port Expansion.

Bright Spots

•As there were not many new launches over the past two years, developers were able to focus on selling off their ongoing completed projects, especially with the help of the Home Ownership Campaign (HOC) 2020-2021.

•The re-opening of international borders which is expected in 2022 will bring back tourists and provide a boost to the hospitality and retail sectors.

•Palm oil has enjoyed a good year as CPO prices have gone up in 2021 and this has supported the state's economy. The state contributes about 25% of the country's raw oil palm exports.

Outlook for 2022

•The residential property market is expected to recover and do well in 2022 barring any major surge of Covid-19 infections. Landed properties will perform better than condominiums/apartments.

•Occupancy rates of purpose-built offices (PBOs) will remain fairly stable.

•The industrial property sector will continue its recovery into 2022.

•The retail and hospitality sectors in the state will take some time before they can recover to pre-pandemic levels.

Residential Overview & Outlook

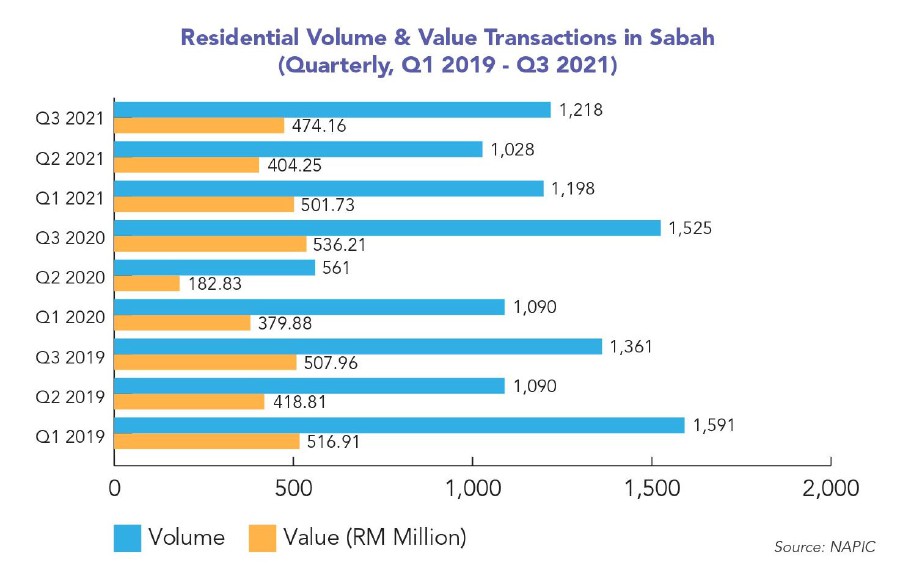

The residential sub-sector in Sabah appeared to have shown some signs of recovery in 2021 with the volume of transactions in the first nine months of 2021 increasing by 8.4% y-o-y from the corresponding period in the previous year while the value of transactions rose by a higher margin at 25.6%. This compares with declines of 21.4% and 23.9% respectively for the corresponding period in 2020 which was badly hurt by the Covid-19 pandemic.

From Q2 to Q3 2021, the value of transactions also increased by 17%. Aside from the relaxations from MCO 2.0, the rise in performance could also be attributed to the continuation of the Home Ownership Campaign (HOC) to the end of 2021, giving buyers the opportunity to still secure their homes with incentives thrown in by the developers. This has also helped developers clear their unsold stocks.

Through the lacklustre 2020 and its spillover effects into 2021, there wasn't much activity on the ground to see new stocks added to the market but in spite of the situation, Kota Kinabalu spotted some resilience in landed residences. This can be attributed to the scarcity factor and also the heightened land cost that has led to more high-rise developments in recent years. As such, the additional premium needed to be paid to acquire a landed residential home is considered to be worth the trouble to land the lucrative deals by the buyers and investors.

High-rise properties on the other hand were given a hand by the HOC, especially in the overhang category where units were being sold at a steady pace. Freebies and incentives extended by the developers as sweeteners were proven to be effective. This bodes well for Sabah's market in 2022 as the risks of increasing the overhanging inventory are also almost zero given the minimal launches seen in 2020 and 2021.

The year 2022 will primarily witness developers clearing existing stocks and releasing units from previously held back launches. These alone shall be enough to meet market demand since not much activity was registered from the muted 2020 and 2021. New launches are therefore likely to be few and far between in 2022.

Barring any further viral outbreaks and political instability, Sabah's residential market is expected to be good in 2022 with landed residential taking the lead.

Commercial, Retail & Hospitality Overview & Outlook

Like the landed residential, Sabah's shop offices in good locations are prized for their value due to their scarcity with buyers and investors having no qualms about paying a premium for them. With the market also returning to some form of normalcy in the era of new normal in 2021, commercial premises were sighted with more activities as consumers made their way to their usual haunts. But "usual" in this sense may not connote "same" anymore as some businesses have called it a day and made way for more adaptable and newer enterprises to fill the vacuum. Performance of the commercial offices and shop offices will however take about 1 to 2 years for it to come back to pre-pandemic levels.

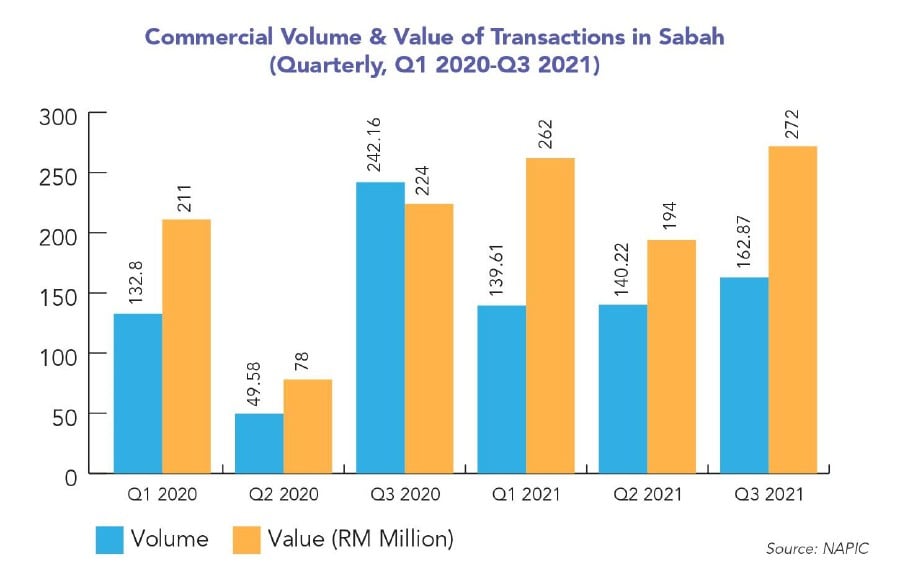

For the first three quarters of 2021, both the volume and value of commercial property transactions saw an increase of about 4.28% and 41.91% respectively compared with the same period in the previous year. The majority of the commercial property transactions were for 2 to 4.5 storeys shop lots followed by shop units/retail lots at 142 and 78 units respectively. In Q3 2020, there were 145 units of 2 to 4.5 storeys shop lots transacted, suggesting that the popularity of this segment still held itself together in the same period in 2021.

The supply of purpose-built office (PBOs) space in the state increased marginally to 103 buildings with a nett lettable area of 827,992 sq metres as of 1H 2021 compared to 100 buildings with a nett lettable area of 799,613 sq metres for the corresponding period in 2020. The overall occupancy rate of PBOs went down slightly from 90% in 2020 to 87.8% in 2021.

Generally, businesses in Sabah preferred to locate their offices in traditional shop offices as the rentals, as well as operating costs for such premises, are lower. The pandemic did not have a very big impact on the occupancy rates of PBOs due largely to limited supply in the state. Nevertheless, some companies took the opportunity to relocate to shop offices as they needed less space after their businesses were impacted by the pandemic-induced slowdown and to reduce costs.

The story is not much different in retail and hospitality as picking up the pieces has not really been that easy, more so when the borders have been shut to foreign tourists for extended periods. Some form of recovery will nevertheless take shape in the hotels by the end of 2021 as local businesses have been allowed to operate including cross-border travel between states.

In retail, the challenge lies in the peculiarity of visiting enclosed and crowded places. The fear surrounding such visits will, unfortunately, continue to linger until full confidence returns. The dicey atmosphere leaves retailers with little choice but to chase after the numbers in order to survive. As such, the market can only expect to have some semblance of a steady recovery in 2022 but its sustenance is very much dependent on externalities beyond its control. Being innovative hence must be a prerequisite for these surviving retailers.

As for the hospitality industry, Sabah's heavy reliance on international travellers has its merits despite not having the borders open as yet. But when it does, the pendulum is expected to swing strongly to usher in the much-awaited foreign travellers back. The question on everyone's lips is, "When? When will the international borders finally be opened?"

Moving forward, the commercial market in Kota Kinabalu in 2022 is not expected to be vibrant, in fact, quite the opposite. But if investors have an inkling to take advantage of the sluggish environment, Sabah's hospitality industry may be a good candidate to look at given the state's record-breaking arrivals pre-Covid-19. Further, this market is also considered young and vibrant compared to its peers around Malaysia and when one looks at it from that perspective, it may suddenly provide investors with more room to explore and a sort of dynamism that could be absent in other locations.

Industrial Overview & Outlook

As forecasted in 2021, the industrial sub-sector continued sustaining investors' interest throughout the year mainly due to the conventionally low-tech utilisation of such properties as a place for manufacturing, storage, and distribution. But given that Covid-19 has also almost transformed the business landscape, industrial lots became highly suited to meet the sudden and heightened need for logistics.

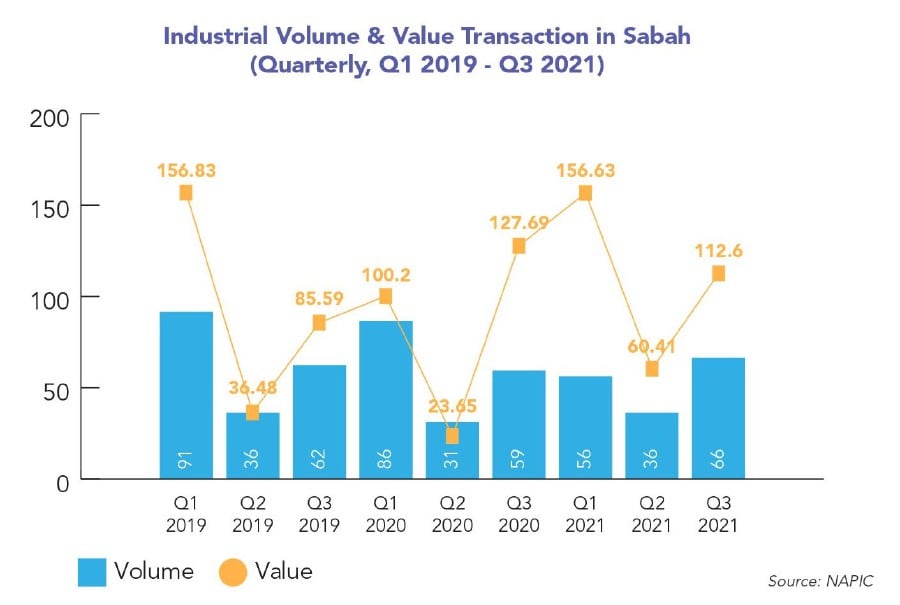

The transactional value of industrial properties in Sabah increased by 31% even though the volume of transactions dropped by 10% during the Q1 to Q3 period in 2021 compared to the same period in 2020. This indicates that the transactions were of higher value properties. There was an announcement of a notable industrial investment in Sabah by South Korea's SK Nexilis which involves a proposed investment of RM2.3 billion to set up a production base in Kota Kinabalu Industrial Park (KKIP). SK Nexilis will build a copper foil manufacturing facility with an annual production of 50,000 tonnes. This project will increase job opportunities in the area whilst at the same time generating higher demand for housing to support the working population there.

The tremendous growth enjoyed by logistics and logistics-related companies during the Covid-19 season has in itself rewarded the industrial sub-sectors in 2021. Prime movers have been the online businesses because the market was in need of a quick alternative solution to the usual but pricier courier services to send and receive goods affordably amid the various modes of lockdown. The typically large floor space of industrial units as such lent itself as the best candidate to meet this demand.

Another innovative scheme is by the F&B operators who have adapted well to the rapidly changing market. Their new business model has seen them taking up industrial units to cater to the preparation and supply of processed and semi-processed food to the restaurants and eateries out in the market. Although the numbers are not as significant, the emergence of industrial lots repurposed as central kitchens has been one of the positive developments in the industrial sub-sectors.

With the market having adapted well to the new normal without any interest waning in 2021, Sabah's industrial sub-sector is positioned to do well in 2022. - Henry Butcher Malaysia

No comments:

Post a Comment