IS the current poor market sentiment a domino effect from the various cooling measures implemented by the previous government to curb speculation and runaway inflation on property prices?

Among the measures implemented since 2010 were interest rate hikes, abolishment of Developer Interest Bearing Scheme (DIBS), raising the Real Property Price Index, raising the minimum property purchase price for foreign investors from RM500,000 to RM1 million, and introducing the maximum 70 per cent Loan-To-Value for third residential mortgage loan onwards.

Market consultants said these measures, especially the removal of DIBS and interest rate hikes, had caused a knee-jerk reaction and the market to go downhill.

DIBS was an innovative home financing scheme which aimed to help lower the cost of buying a house. Under DIBS, interest payments would be borne by the developer during the construction period. With its abolishment, buyers can’t avoid the interest costs, thus increasing the expenditure threshold needed for property speculation. As a result, houses may become less affordable to

the genuine house buyer.

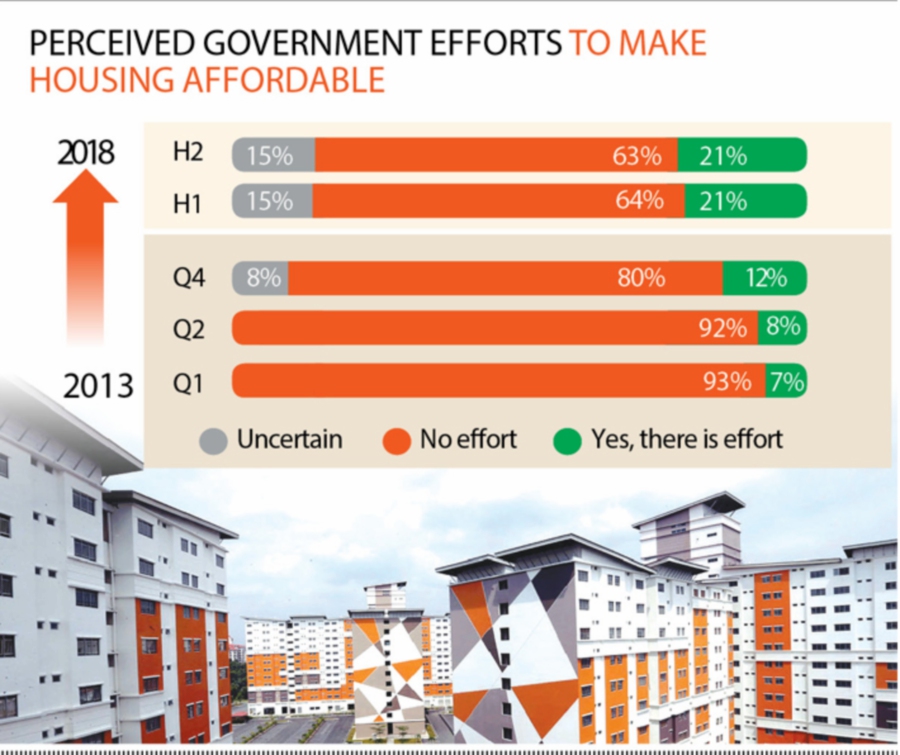

In the first quarter of 2013, 93 per cent of participants in the PropertyGuru Consumer Sentiment Survey expressed dissatisfaction with the housing initiatives available at the time.

This decreased to 63 per cent in the second half 2018 survey, with satisfaction rising from seven to 22 per cent over a similar timeframe.

“These movements reflect increasing confidence in public sector initiatives over the past few years, with Malaysians wanting the government to up the ante in their initiatives to provide more affordable national housing for the masses,” said PropertyGuru Malaysia country manager Sheldon Fernandez.

The survey was based on a sample group of 944 participants, responding to online questionnaires. The majority of respondents comprised 30 to 39 year olds from the PMEB (professionals, managers, executives and businessmen) working demographic and medium to high-income households in Klang Valley.

Will current government initiatives spur the property market?

According to the survey, a majority of Malaysians still feel that a more targeted approach could be taken to address the pressing gap in the property market, including issues related to affordable housing.

The sentiment comes amid widespread perceptions that property prices remain high in the country, with unfavourable market timing. Lack of capital and good financial options were also cited as challenges by property seekers.

The survey showed that actual uptake of national affordable housing programmes is low, despite demand for such initiatives.

“Only 19 per cent of survey participants applied for the 1Malaysia People’s Housing scheme, for example. Participation rates ranged from four to nine per cent for other initiatives such as Rumah Selangorku, the Federal Territories Affordable Housing Project, My First Home Scheme, 1Malaysia Civil Servants Housing and MyHome.

“In fact, 41 per cent of respondents reflected that they were not qualified to apply for such national housing initiatives.

“A large segment of home seekers is either not qualified, or unaware about existing affordable housing initiatives. That has deterred them from applying for or even considering these options,” said Fernandez.

He said another challenge is the lack of consensus on what exactly constitutes affordable housing itself.

“Baseline prices vary from location to location. That being said, the majority (nearly eight out of 10) of respondents considered properties in the RM300,000-RM500,000 range to be on the affordable spectrum.”

NEGATIVE PRICE SENTIMENT

Some 76 per cent of Malaysians anticipate continued price increases in the next six months.

Fernandez said regardless of price movements, household income in Malaysia has failed to commensurate with living cost and this has caused many to cite unfavourable timing and market conditions as a factor in their property decisions.

At least 67 per cent of Malaysians have a budget of RM500,000 or less for property purchases.

The survey found that 51 per cent of respondents resorted to withdrawing their Employees Provident Fund savings at least once to purchase properties.

“Given income stagnation in the country, the younger generation has been particularly hard hit by property financing issues. Over 70 per cent of house seekers under 29 years of age, for example,

see prevailing interest rates in Malaysia as excessively high.

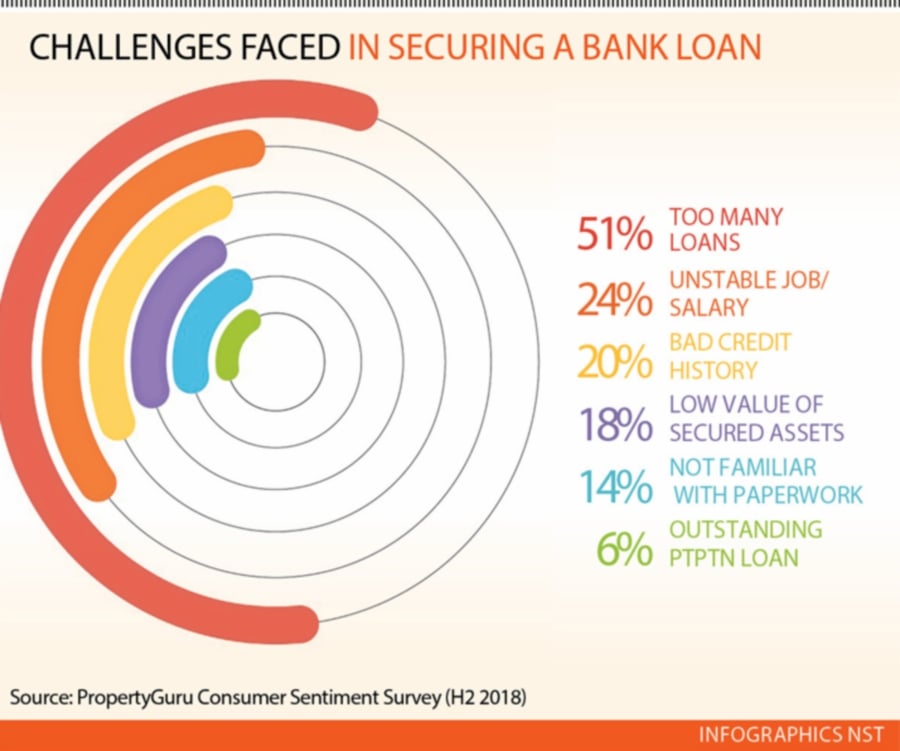

“Further challenges for house buyers seeking financing include unfamiliarity with the paperwork involved, unfavourable credit histories, unstable sources of income and other outstanding debts that contribute towards high debt-service ratios in the country, such as car loans, personal loans and outstanding credit card debts,” said Fernandez.

SILVER LINING

Fernandez said Johor, Penang, Kuala Lumpur and Selangor are seen as primary contributors to transactions last year, with 75 per cent of loans approved undertaken for properties in these areas.

He said asking prices generally trended downwards or sideways in the third quarter as the market adjusted to larger economic tides.

However, the Johor, Penang and Kuala Lumpur markets registered marginal quarter-on-quarter

increases of up to 0.5 per cent, in line with their role as key focuses in national development.

Location-wise, the PropertyGuru Market Index Q1 2019 report found areas of high demand for affordable properties in Klang and Shah Alam.

“This demand is catalysed by the upcoming Light Rail Transit Line 3 alignment linking these areas to

the city centre,” said Fernandez.

In terms of property types, more Malaysians are looking at landed, semi-detached and mixed-use projects, with home seekers expressing fewer intentions to buy terrace, condominium, flat/apartment and bungalow properties.

Fernandez believes that government initiatives, such as the Home Ownership Campaign, could stimulate buying appetite in the short to mid term.

-------------------------------------------------------

Among the measures implemented since 2010 were interest rate hikes, abolishment of Developer Interest Bearing Scheme (DIBS), raising the Real Property Price Index, raising the minimum property purchase price for foreign investors from RM500,000 to RM1 million, and introducing the maximum 70 per cent Loan-To-Value for third residential mortgage loan onwards.

Market consultants said these measures, especially the removal of DIBS and interest rate hikes, had caused a knee-jerk reaction and the market to go downhill.

DIBS was an innovative home financing scheme which aimed to help lower the cost of buying a house. Under DIBS, interest payments would be borne by the developer during the construction period. With its abolishment, buyers can’t avoid the interest costs, thus increasing the expenditure threshold needed for property speculation. As a result, houses may become less affordable to

the genuine house buyer.

In the first quarter of 2013, 93 per cent of participants in the PropertyGuru Consumer Sentiment Survey expressed dissatisfaction with the housing initiatives available at the time.

This decreased to 63 per cent in the second half 2018 survey, with satisfaction rising from seven to 22 per cent over a similar timeframe.

“These movements reflect increasing confidence in public sector initiatives over the past few years, with Malaysians wanting the government to up the ante in their initiatives to provide more affordable national housing for the masses,” said PropertyGuru Malaysia country manager Sheldon Fernandez.

PropertyGuru Malaysia country manager Sheldon Fernandez says the survey shows increased confidence in public sector initiatives in the second half of 2018.

Will current government initiatives spur the property market?

According to the survey, a majority of Malaysians still feel that a more targeted approach could be taken to address the pressing gap in the property market, including issues related to affordable housing.

The sentiment comes amid widespread perceptions that property prices remain high in the country, with unfavourable market timing. Lack of capital and good financial options were also cited as challenges by property seekers.

The survey showed that actual uptake of national affordable housing programmes is low, despite demand for such initiatives.

“Only 19 per cent of survey participants applied for the 1Malaysia People’s Housing scheme, for example. Participation rates ranged from four to nine per cent for other initiatives such as Rumah Selangorku, the Federal Territories Affordable Housing Project, My First Home Scheme, 1Malaysia Civil Servants Housing and MyHome.

“In fact, 41 per cent of respondents reflected that they were not qualified to apply for such national housing initiatives.

“A large segment of home seekers is either not qualified, or unaware about existing affordable housing initiatives. That has deterred them from applying for or even considering these options,” said Fernandez.

He said another challenge is the lack of consensus on what exactly constitutes affordable housing itself.

“Baseline prices vary from location to location. That being said, the majority (nearly eight out of 10) of respondents considered properties in the RM300,000-RM500,000 range to be on the affordable spectrum.”

NEGATIVE PRICE SENTIMENT

Some 76 per cent of Malaysians anticipate continued price increases in the next six months.

Fernandez said regardless of price movements, household income in Malaysia has failed to commensurate with living cost and this has caused many to cite unfavourable timing and market conditions as a factor in their property decisions.

At least 67 per cent of Malaysians have a budget of RM500,000 or less for property purchases.

The survey found that 51 per cent of respondents resorted to withdrawing their Employees Provident Fund savings at least once to purchase properties.

“Given income stagnation in the country, the younger generation has been particularly hard hit by property financing issues. Over 70 per cent of house seekers under 29 years of age, for example,

see prevailing interest rates in Malaysia as excessively high.

“Further challenges for house buyers seeking financing include unfamiliarity with the paperwork involved, unfavourable credit histories, unstable sources of income and other outstanding debts that contribute towards high debt-service ratios in the country, such as car loans, personal loans and outstanding credit card debts,” said Fernandez.

SILVER LINING

Fernandez said Johor, Penang, Kuala Lumpur and Selangor are seen as primary contributors to transactions last year, with 75 per cent of loans approved undertaken for properties in these areas.

He said asking prices generally trended downwards or sideways in the third quarter as the market adjusted to larger economic tides.

However, the Johor, Penang and Kuala Lumpur markets registered marginal quarter-on-quarter

increases of up to 0.5 per cent, in line with their role as key focuses in national development.

Location-wise, the PropertyGuru Market Index Q1 2019 report found areas of high demand for affordable properties in Klang and Shah Alam.

“This demand is catalysed by the upcoming Light Rail Transit Line 3 alignment linking these areas to

the city centre,” said Fernandez.

In terms of property types, more Malaysians are looking at landed, semi-detached and mixed-use projects, with home seekers expressing fewer intentions to buy terrace, condominium, flat/apartment and bungalow properties.

Fernandez believes that government initiatives, such as the Home Ownership Campaign, could stimulate buying appetite in the short to mid term.

-------------------------------------------------------

Please watch the video by up and coming youtuber Neshall S.

Please subscribe to his channel (Neshall S.), hit the notification button and click like in support of his passion to promote places of interest, the environment, sea creatures, food, music etc....

No comments:

Post a Comment